The bearish flag pattern is one of the most commonly used trend continuation patterns in technical analysis. It helps traders identify opportunities to trade in the direction of an existing downtrend, rather than attempting to anticipate a reversal too early.

In this guide, I will walk you through how bearish flag patterns form, how to identify them on forex charts, and how professional traders apply them to build structured trading setups with clearly defined risk and reward.

What You’ll Learn in This Guide

This article covers:

- What a bearish flag pattern is

- How to identify a bearish flag on forex charts

- A practical bearish flag trading strategy

- The reliability and limitations of the pattern

- Key differences between bear flags and bull flags

What Is a Bear Flag Pattern?

A bearish flag is a technical continuation pattern that forms within an established downtrend. It signals a temporary pause in selling pressure before price resumes lower.

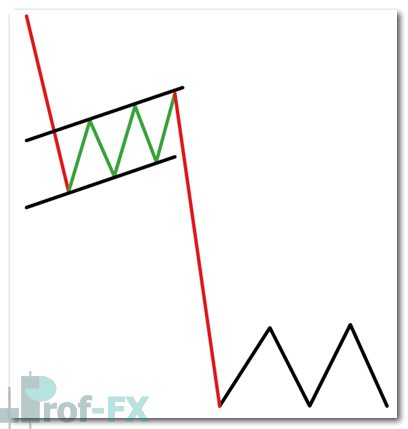

The pattern consists of two main components:

- The flagpole: a strong, impulsive downward move

- The flag: a short-term consolidation that typically slopes slightly upward

The initial sell-off reflects aggressive bearish momentum, while the subsequent consolidation represents profit-taking and short-term buying—rather than a true trend reversal. Once price breaks below the lower boundary of the flag, the downtrend often resumes.

Bearish Flag Pattern Illustration

How to Identify a Bearish Flag on Forex Charts

Identifying a bearish flag becomes straightforward once traders understand its structure. This pattern applies across forex, equities, indices, and commodities, making it a versatile tool in technical trading.

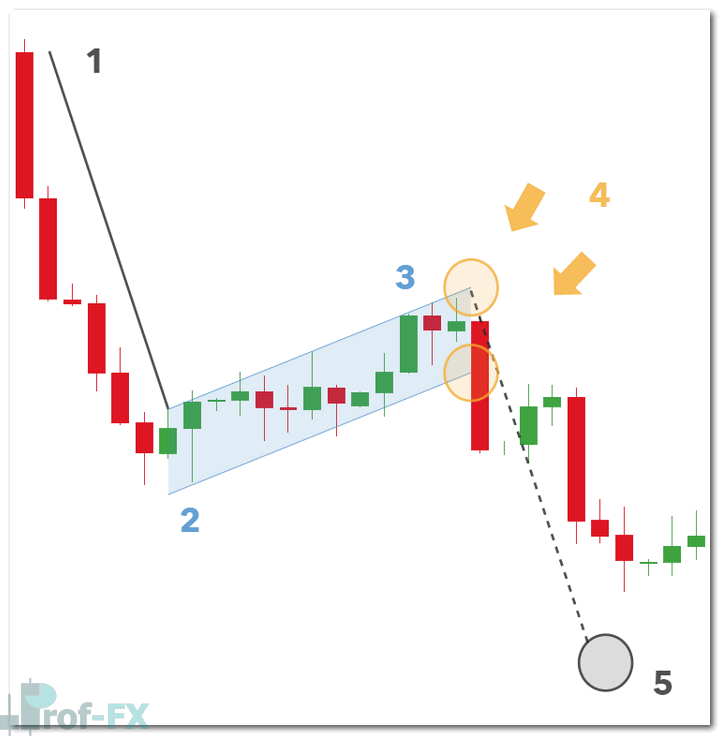

Key Components of a Bear Flag Pattern

1. The Flagpole

The flagpole is the initial downward move that establishes bearish dominance. This decline may be sharp or gradual but must be clearly directional to form a valid pattern.

2. The Flag (Consolidation Phase)

After the initial decline, price enters a consolidation phase. During this stage:

- Price typically drifts higher within a narrow channel

- The retracement should remain controlled

- Ideally, the retracement is less than 38% of the flagpole

- If price retraces more than 50%, the structure may no longer qualify as a bearish flag

Traders wait patiently for price to break below the lower boundary of the consolidation.

3. Projecting the Profit Target

Once price breaks lower, traders estimate a profit target by:

- Measuring the length of the flagpole

- Projecting that same distance downward from the breakout point

This measured move provides a structured take-profit zone, not an absolute guarantee.

Bear Flag Formation Summary

- Existing downtrend (flagpole)

- Upward-sloping consolidation (flag)

- Controlled retracement (<38% preferred)

- Entry near flag resistance or on downside breakout

- Target projected using the flagpole length

Bearish Flag Trading Strategy: Step-by-Step Example

Let’s look at how traders apply this pattern in practice using a forex chart.

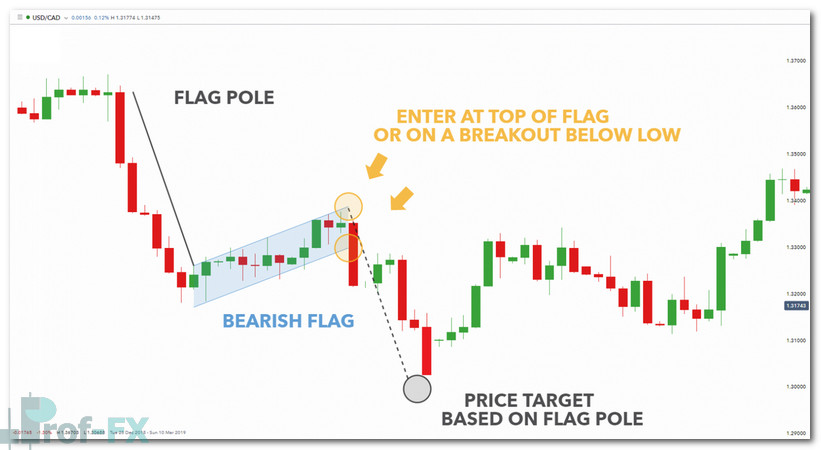

USD/CAD Daily Chart – Bearish Flag Pattern

In this example, the flagpole is formed by the decline from the January 3rd high near 1.36500 to the January 9th low near 1.31800, producing an initial move of approximately 470 pips.

Following this sell-off, price enters a rising consolidation channel—the flag. Importantly, the pattern is not confirmed until price breaks below the lower boundary of the channel.

Once the breakdown occurs, traders project the 470-pip flagpole downward from the breakout area, identifying a potential target near 1.30000.

It’s worth noting that price does not always reach the exact projected level. The measured move serves as a guideline, while traders must remain aware of evolving price action, macroeconomic developments, and key support zones.

How Reliable Is the Bearish Flag Pattern?

When all structural criteria are respected, the bearish flag is regarded as a high-probability continuation pattern.

Advantages

- Applicable across all major financial markets

- Provides clear entry, stop-loss, and target levels

- Often offers a favorable risk-to-reward profile

Limitations

- The structure can be difficult for novice traders to recognize

- False breakouts may occur in choppy or low-volume markets

Like all technical patterns, the bearish flag improves probabilities—but does not eliminate risk.

Bear Flag vs. Bull Flag: Key Differences

The bear flag and bull flag are essentially mirror images of each other.

- Bear flag: continuation of a downtrend

- Bull flag: continuation of an uptrend

Both patterns consist of:

- A flagpole

- A consolidating channel

- A projected target based on the flagpole length

Although the structure is similar, traders must always interpret these patterns within the broader market context to avoid confusion.

Common Questions About Trading Bearish Flags

Where Is the Best Entry Point?

Bearish flag entries typically occur:

- Near the upper boundary of the flag, or

- On a confirmed breakout below the lower channel

Many traders use Fibonacci retracement levels to help identify potential turning points within the flag, as these mathematically significant ratios often align with resistance in trending markets.

Bearish Flag or Bullish Breakout?

One common mistake is confusing a bearish flag with the start of a bullish reversal.

Key distinctions:

- Bearish flags tend to rise gradually

- Bullish breakouts often display sharp, impulsive upside moves

Indicators such as the Donchian Channel can help traders identify genuine breakouts by highlighting expanding price ranges.

Continue Learning Forex Chart Patterns

The bearish flag is just one of many price patterns used by professional traders. To deepen your understanding, consider exploring:

- Guides on risk management principles

- Educational page such as the Free Forex Trading Courses

Regardless of the pattern used, consistent risk management remains the foundation of long-term trading success.

Prof FX provides ongoing forex news, macroeconomic insights, and professional technical analysis focused on the trends shaping global currency markets.