U.S. Core PCE Price Index m/m

Forecast: 0.2% Previous: 0.2%

Collecting data.

Wait until next event.

00

Days

00

Hours

00

Minutes

00

Seconds

New Programs

| Central Banks | ||

| Federal Reserve | 4.50% | |

| European Central Bank | 3.15% | |

| Bank of England | 4.75% | |

| Swizz National Bank | 0.50% | |

| Reserve Bank of Australia | 4.35% | |

| Bank of Canada | 3.25% | |

| R. Bank of New Zealand | 4.25% | |

| Bank of Japan | 0.25% | |

Forex Education & Journal’s

-

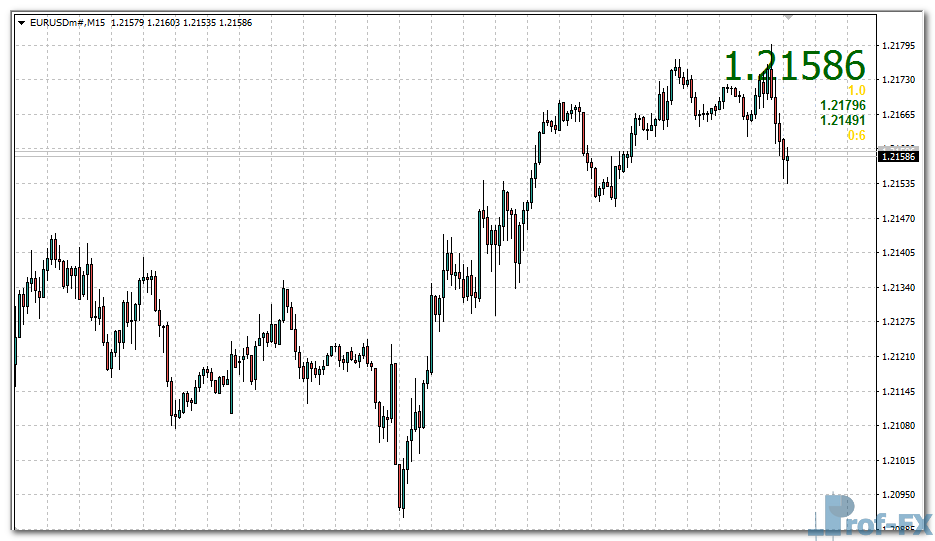

The technical analysis space amidst the scope of the market trade is wrought with innumerable options to track the market ….

-

A Closer Look at Simple Moving Averages (SMA) Moving averages are among the most widely used tools in forex trading ….

-

In the first part of our series on trading support and resistance, we explored the significance of these levels in ….

-

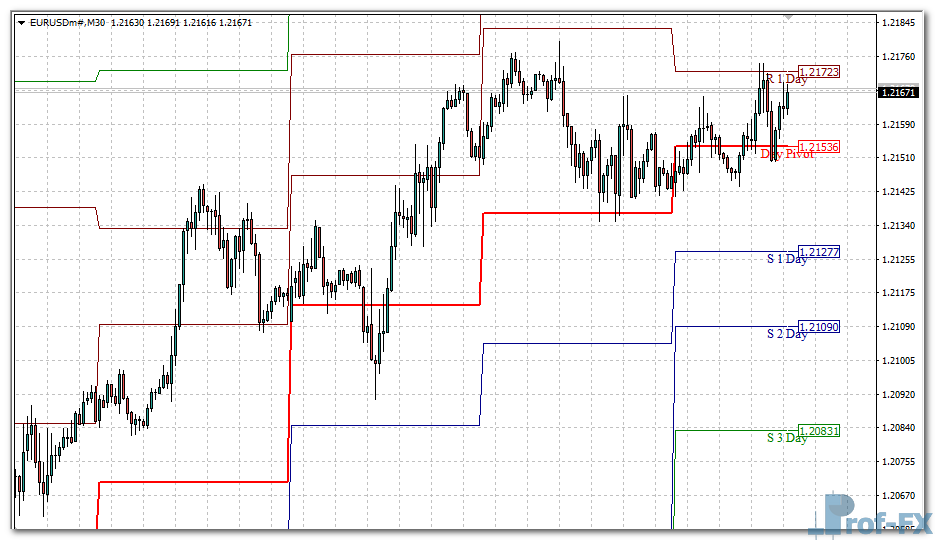

Support and resistance levels are among the most widely utilized technical tools in the Forex market. These pivotal charting points ….