What Economic Growth Really Means — And Why Traders Should Care

Financial news cycles are often dominated by updates on Gross Domestic Product (GDP), and there is a very good reason for that. GDP data carries enormous signaling power for forex traders, institutional investors, portfolio managers, and policymakers. A single release can shift market sentiment, strengthen or weaken a currency, and reshape expectations for future central bank policy.

In this article, we explore the meaning of economic growth, how GDP is measured, and why every trader—especially in the forex market – should understand how GDP trends influence market behavior.

How GDP Growth Works and How It’s Presented in Financial Markets

What GDP Growth Actually Measures

When the media refers to “growth,” they are almost always pointing to Gross Domestic Product (GDP). GDP represents the total value of all goods and services produced within a country over a specific period. It is considered one of the clearest indicators of an economy’s overall health and direction.

In simple terms, GDP allows traders to quantify whether an economy is improving, stagnating, or contracting over time.

How GDP Numbers Are Released

GDP is released four times per year, categorized as Q1, Q2, Q3, and Q4. However, traders often notice monthly reports discussing GDP because it is a lagging economic indicator—meaning the data requires time for collection, verification, and seasonal adjustment.

Unlike lagging technical indicators in chart analysis, lagging economic indicators refer to macroeconomic data that confirms trends after they happen.

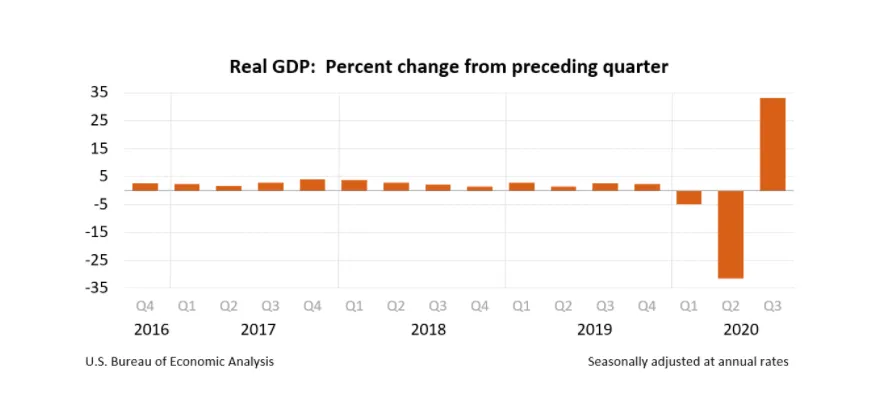

GDP data is commonly expressed in two formats:

- Quarter-on-Quarter (QoQ) — comparing GDP to the previous quarter

- Year-on-Year (YoY) — comparing GDP to the same quarter last year

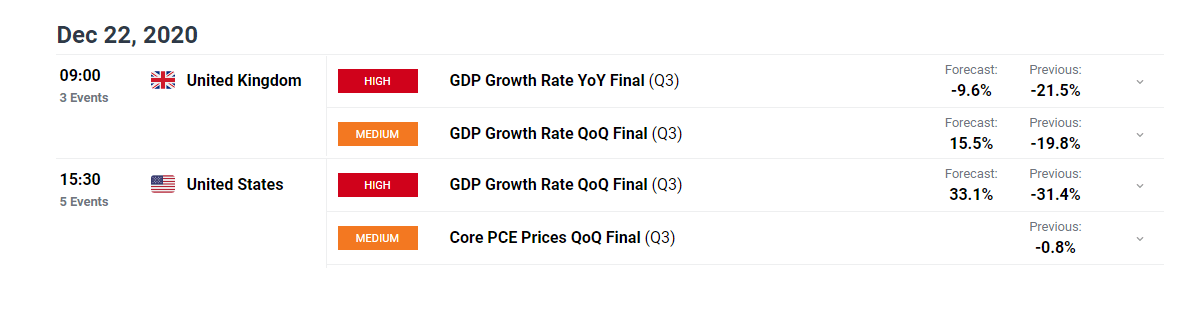

Below is the typical representation of changes in real GDP (QoQ), which adjusts for inflation to provide a more accurate depiction of true economic output.

Real GDP removes the influence of price increases, offering a clearer picture of actual production and consumption.

The Three Stages of a GDP Release

Each quarter includes three GDP readings:

- Advance/Preliminary Estimate

- Second Estimate

- Final GDP Figure

The advance figure is the most important for traders because it often triggers the strongest price reactions. Later estimates usually refine the initial numbers but rarely result in massive surprises.

Although GDP is less prone to unexpected shocks compared to high-impact events like Non-Farm Payrolls (NFP), even a deviation of 0.2 – 0.3 percentage points in a major economy can represent billions of dollars in output—enough to increase volatility and shift market sentiment.

To track upcoming releases, traders often rely on tools such as the Economic Calendar.

Why GDP Growth Signals Matter for Forex and Financial Markets

Governments and central banks analyze GDP trends with extreme precision. Economic growth (or contraction) shapes monetary policy decisions, which directly influence currency valuations.

When GDP Weakens: Accommodative Policy

How Central Banks Respond With Lower Interest Rates

When GDP begins to contract or shows signs of stagnation, central banks typically shift toward accommodative monetary policy. The primary tool they use is the interest rate, often lowering the benchmark rate to stimulate borrowing and investment.

Lower interest rates reduce the cost of credit for households and businesses, encouraging spending, expansion, and risk-taking. In the forex market, however, lower rates generally make a currency less attractive as yields decline.

Why Increased Liquidity Supports Economic Recovery

An accommodative stance also involves increasing liquidity in the financial system. Central banks may expand their balance sheets through asset purchases (known as quantitative easing) or provide additional funding to commercial banks.

Higher liquidity aims to ensure smoother credit flow, ease financial stress, and support broader economic recovery. For traders, an increase in liquidity can result in stronger equity markets, as investors turn toward higher-yielding or riskier assets.

Role of Government Spending in Weak GDP Conditions

Governments often step in during weak economic conditions by increasing fiscal spending. This may include infrastructure projects, social programs, subsidies, or tax incentives.

The goal is to boost aggregate demand and accelerate economic activity when private-sector spending slows. Fiscal stimulus can temporarily cushion the downturn, but it can also lead to higher deficits and long-term debt accumulation.

Impact on Risk Assets and Currency Performance

A low-growth environment paired with accommodative policy typically benefits risk assets such as equities, emerging-market currencies, and commodities.

However, the domestic currency often weakens as lower interest rates reduce foreign capital inflows. Traders commonly observe this dynamic in currencies tied to central banks like the Federal Reserve, European Central Bank (ECB), or Bank of England (BoE) during periods of economic slowdown.

When GDP Strengthens: Contractionary Policy

Why Central Banks Raise Interest Rates in Strong Economies

When GDP growth accelerates and inflationary pressures rise, central banks usually shift toward contractionary monetary policy. Increasing interest rates helps cool off excessive borrowing, slow demand, and prevent the economy from overheating.

Higher rates also attract foreign investment into interest-bearing assets, making the currency more valuable relative to others.

How Tightening Liquidity Controls Inflation

A strengthening economy often means higher employment, rising wages, and increased consumption—all of which can push inflation upward.

To maintain price stability, central banks may tighten liquidity by reducing asset purchases, selling securities, or raising reserve requirements for commercial banks.

For traders, tightening liquidity usually leads to reduced risk appetite and more cautious capital flows.

Government Fiscal Adjustments During Economic Expansion

Governments may scale back spending during periods of strong growth, especially if tax revenues increase naturally from higher economic activity.

This fiscal restraint can help prevent inflationary spikes and maintain economic balance. It also positions the government to react more aggressively in future downturns.

How Hawkish Policy Strengthens Currencies

Currencies tend to appreciate when central banks adopt a hawkish tone or begin a rate-hiking cycle. Traders and investors anticipate higher yields and increased capital inflows, driving the currency upward.

Conversely, currencies tied to dovish policy—where interest rates are cut or remain low—often depreciate due to reduced yield attractiveness.

This relationship between policy stance and currency strength is a fundamental aspect of fundamental analysis in forex trading and plays a major role in long-term currency trends.

Central Bank Case Studies: Accommodative vs. Contractionary Policy

When GDP Weakens: Accommodative Policy in Action

Case Study 1: Federal Reserve (The Fed) – 2008 Global Financial Crisis

During the 2008 crisis, U.S. GDP contracted sharply as the financial system faced systemic stress. In response, the Federal Reserve implemented aggressive accommodative measures:

- Cut the federal funds rate to near 0%

- Launched large-scale Quantitative Easing (QE) programs

- Injected liquidity into banks and credit markets

- Supported government stimulus measures

These actions helped stabilize financial markets, but also caused the USD to weaken initially due to ultra-low yields and increased money supply.

Case Study 2: European Central Bank (ECB) – Eurozone Debt Crisis

Between 2011–2013, Eurozone economies such as Greece, Portugal, and Spain experienced severe recessions. The ECB responded with:

- Policy rate cuts

- Long-Term Refinancing Operations (LTRO) to support banks

- Later adopting its own QE program

The accommodative stance increased liquidity but pressured the Euro (EUR), especially against the U.S. Dollar.

Case Study 3: Bank of Japan (BoJ) – Chronic Low Growth

Japan’s economy has struggled with low growth and deflation for decades. As a result, the BoJ consistently pursues accommodative measures:

- Negative interest rates (NIRP)

- Continuous asset purchases

- Yield Curve Control (YCC) to keep long-term rates low

This persistent easing has historically contributed to the weakening of the Japanese Yen (JPY), particularly during global risk-on periods.

When GDP Strengthens: Contractionary Policy in Action

Case Study 1: Federal Reserve – 2015–2018 Rate-Hiking Cycle

After years of recovery following the 2008 crisis, U.S. GDP growth strengthened and unemployment dropped. The Fed responded with:

- Multiple interest rate hikes beginning in 2015

- Gradual balance sheet reduction (“Quantitative Tightening”)

As yields rose, the U.S. Dollar (USD) appreciated sharply, especially against currencies linked to lower-rate central banks like the EUR, JPY, and AUD.

Case Study 2: Bank of England (BoE) – Post-2021 Inflation Surge

Following the reopening after COVID-19 lockdowns, the UK experienced robust GDP recovery and surging inflation. The BoE implemented contractionary policy by:

- Increasing interest rates from historic lows

- Signaling a hawkish stance to fight inflation

- Slowing asset purchases

This caused the British Pound (GBP) to strengthen during the early stages of the tightening cycle.

Case Study 3: Reserve Bank of New Zealand (RBNZ) – Early Hawkish Leader

The RBNZ was one of the first major central banks to raise interest rates after COVID, as New Zealand’s economic rebound outpaced global peers. The bank:

- Hiked rates aggressively

- Emphasized concerns about inflation and overheating

The New Zealand Dollar (NZD) appreciated as traders priced in higher yields and strong policy leadership.

How GDP Impacts Currencies, Equities, and Market Expectations

For currency traders:

- Higher GDP growth usually strengthens the currency due to expectations of higher interest rates.

- Lower GDP growth often weakens the currency as central banks shift toward easing.

For stock market investors:

- Lower interest rates increase access to cheap credit

- Future cash flows are discounted at lower rates, boosting equity valuations

This makes GDP a critical macroeconomic driver for the forex market, bond market, and stock market.

Central bank press conferences – particularly from the Federal Reserve, ECB, BoE, BoJ, and other major institutions – often provide clues on the future path of monetary policy. These forward-guidance signals help traders position ahead of major movements.

Breaking Down GDP: The Four Pillars of Economic Growth

Economists categorize GDP into four major components:

- Consumption (C)

- Investment (I)

- Government Spending (G)

- Net Exports (X – M)

GDP = C + I + G + (X – M)

Consumption

Daily household purchases—food, services, internet, transportation. This is usually the largest component.

Investment

Business spending on capital equipment, technology, and infrastructure that boosts future productivity.

Government Spending

Includes public infrastructure, salaries, defense, and national services—especially significant when private sector spending declines.

Net Exports

Exports minus imports. Positive net exports add to GDP; negative net exports reduce GDP.

Leading Indicators That Signal GDP Trends Before the Release

Since GDP is lagging, traders also use forward-looking indicators to anticipate economic conditions:

1. New Building Permits

Reflects housing demand and construction activity — traditionally tied to overall economic strength.

2. Consumer Credit

Rising credit usage signals confidence and spending capacity. Falling credit suggests caution and financial stress.

3. Retail Sales

One of the strongest indicators of consumer spending, which forms a major portion of GDP.

4. Consumer Confidence Index (CCI)

Higher confidence generally leads to higher spending; lower readings warn of potential economic slowdown.

5. ISM Manufacturing and Services PMI

A value above 50 signals expansion, while below 50 signals contraction. Purchasing managers provide real-time insight into business expectations.

You can track these events using the DailyFX Economic Calendar.

Further Reading for Traders

- Track global central bank decisions with our Central Bank Calendar

- Explore NFP and Forex: What Is NFP and How to Trade It

Learn how Interest Rates Affect Forex Markets