Understanding forex order types is a fundamental skill every trader must master before executing trades in the currency market. Forex orders allow traders to control entries, manage exits, and limit risk, regardless of market conditions or trading style.

While order functionality may vary slightly between brokers and trading platforms, the core types of FX orders are universally accepted across the industry. Knowing how and when to use each order type helps traders trade with precision, discipline, and emotional stability.

In this guide, we will walk through the main types of forex orders, explain how they work in real trading environments, and show how traders can use them effectively in live markets.

Market Orders: Executing Trades at the Current Price

A market order is the most basic and widely used forex order type. As the name suggests, a market order executes immediately at the best available market price.

Market orders are ideal when speed and certainty of execution are more important than price precision.

When Traders Use Market Orders

Market orders are commonly used by:

- Scalpers, who require instant execution

- Day traders, entering or exiting during high-momentum moves

- Traders reacting to breakouts or news-driven volatility

Market Order Example

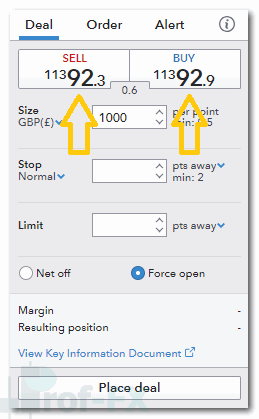

On a live EUR/USD deal ticket, traders are shown two prices:

- Buy (Ask) price

- Sell (Bid) price

Placing a market buy order at 1.13929 will execute instantly at the prevailing market price. The same principle applies when opening short (sell) positions.

Entry Orders: Planning Trades in Advance

Entry orders allow traders to pre-define a price level at which a new position will automatically open in the future. Unlike market orders, entry orders are placed away from the current market price.

This order type is particularly useful for traders who:

- Follow breakout strategies

- Trade retracements

- Cannot monitor charts continuously

Entry orders allow traders to remain disciplined and systematic, removing emotional decision-making from execution.

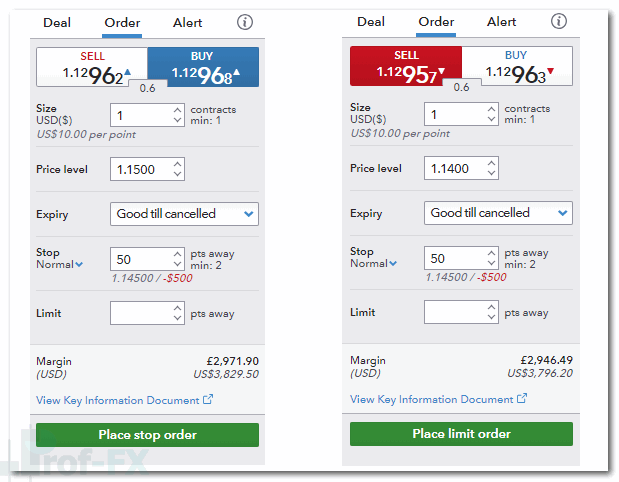

Limit Orders: Entering or Exiting at Better Prices

A limit order is designed to execute at a specified price or better. There are two main applications of limit orders in forex trading.

Limit Orders to Open a Trade

Limit entry orders are used when traders want to enter the market at a more favorable price than the current one.

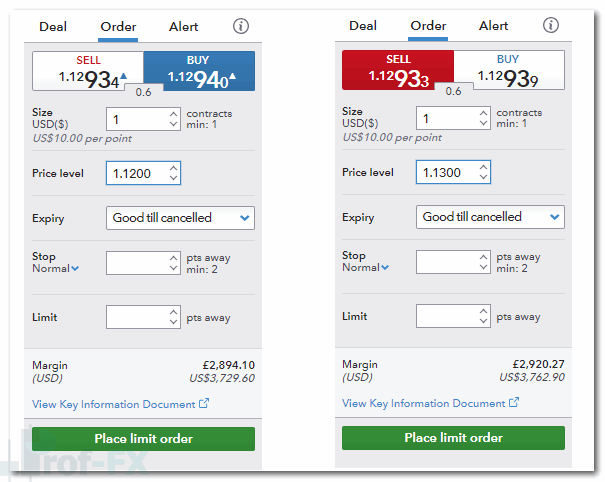

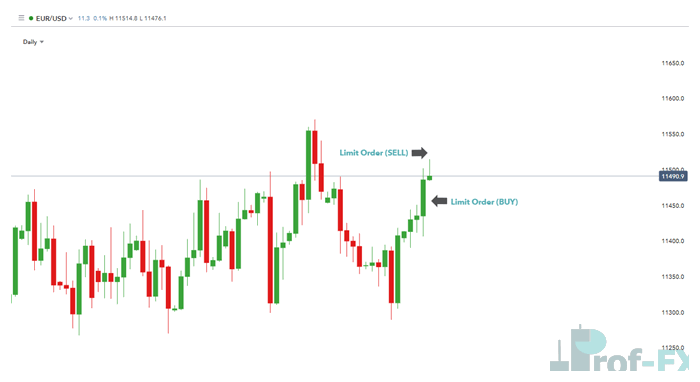

Example: Buying Lower or Selling Higher

- If EUR/USD is trading at 1294 and a trader expects price to retrace before rising, a buy limit can be placed at 1.1200.

- If price is trading at 1294 and the trader expects a pullback from higher levels, a sell limit can be placed at 1.1300.

Limit orders will only be filled at the designated price or better.

Limit Orders to Close a Trade (Take Profit)

Limit orders are also widely used to lock in profits once price reaches a favorable level.

Example: Taking Profit

- Buy EUR/USD at 1300, target 100 pips profit → sell limit at 1.1400

- Sell EUR/USD at 1300, target 100 pips profit → buy limit at 1.1200

This approach supports structured risk-to-reward planning and removes emotional exits.

Visual Representation of a Limit Order

Stop Orders: Managing Breakouts and Risk

Stop orders are another essential forex order type, commonly used for breakout trading and risk protection.

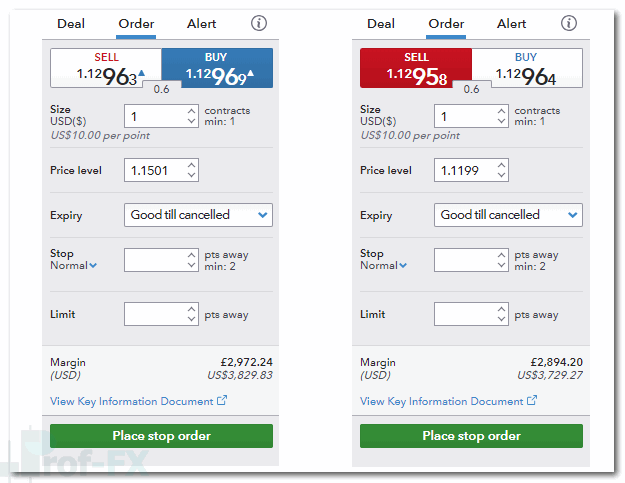

Stop Orders to Open a Trade (Entry Stops)

Entry stop orders trigger only when price moves beyond a specific level, making them ideal for breakout strategies.

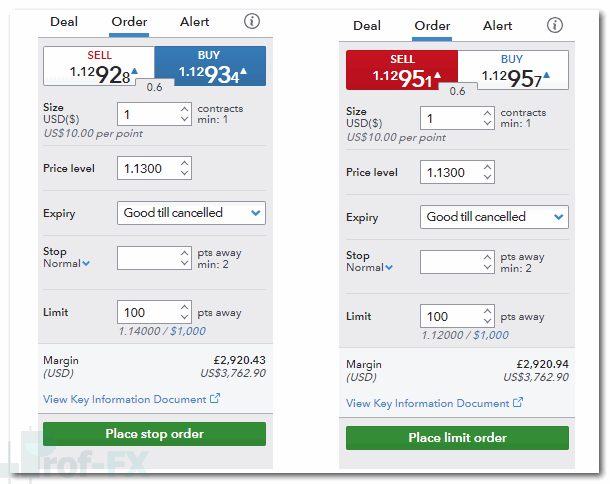

Breakout Example

- If EUR/USD breaks above 1500, a buy stop at 1.1501 enters the trade as momentum continues.

- If EUR/USD falls below 1200, a sell stop at 1.1199 enters the market in the direction of downside momentum.

Once triggered, stop orders convert into market orders and fill at the best available price.

Stop Orders to Close a Trade (Stop Loss)

Protective stop orders are used to limit downside risk, making them one of the most critical tools in professional trading.

Risk Management Example

- Buy EUR/USD at 1500, risk 50 pips → stop loss at 1.1450

- Sell EUR/USD at 1400, risk 50 pips → stop loss at 1.1450

Using stop losses ensures that no single trade can cause catastrophic damage to the trading account.

Visual Representation of a Stop Order

How to Place a Forex Order on a Trading Platform

Although platforms differ slightly, the general process of placing a forex order remains consistent:

1. Open the deal ticket

2. Select Buy or Sell

3. Enter the desired price level

- Above market → stop order

- Below market → limit order

4. Add stop loss and take profit

5. Confirm and submit the order

Traders are strongly advised to practice on demo accounts to fully understand platform mechanics before trading live capital.

Key Takeaways for Forex Order Execution

Forex orders provide traders with:

- Precision in entries and exits

- Improved emotional control

- Better risk management

- Flexibility across trading styles

Mastering order types is not optional—it is a core competency for long-term survival in the forex market.

Further Resources to Improve Your Forex Trading

To deepen your trading knowledge:

- Attend our live forex webinars covering central banks, economic news, and technical patterns

- Learn how much capital to risk per trade to protect your account

- Explore our Traits of Successful Traders guide to understand what separates professionals from amateurs