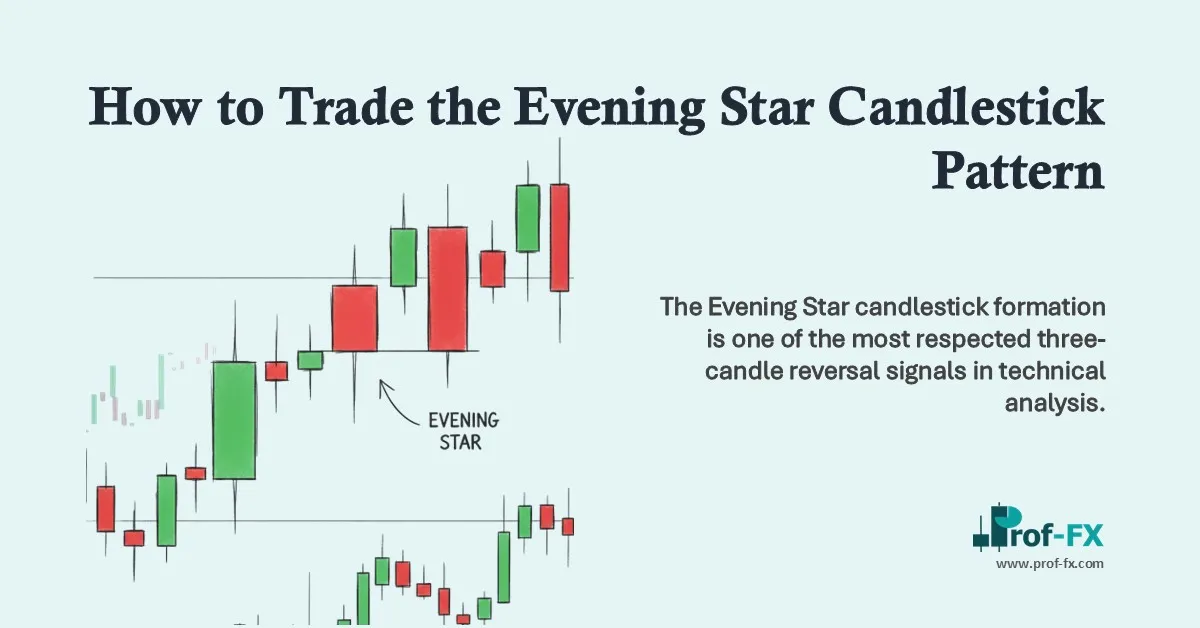

The Evening Star candlestick formation is one of the most respected three-candle reversal signals in technical analysis. For forex traders, the ability to recognize early signs of exhaustion in an uptrend – and anticipate a potential bearish reversal – can offer highly attractive entry levels with favorable risk-to-reward structures.

This guide provides a comprehensive breakdown of the Evening Star pattern, including its characteristics, identification criteria, trading techniques, and reliability within the forex market.

What You Will Learn

- What the Evening Star candlestick pattern is

- How to identify the formation correctly on forex charts

- How to trade the Evening Star pattern using rules-based methodology

- Advantages and limitations of the pattern in real-market conditions

What Is an Evening Star Candlestick?

The Evening Star is a three-candle bearish reversal pattern that forms near the top of an uptrend. It signals weakening bullish momentum followed by a shift in control from buyers to sellers, often marking the early stage of a new downward trend.

The psychology behind the pattern reflects a transition from strong buying pressure, to hesitation, and finally to decisive selling activity.

How to Identify an Evening Star on Forex Charts

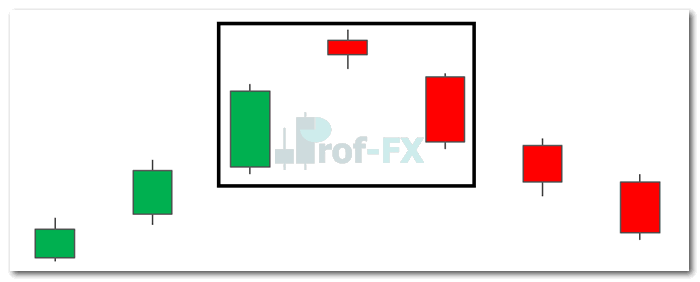

Spotting the Evening Star is not only about recognizing the three candles visually; it requires context. Traders must evaluate the prevailing market structure and confirm that the pattern appears at the end of an established bullish trend.

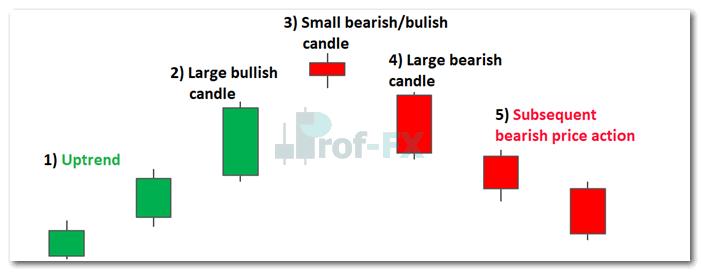

1. Confirm an Existing Uptrend

The market should display a clear sequence of higher highs and higher lows. Without an uptrend, the signal loses its significance as a reversal pattern.

2. Candle One: Large Bullish Candle

A strong bullish candle indicates aggressive buying pressure and continuation of the established uptrend. At this point, there is no evidence of reversal.

3. Candle Two: Small Candle (Indecision Candle / Doji)

The second candle is small and may be bullish, bearish, or a Doji.

Its significance lies in the loss of momentum.

This candle often gaps higher in non-forex markets, forming a higher high, but remains narrow as buyers struggle to extend the trend.

4. Candle Three: Large Bearish Candle

This candle marks the decisive takeover by sellers.

In equities, it typically gaps down; in forex, it usually opens near the second candle’s close due to lower likelihood of gaps.

A close well below the midpoint of the first candle strengthens the signal.

5. Post-Pattern Price Action

A valid reversal is confirmed when subsequent price movement begins forming lower highs and lower lows.

Proper stop placement is essential to manage failed reversals.

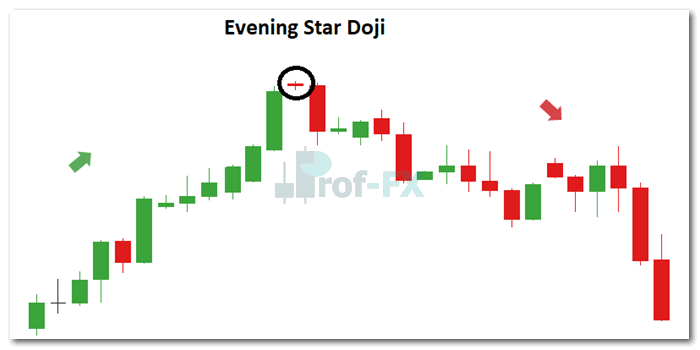

Evening Star Doji Formation

At times, the second candle forms a Doji, highlighting pronounced indecision.

A Doji signals that bullish sentiment has stalled completely—often creating an ideal setup for bears to step in on the next candle.

The third bearish candle that follows provides the confirmation required for traders to consider short positions.

The Opposite Pattern: Morning Star

The Morning Star is the bullish counterpart of the Evening Star.

Where the Evening Star signals a bearish reversal at the top of an uptrend, the Morning Star signals a bullish reversal at the bottom of a downtrend.

The analytical framework is identical, but applied in the opposite direction.

How to Trade the Evening Star Candlestick Pattern

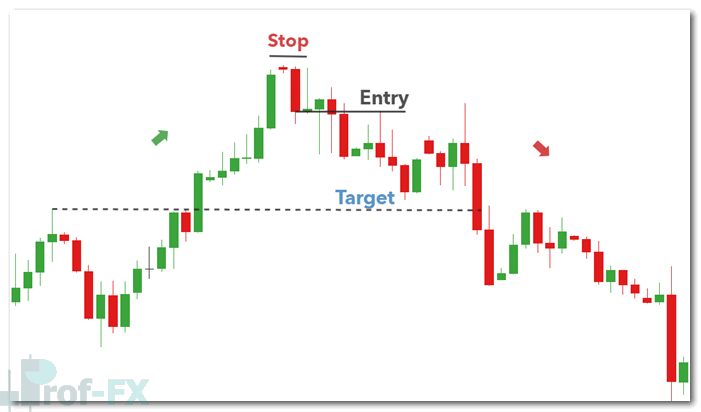

Below is a real-market example on the EUR/GBP pair, where a clear uptrend precedes the formation of the Evening Star.

Once the pattern completes, traders can consider the following trade setup:

1. Entry

Enter at the open of the candle immediately following the completed Evening Star.

A more conservative approach is to wait for additional bearish confirmation, though this may result in entering at a less favorable price—especially in fast-moving markets.

2. Stop Placement

Place stops above the recent swing high that forms just before the Evening Star.

If price breaks this level, the reversal structure is invalidated.

3. Profit Targets

Targets can be placed:

- At previous support levels

- At areas of consolidation

- Or using a measured-move approach depending on your trading system

Risk management is essential—no reversal pattern guarantees continuation.

Because gaps are rare in forex, the three candles typically form without the distinct spacing seen in stock markets, but the psychological structure remains intact.

How Reliable Is the Evening Star in Forex Trading?

The Evening Star is a widely recognized reversal pattern, but like all candlestick signals, it should not be traded in isolation.

Its reliability increases when combined with:

- Trend analysis

- Support/resistance levels

- Volume behavior (in applicable markets)

- Complementary technical indicators

Below is a balanced look at its strengths and weaknesses.

Advantages

- Frequently appears on forex charts

- Provides clear and well-defined entry and exit levels

- Easy to identify even for novice traders

- Offers early positioning for potential bearish reversals

Limitations

- Failed reversals can occur, with price continuing to move upward

- Requires broader market context to filter out false signals

- Effectiveness depends heavily on trend quality and confirmation

Further Reading on Candlestick Patterns

If you’re building your candlestick expertise, consider reviewing:

- Top 10 Candlestick Patterns every trader should know

- Key reversal formations such as:

– Bearish Engulfing

– Bearish Harami

– Morning Star - Explore our technical analysis guide

Prof FX delivers daily forex news, market insights, and technical analysis covering major currency pairs, commodities, and global macro trends.