Key Concepts Discussed in This Guide

- Understanding what the opening range represents in financial markets

- Why the opening range bias is a powerful and objective trading tool

- How opening ranges operate across multiple timeframes

- Practical trading insights from real institutional examples

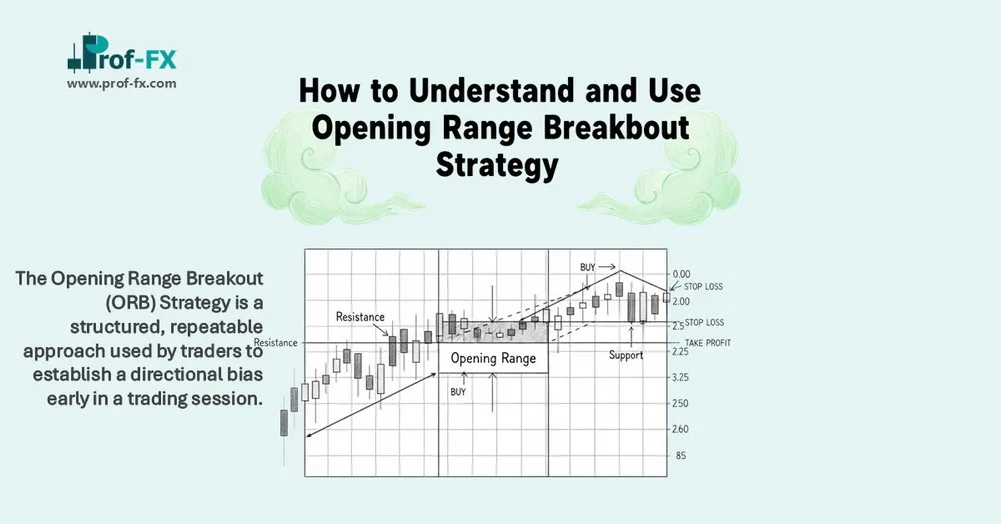

The Opening Range Breakout (ORB) Strategy is a structured, repeatable approach used by traders to establish a directional bias early in a trading session. The strategy revolves around identifying the market-defined price range formed shortly after the open – and using a break above or below that range to determine where institutional order flow, liquidity, and momentum are likely to travel next.

In a special edition of the Prof FX podcast Trading Global Markets Decoded, Senior Strategist Martin Thomas breaks down the logic behind opening ranges. He explains why traders rely on this method to build conviction, how these breakouts typically unfold, and what pitfalls to avoid when using ORB in volatile market conditions.

At its core, the opening range breakout strategy appeals to traders who aim to capture early directional moves. Bulls position themselves long and bears position themselves short as soon as the session begins, anticipating that the first decisive breakout will reveal the market’s path of least resistance. Once the initial range forms, the breakout often shapes intraday sentiment, influencing trend development for the rest of the day.

Martin references a well-known example from the 1990s: the “10 O’Clock Bulls.” The U.S. equity market opened at 9:30 AM, trend-followers waited for the initial range to form, and by 10:00 AM many bullish breakouts occurred.

When upside levels broke, bearish positions were quickly unwound and traders aggressively bought into the rising momentum – a pattern so consistent it earned that iconic nickname.

Understanding the Opening Range and Its Market Logic

With the opening range concept, traders observe the high and low of the first 30 minutes of a session – a time window where liquidity providers, institutional traders, and algorithmic systems shape initial price discovery.

Once that range is defined:

- A break above the opening range often signals strong bullish order flow, making it unlikely for price to revisit the session low.

- A break below typically indicates bearish momentum strong enough to keep the session high intact.

This structure gives traders two crucial elements:

- Bias clarity – the market reveals its dominant direction

- Objective stop placement – the opposite side of the range serves as a natural invalidation point

This approach differs significantly from fundamental analysis, where traders evaluate macroeconomic indicators, interest rate expectations, and policy themes to estimate an asset’s value. ORB focuses exclusively on price action, market behavior, volatility, and risk management, offering traders a rules-based method to stay consistent.

Below is an illustration showing how four opening ranges played out across consecutive years – highlighting their ability to signal sustained directional bias.

Why Opening Ranges Matter: Behavioral and Technical Advantages

One of the most valuable aspects of the opening range breakout strategy is the clear messaging it provides about market psychology and trader behavior. Early in the year, month, or session, traders do not want to miss the first strong move — nor do they want to underperform key benchmarks. This creates powerful liquidity surges when ranges break.

Martin explains that traders also cannot afford to hold losing positions against an opening range breakout. When their bias is invalidated, they must exit quickly – and may even stop-and-reverse, adding fuel to the emerging trend.

From a trading perspective, this is incredibly useful. ORB gives traders a structured plan:

- If you’re bullish and price breaks below the range – exit and reassess

- If you’re bearish and price breaks above the range – exit or reverse

- If invalidation occurs – move to a different market with clearer structure

This disciplined approach helps traders preserve capital, reduce emotional decision-making, and stay aligned with genuine market direction.

Macro Opening Ranges: Applying the Strategy Across Timeframes

A critical but often overlooked concept is that opening ranges scale across multiple timeframes. You are not limited to intraday sessions. Traders can identify and apply ORB logic to:

- Session opening ranges (e.g., London, New York)

- Daily opening ranges

- Weekly opening ranges

- Monthly opening ranges

- Quarterly and even biannual opening ranges

Martin advises traders to choose a few markets they specialize in – whether major currency pairs, equity indices, or commodities – and use opening ranges to maintain bias alignment, manage risk, and identify when trends are strengthening or weakening.

Opening range breakouts are not just a strategy – they are a risk measurement tool. Traders need an objective metric showing when their market view is no longer valid. The opening range provides that metric clearly and consistently.

Prof FX provides forex news and technical analysis on the trends that influence the global currency markets, empowering traders with data-driven insights and professionally structured trading knowledge.