Introduction: Why Fear and Greed Matter in Forex Trading

In the foreign exchange market – one of the most liquid and volatile financial markets in the world – fear and greed shape trader behavior more strongly than any technical indicator or economic calendar event. While monetary policy decisions, macroeconomic data, and market sentiment shifts influence price action, the human responses to these forces often determine whether a trader succeeds or fails.

Fear and greed are not merely psychological buzzwords; they are the core emotional drivers that influence risk-taking, decision-making, and trade execution. Their impact on forex trading performance is so profound that many institutional trading desks incorporate psychological coaching, pre-trade checklists, and structured performance journals to control these instincts.

This long-form guide breaks down the deeper mechanics of fear and greed, how they manifest in forex markets, and how professional traders maintain discipline through risk frameworks and structured planning.

The Two Primary Emotions Behind Market Behavior

Even though it is simplistic to claim that markets move solely because of “fear and greed,” these emotions heavily influence retail trader behavior, causing predictable mistakes such as:

- Overleveraging

- Exiting winning trades prematurely

- Refusing to close losing trades

- Chasing impulsive positions

- Adding unnecessary size to winning trades

- Removing stop losses

Whether a trader is navigating major currency pairs such as EURUSD, USDJPY, or GBPUSD – or cross pairs like AUDNZD and EURGBP – the psychological patterns remain consistent.

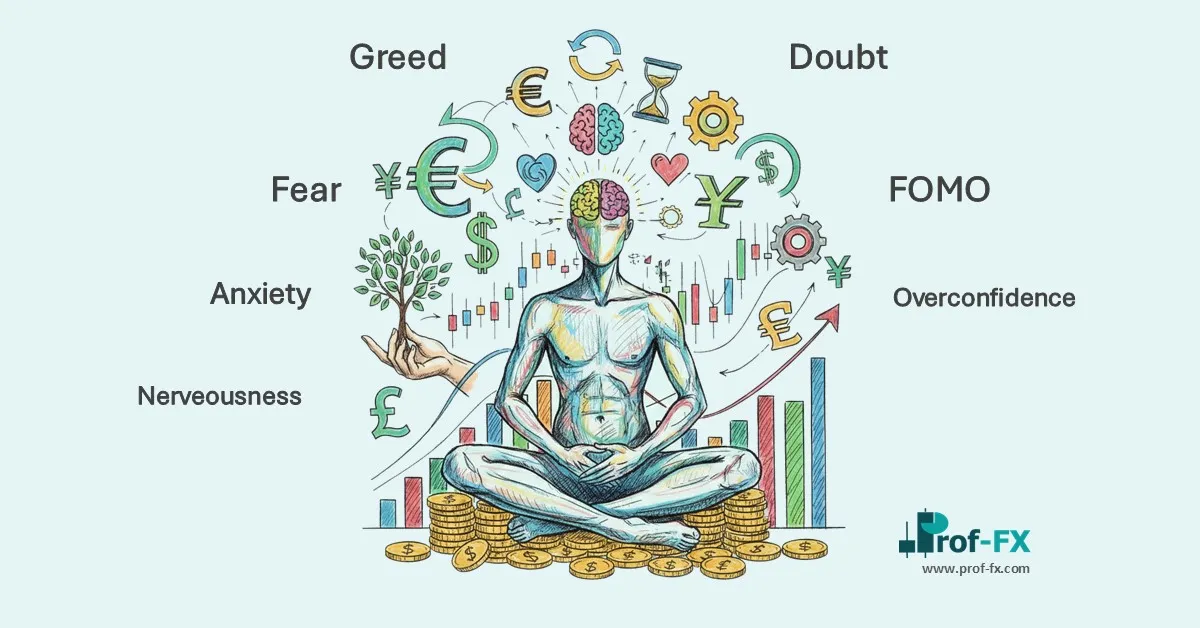

Where Do These Emotions Come From? A Survival-Based Explanation

The origins of fear and greed are deeply tied to human survival instincts:

- Fear → Avoid danger, prevent risk, minimize loss

- Greed → Seek reward, maximize gain, pursue opportunity

In the forex market, where liquidity can shift rapidly during high-impact events like Federal Reserve decisions, Non-Farm Payrolls (NFP), or CPI releases, traders often experience intensified emotional reactions. The brain interprets financial risk similarly to physical danger, triggering instinctive fight-or-flight responses.

But trading success requires suppressing these instincts and replacing them with structured logic.

What Is Fear in Forex Trading? A Deep Dive

Fear manifests in trading in several ways, each tied to risk aversion and loss avoidance.

1. Fear of Loss

This is the most common form of fear. When the market moves against an open position, the trader’s mind anticipates pain – the realization of a monetary loss. Instead of following their trading plan or technical analysis, they hold losing trades longer than intended.

This phenomenon is validated by Prof FX’s research on 1 thousand live trades, which identified:

The number one mistake retail traders make is holding losing trades longer than winning trades.

This pattern is consistent across currency pairs and timeframes.

2. Fear Before Entering a Valid Trade

Even with clear confluence – trend alignment, support/resistance, and confirmation from indicators like RSI or MACD – fear can cause hesitation.

This leads to missed opportunities and frustration.

3. Fear After Market Crashes or Sharp Selloffs

During extreme downside volatility, traders fear that prices may collapse further.

This causes paralysis at the exact moment when professional traders prepare to enter positions at discounted levels.

What Is Greed in Forex Trading? The Hidden Opponent

Greed emerges during periods of winning trades, high confidence, or rapid market movement.

1. Overleveraging During Winning Streaks

A trader increases lot size beyond sustainable risk parameters – often abandoning their tested risk management rules.

For example:

- Opening 5 lots on a small account

- Increasing leverage because “the setup feels right”

- Ignoring margin requirements

Greed disguises itself as ambition, but its consequences can be severe.

2. Doubling Down on Losing Positions

This is one of the fastest ways to experience a margin call.

The trader hopes that adding more capital will help recover previous losses – a classic emotional decision and a violation of risk frameworks used by institutional traders.

3. The Illusion of Infinite Trends

Greed also fuels speculative bubbles.

Historical examples include:

- Dot-com bubble

- Bitcoin mania

- Housing market bubble 2008

Greed blinds traders to risk and creates a false narrative of “the market can only go higher.”

How to Manage Fear and Greed Like a Professional Trader

Professional traders do not eliminate emotions – they anticipate them.

Below are the most effective long-term strategies.

1) Build a Structured, Rules-Based Trading Plan

A strong trading plan eliminates impulsive decisions by specifying:

- Entry criteria

- Exit criteria

- Stop placement (fixed, ATR-based, or structural)

- Position sizing model

- Maximum daily/weekly loss

- Risk-to-reward minimum (1:1, 1:2, 1:3)

- When not to trade (e.g., low-liquidity sessions or high-impact news events)

A trading plan removes randomness and sets objective rules – reducing emotional interference.

2) Reduce Position Size: The Simplest Cure for Emotional Stress

Victor Chen, Prof FX Currency Strategist, states:

“One of the easiest ways to decrease the emotional effect of your trades is to lower your trade size.”

Large position sizes create disproportionate emotional reactions.

Even with strong technical analysis, traders become overly sensitive to small fluctuations.

Lowering position size improves:

- Clarity

- Patience

- Execution discipline

- Emotional stability

This is why institutional traders rarely risk more than a fraction of a percent per trade.

3) Keep a Detailed Trading Journal (Your Psychological Mirror)

A trading journal allows traders to evaluate behavior – not just results.

A good journal includes:

- Pair traded

- Entry & exit prices

- Market structure analysis

- Reason for trade

- Risk-to-reward ratio

- Emotional state before/after trade

- Mistakes

- Improvements

When reviewed objectively, it highlights patterns such as:

- Greed-driven overtrading

- Fear-based premature exits

- Repeated emotional mistakes

- Entries outside trading plan

This is one of the most powerful tools for mastery.

4) Learn From the Traits of Successful Traders (Based on 1+ Thousand Trades)

Prof FX research revealed a groundbreaking insight:

Traders win more than 50% of their trades but still lose money overall.

Why? Because:

- Losing trades are too large

- Winning trades are too small

Martin Thomas summarized this imbalance:

“Use stops and limits to enforce a risk/reward ratio of 1:1 or higher.”

A disciplined risk-to-reward framework neutralizes both fear and greed.

Additional Tools to Build Psychological Strength in Trading

1. Pre-Trade Checklist

Before entering a trade, confirm:

- Trend direction

- Support/resistance

- Technical confluence

- Market volatility

- Position size

- Risk-to-reward alignment

2. Post-Trade Review

Immediately analyze:

- Did I follow the plan?

- Did emotion influence the decision?

- Was the trade valid even if it lost?

3. Using Economic Calendars

Preparing for events like FOMC, NFP, ECB speeches helps traders avoid impulsive trades during high volatility.

Conclusion: Mastering Fear and Greed Is the Foundation of Forex Success

Trading is not merely a technical activity – it is a psychological performance discipline.

Traders who understand and manage fear and greed gain massive advantages in consistency, risk management, and long-term profitability.

Whether you’re trading major currency pairs, applying multi-timeframe analysis, or running algorithmic strategies, emotional control remains the foundation of performance.

Further Reading for Forex Psychology Mastery

- How to manage the emotions of trading

- Why traders chase daily pip targets (and why it’s harmful)

- How to maintain confidence in trading

- How to build a professional forex trading journal

About Prof FX

Prof FX provides global forex news, technical analysis, price action insights, and trader education tailored for the international currency markets.