Introduction: Understanding Forex Trading Strategies

A forex trading strategy is a structured approach that defines when to enter a trade, when to exit, and how to manage risk. In professional trading, a strategy is not just an idea—it is a repeatable system built on clear rules. Forex traders typically rely on:

- Technical analysis

- Fundamental analysis

- Or a combination of both

A well-designed strategy allows traders to analyze market conditions objectively, execute trades with confidence, and apply sound risk management principles consistently.

Forex Trading Strategies: A High-Level Overview

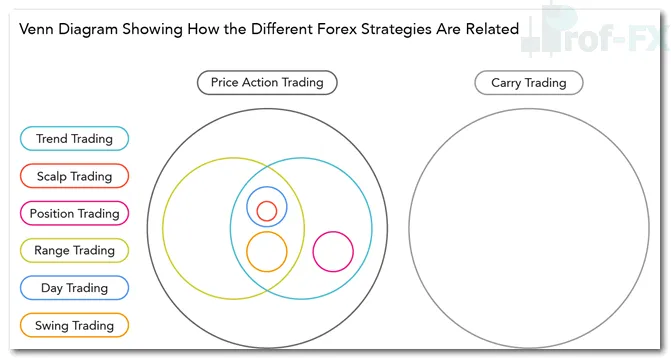

Forex strategies can be organized into a structured framework that helps traders quickly identify which approach best suits their time availability, personality, and risk tolerance. The diagram below illustrates how each trading strategy fits into the broader forex strategy landscape and how they relate to one another.

This top-down view is especially useful for beginner traders, as it highlights that no single strategy is superior in all conditions—each serves a different purpose.

Forex Trading Strategies That Actually Work

Successful forex trading requires aligning multiple factors into a coherent trading plan. While there are countless strategies available, the most important factor is not complexity—but clarity and comfort with execution. Every trader has different:

- Financial goals

- Time resources

- Risk tolerance

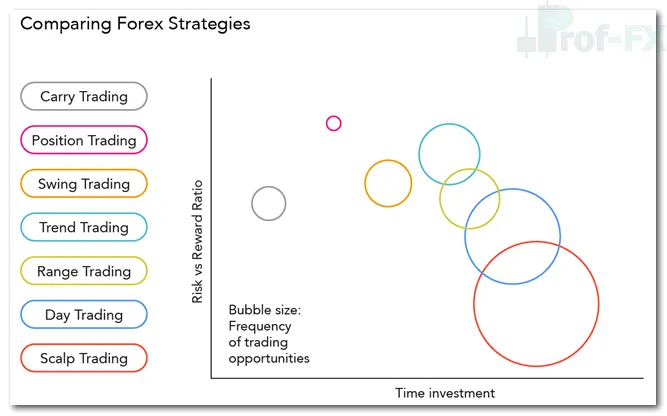

Three Key Criteria for Comparing Forex Strategies

Traders can objectively compare strategies using the following criteria:

- Time investment required

- Frequency of trading opportunities

- Typical distance to target (risk-to-reward ratio)

To visualize this comparison, the strategies are plotted on a bubble chart:

- Vertical axis: Risk-to-reward ratio

- Horizontal axis: Time investment required

Strategies such as position trading tend to offer higher risk-to-reward ratios, while scalping demands the greatest time commitment due to frequent trade execution.

1. Price Action Trading

Price action trading focuses on analyzing historical price movements to identify trading opportunities. It can be used as:

- A standalone strategy, or

- In combination with indicators

Fundamental analysis is used sparingly, though economic events may occasionally support technical setups.

Length of Trade

Price action trading is highly flexible and can be applied across:

- Short-term

- Medium-term

- Long-term timeframes

This adaptability makes it one of the most popular approaches among professional traders.

Entry and Exit Techniques

Common tools used to identify support and resistance include:

- Fibonacci retracement

- Candle wicks

- Trend structure

- Indicators

- Oscillators

Many other strategies—such as range trading, trend trading, scalping, swing trading, and position trading—fall under the broader price action umbrella.

2. Range Trading Strategy

Range trading involves identifying clear support and resistance levels and placing trades within that range. This strategy works best in low-volatility markets with no clear trend.

Length of Trade

There is no fixed holding period. Range-bound strategies can be applied across multiple timeframes, but risk management is critical, as breakouts can invalidate the range.

Entry and Exit Tools

Oscillators are commonly used for timing, including:

- Relative Strength Index (RSI)

- Commodity Channel Index (CCI)

- Stochastics

Price action is often used to validate oscillator signals.

Example: USD/JPY Range Trading

In this example, USD/JPY trades within a clearly defined range. The RSI highlights overbought (blue) and oversold (red) conditions, helping traders time entries and exits around key levels.

Pros:

- Frequent trading opportunities

- Favorable risk-to-reward potential

Cons:

- Requires extended monitoring

- Strong technical analysis skills needed

3. Trend Trading Strategy

Trend trading aims to capture profits by trading in the direction of a market’s dominant momentum. This strategy is widely used across all experience levels.

Length of Trade

Trend trades typically span the medium to long term, depending on the strength and duration of the trend. Multiple timeframe analysis is commonly used.

Entry and Exit Logic

- Entries are often timed using oscillators such as RSI or CCI

- Exits are based on predefined risk-to-reward ratios

Example: Identifying and Trading a Trend

EUR/USD displays a classic uptrend defined by higher highs and higher lows.

Using the CCI, entries are timed when momentum temporarily weakens before resuming in the trend direction.

Pros:

- Numerous opportunities

- Favorable risk-to-reward

Cons:

- Time-intensive

- Requires strong technical discipline

4. Position Trading

Position trading is a long-term strategy primarily driven by fundamental analysis, with technical tools used for timing.

Length of Trade

Trades can last weeks, months, or even years, making this strategy suitable for patient traders with a macroeconomic focus.

Entry and Exit Analysis

Weekly and monthly charts are commonly used to identify:

- Key support and resistance levels

- Long-term technical patterns

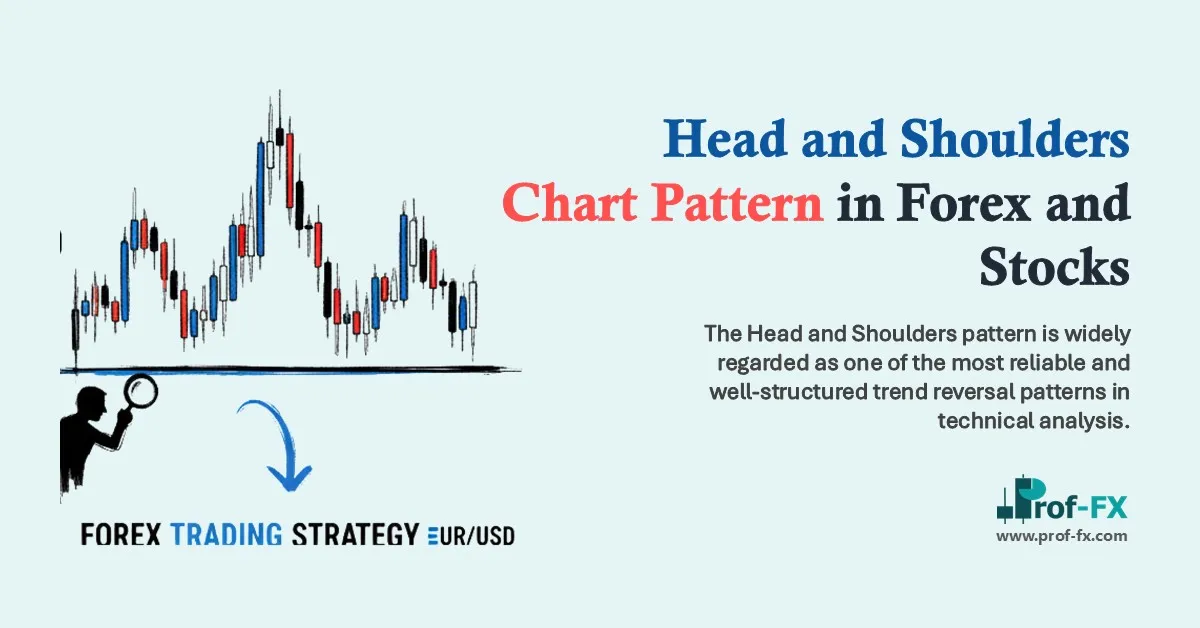

Example: Germany 30 (DAX) Position Trade

In this example, a long-term head and shoulders pattern aligned with macroeconomic factors such as:

- Germany’s technical recession

- US–China trade tensions

- Brexit-related uncertainty

This illustrates the effectiveness of combining technical and fundamental analysis.

Pros:

- Minimal time commitment

- Strong risk-to-reward potential

Cons:

- Few trading opportunities

- Requires deep technical and fundamental knowledge

5. Day Trading Strategy

Day trading involves opening and closing all positions within the same trading day.

Length of Trade

Trades may last:

- Minutes

- Hours As long as positions are closed before the market session ends.

Example: EUR/USD Day Trading

Entries occur when price breaks the 8-period EMA in the direction of the trend, with take-profit levels matching stop distances.

Pros:

- Frequent opportunities

- Moderate risk-to-reward

Cons:

- Highly time-intensive

- Demands strong technical execution

6. Forex Scalping Strategy

Scalping focuses on capturing small price movements through high-frequency trading.

Length of Trade

Trades typically last seconds to minutes and are executed on:

- 1-minute to 30-minute charts

Example: EUR/USD Scalping

Trend direction is confirmed using the 200 MA, while entries and exits are refined using oscillators and MACD signals.

Pros:

- Highest number of trading opportunities

Cons:

- Lowest risk-to-reward ratio

- Extremely time-demanding

- Requires advanced technical skills

7. Swing Trading

Swing trading aims to capture medium-term price movements in both trending and range-bound markets.

Length of Trade

Trades typically last from:

- A few hours

- Several days

Example: GBP/USD Swing Trading

This setup uses:

- Moving averages for trend direction

- Stochastics for entries

- ATR for stop placement

A minimum 1:2 risk-to-reward ratio is recommended for consistency.

Pros:

- Balanced opportunity frequency

- Moderate risk-to-reward

Cons:

- Still time-intensive

- Requires solid technical understanding

8. Carry Trade Strategy

Carry trading involves borrowing a low-interest currency and investing in a higher-yielding currency to earn the interest differential.

Length of Trade

Carry trades are typically held over the medium to long term, depending on interest rate stability.

Key Considerations

- Exchange rate risk

- Interest rate risk

- Strong trending environments

Pairs like AUD/JPY are commonly used when interest rate differentials are favorable.

Pros:

- Minimal monitoring required

- Stable returns in the right conditions

Cons:

- Infrequent opportunities

- Requires strong macroeconomic understanding

Forex Trading Strategies: Final Summary

This guide has outlined eight proven forex trading strategies, each with distinct characteristics. When selecting a strategy, traders should consider:

- Time availability

- Risk-to-reward expectations

- Frequency of opportunities

Matching your trading personality with the appropriate strategy is one of the most important steps toward long-term success.

Enhance Your Forex Trading Knowledge

- Visit a Forex for Traders Guide

- Attend live trading webinars covering central banks, economic data, and technical patterns

- Stay informed with an economic calendar

- Learn proper risk management techniques

- Study the traits of successful traders

Prof FX provides professional forex news and technical analysis on the trends shaping global currency markets.