What Forex Spreads Tell Traders — Key Points

- Forex spreads are derived from the Bid and Ask prices of a currency pair.

- Trading costs are directly influenced by spread size, pip value, and lot size.

- Spreads fluctuate based on liquidity, volatility, and market session activity, and must be monitored in real-time on your platform.

Being able to read and interpret forex spreads is essential for traders because spreads represent the primary transaction cost in the foreign exchange market. In this guide, we’ll explore how spreads work, how costs are calculated, what causes spreads to widen or tighten, and how traders can manage spread-related risks more effectively.

What Is a Spread in Forex Trading? A Clear Explanation for New Traders

Every financial market includes a spread, and the foreign exchange (FX) market is no exception. In simple terms, a spread refers to the difference between the price at which you can buy (Ask) and sell (Bid) a currency pair. Equity traders often refer to this as the Bid–Ask Spread, and the concept is identical in FX — only presented with tighter pricing due to higher liquidity.

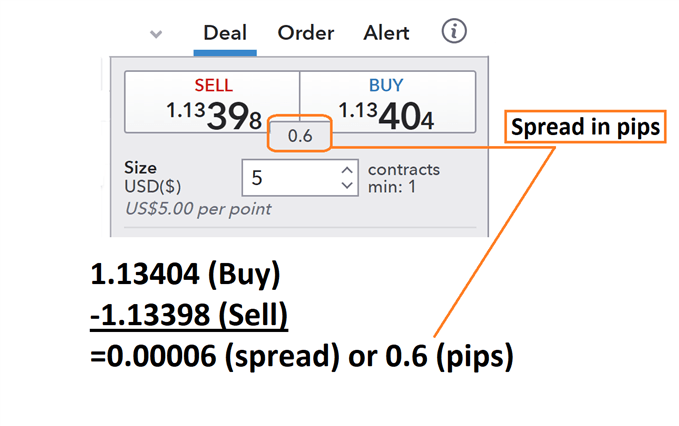

To illustrate, consider the EUR/USD quote below. If the Ask price is 1.13398 and the Bid price is 1.13404, subtracting the two gives you:

1.13404 – 1.13398 = 0.00006,

which equals 0.6 pips, because the pip for EUR/USD is identified at the fourth decimal place.

This basic calculation forms the foundation for understanding how trading costs work — so let’s continue with how these costs translate into real money.

How to Calculate Forex Spreads and Trading Costs

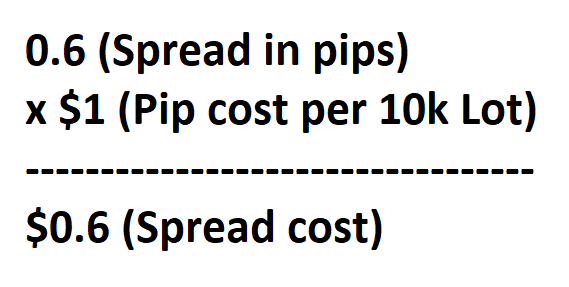

As established, the spread equals the Ask price minus the Bid price. Using the previous EUR/USD quote:

1.13404 – 1.13398 = 0.00006 (0.6 pips)

If you open a buy trade at the Ask price, the position immediately reflects a 0.6-pip cost, because you could only close the trade at the lower Bid price at that moment.

To calculate the total monetary cost, multiply the spread by the pip cost and your lot size:

- For a 10,000-unit (0.1 lot) EUR/USD position:

00006 × 10,000 = $0.60 - For a standard 100,000-unit (1.0 lot) position:

00006 × 100,000 = $6.00

If your account balance is denominated in another currency such as GBP, you must convert the pip value to USD to determine the actual cost.

Understanding these mechanics helps traders estimate expenses before entering a position — a crucial component of risk management.

Why Forex Spreads Change: High vs. Low Spread Environments

Spreads are not fixed. They expand and contract depending on market conditions, liquidity levels, and macro-economic events. Recognizing when spreads are likely to widen or narrow can help traders time their entries more efficiently.

High Spread Conditions: What They Indicate

A high spread means the gap between Bid and Ask prices is relatively wide. This typically signals one of the following:

- High volatility, often caused by major economic releases or geopolitical uncertainty

- Low liquidity, such as during off-peak hours or holidays

- Trading exotic or emerging market currency pairs (e.g., USD/ZAR, USD/TRY), which naturally carry higher spreads due to lower trading volumes

Events like Brexit, U.S. elections, FOMC meetings, or unexpected macro shocks often trigger significant spread widening as liquidity providers adjust their pricing models to manage risk.

Low Spread Conditions: Preferred by Most Traders

A low spread indicates:

- High liquidity

- Stable volatility

- Active trading during major market sessions (London, New York, Tokyo)

Major pairs such as EUR/USD or USD/JPY tend to have the lowest spreads because they are heavily traded by institutions, hedge funds, central banks, and electronic communication networks (ECNs).

Monitoring Spread Changes: Why It Matters

Economic news releases — especially those on the economic calendar such as NFP, CPI, PMI, interest rate decisions, GDP reports, and central bank statements — often cause spreads to widen sharply.

Even large institutional liquidity providers (LPs) don’t know news outcomes in advance. To offset potential risk from sudden volatility, LPs temporarily widen spreads. Retail brokers pass this pricing directly to traders.

Monitoring spread behavior helps traders:

- Avoid entering trades during unnecessary volatility

- Reduce exposure to unpredictable price spikes

- Improve execution quality and slippage management

The Hidden Risk: Spread Widening Can Trigger Margin Calls

Spread widening can impact open positions even if the underlying market price has not moved significantly. A sudden jump in spreads may cause:

- Stop-outs due to the Ask/Bid hitting your stop level

- Margin calls if your free margin becomes insufficient due to temporary pricing distortions

The best protection is prudent leverage management and avoiding overexposure during high-risk periods (e.g., major news releases). Sometimes, remaining in a trade until spreads normalize can prevent premature stop-outs — provided the underlying position remains fundamentally valid.

Further Strategies and Practical Insights for Managing Forex Spreads

To deepen your understanding and improve execution quality, consider reviewing practical forex spread trading strategies, including:

- Trading during high-liquidity sessions

- Avoiding low-liquidity rollover periods

- Using limit orders instead of market orders in volatile markets

- Segmenting currency pairs based on their average spreads

These concepts help traders enhance long-term consistency.

Take Your FX Knowledge to the Next Level

If you’re new to trading, visit our Beginner’s Forex Trading Guide for expert insights, foundational concepts, and actionable trading techniques.