Margin calls are among the most feared events in forex trading. Experienced traders go to great lengths to avoid them, not because they are rare, but because they are entirely preventable with proper risk management. To trade successfully over the long term, it is essential to understand what a margin call is, why it happens, and how to avoid it.

This article provides a clear and practical explanation of margin calls in forex trading, covering the relationship between margin and leverage, the most common causes of margin calls, what happens when a margin call occurs, and proven ways traders can reduce the risk of ever facing one.

“Never meet a margin call. You are on the wrong side of a market. Why send good money after bad? Keep the money for another day.”

— Martin Thomas.

Understanding Margin and Leverage in Forex Trading

To fully grasp how margin calls occur, traders must first understand the close relationship between margin and leverage. These two concepts are inseparable and function as two sides of the same coin.

Margin refers to the minimum amount of capital required to open and maintain a leveraged position.

Leverage, on the other hand, allows traders to control a larger market position without depositing the full value of the trade.

While leverage increases market exposure, it also amplifies both profits and losses. This is why leveraged trading carries substantial risk. A small adverse price movement can have a disproportionately large impact on account equity if leverage is not used responsibly.

For this reason, margin and leverage must always be considered within the broader context of risk management, position sizing, and capital preservation.

What Causes a Margin Call in Forex Trading?

A margin call occurs when a trader no longer has sufficient usable (free) margin in their trading account. In simple terms, the account equity has fallen below the broker’s required maintenance level, and additional funds are needed to support open positions.

Margin calls typically result from trading losses that reduce free margin to unacceptable levels as defined by the broker. From the broker’s perspective, margin calls are a necessary risk control mechanism to prevent traders from losing more money than they have deposited.

Common Causes of Margin Calls

Although margin calls can happen for various reasons, the most common causes include:

- Holding on to losing trades for too long, allowing losses to erode free margin

- Excessive use of leverage, especially when combined with losing positions

- Trading with an underfunded account, forcing oversized positions

- Failing to use stop loss orders during aggressive market moves

In most cases, margin calls are not caused by a single mistake but by a combination of poor leverage management and weak risk controls.

What Happens When a Margin Call Occurs?

When a margin call is triggered, the broker will begin liquidating open positions, often without the trader’s consent. This forced liquidation serves two purposes:

- The trader no longer has sufficient capital to support the losing positions

- The broker reduces their exposure to further losses

It is important for traders to understand that leveraged trading can, in extreme situations, result in losses that exceed the initial deposit. This is why margin calls must be avoided at all costs.

Margin Call Example: How High Leverage Increases Risk

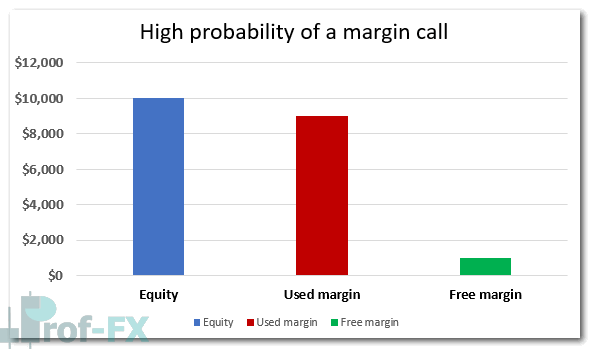

Below is a simplified example of a trading account that is highly vulnerable to a margin call:

Account Deposit: $10,000

Number of Standard Lots Traded: 4 (100k lots)

Margin Requirement: 2%

Used Margin: $9,000

Free Margin: $1,000

The used margin is calculated as follows (EUR/USD at 1.125):

Trade size × price × margin percentage × number of lots

$100,000 × 1.125 × 2% × 4 = $9,000

In this scenario, the trader has allocated most of their account equity to margin. While the account may appear healthy at first glance, it has very little capacity to absorb losses.

If the market moves just 25 pips against the trader (excluding spread), the loss would equal the remaining free margin:

$40 per pip × 25 pips = $1,000

At this point, the trader would face a margin call, and the position would likely be liquidated.

Why Margin Calls Are Closely Linked to Leverage

Leverage is often described as a double-edged sword, and this description is especially accurate in the context of margin calls. The higher the leverage used relative to account size, the less free margin remains available to absorb adverse price movements.

When usable margin reaches zero, a margin call becomes inevitable. This reinforces the importance of using protective stop loss orders and keeping losses as small as possible.

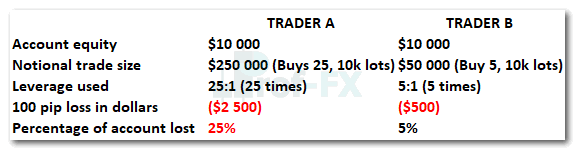

To further illustrate the impact of leverage alone, consider two trades that are identical in every way except for the leverage used:

The difference in leverage dramatically changes how quickly losses accumulate and how close the account comes to a margin call—even when market conditions are identical.

How to Avoid a Margin Call in Forex Trading

While margin calls can be devastating, they are largely preventable. The key lies in disciplined leverage usage and consistent risk management.

Top 4 Practical Ways to Avoid Margin Calls

- Avoid Over-Leveraging Your Trading Account

Reduce your effective leverage and trade conservatively. At Prof FX, a leverage level of 10:1 or lower is often recommended, especially for developing traders. - Use Stop Loss Orders on Every Trade

Protective stops limit downside risk and prevent small losses from becoming account-threatening events. - Maintain Healthy Free Margin Levels

Keep sufficient free margin to stay in trades during normal market fluctuations. A practical guideline is risking no more than 1% of account equity per trade and no more than 5% total exposure at any time. - Trade Smaller Position Sizes

Approach each trade as one of many rather than a make-or-break opportunity. Consistency, not aggression, is what builds long-term profitability.

Free Resources to Improve Your Forex Trading Knowledge

For traders at the beginning of their journey, a strong educational foundation is essential. Prof FX offers a range of learning resources designed to support traders at every level.

- Start with the New to Forex guide to understand core concepts

- Explore advanced trading guides to refine strategy and execution

- Study how margin and leverage interact to influence risk

- Learn from the Traits of Successful Traders, based on analysis of over 30 million live trades

Prof FX provides professional forex news, market insights, and technical analysis focused on the global currency markets, helping traders make informed and disciplined trading decisions.

Final Perspective for Forex Traders

A margin call is not bad luck—it is a warning sign of excessive risk. By understanding margin, leverage, and free margin, and by applying disciplined risk management, traders can avoid margin calls entirely and focus on sustainable growth in the forex market.