Inflation remains one of the most critical macroeconomic forces shaping global financial markets, consumer behavior, and monetary policy decisions. For traders—especially those active in forex—understanding inflation is essential because it influences currency valuations, interest rate expectations, and overall market sentiment. This comprehensive guide breaks down the concept of inflation, its sources, its consequences, and how governments manage it.

What Is Inflation and Why Does It Matter?

Inflation refers to the sustained increase in the general price level of goods and services within an economy over a given period. It is typically expressed as an annual percentage rate.

For instance, when inflation reaches 2%, it means that on average, prices are 2% higher compared with the previous period. A product that cost $1 last year would now cost approximately $1.02.

This gradual increase erodes purchasing power, meaning that each unit of currency buys fewer goods and services over time. For households, businesses, and traders, inflation shapes decision-making, savings behavior, and investment strategies.

Understanding Deflation

Deflation occurs when prices decline across the economy. While it may sound beneficial to consumers, deflation often signals weak demand and slowing economic activity.

This environment typically leads to lower interest rates and can trap an economy in stagnation, as seen in historical cases like Japan’s “lost decade.”

Deflation is uncommon in most advanced economies but remains a risk during severe recessions or financial crises.

Stagflation vs. Hyperinflation: Extreme Economic Scenarios

Stagflation

Stagflation emerges when an economy faces high inflation combined with low or zero economic growth.

This paradox often arises from external shocks—such as spikes in oil prices—that increase costs while simultaneously slowing production.

Hyperinflation

Hyperinflation refers to extremely rapid and out-of-control price increases, usually caused by excessive money supply growth or severe loss of confidence in a currency.

Both stagflation and hyperinflation can destabilize economies, increase unemployment, and damage financial markets. These risks highlight why central banks prioritize price stability.

How Inflation Is Measured: Key Indicators Used by Economists and Central Banks

Inflation is measured through several indices depending on the economic context and policy needs.

Consumer Price Index (CPI) – The Standard Benchmark

CPI is the most widely used inflation measure. It tracks price changes in a “basket of goods and services” representing typical consumer consumption patterns.

This basket often includes food, housing, energy, transportation, healthcare, and other essential categories.

Each country’s central bank customizes its CPI basket based on local consumption patterns, making CPI both universal and regionally specific.

Core CPI vs. Headline CPI

- Headline CPI includes volatile food and energy prices.

- Core CPI excludes these categories to provide a clearer picture of underlying inflation trends.

Central banks often rely on core CPI because it reflects long-term structural inflation rather than short-term supply shocks.

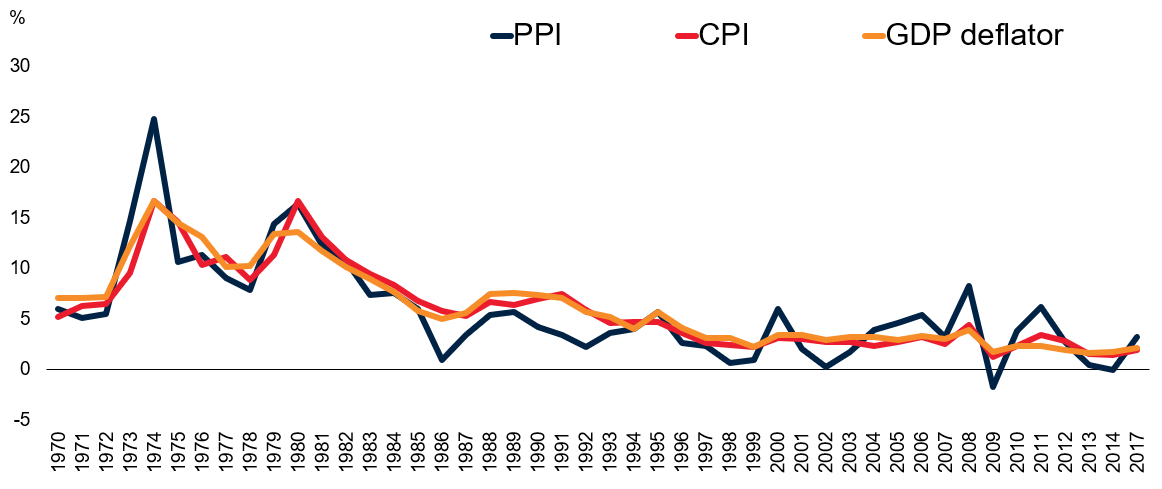

Producer Price Index (PPI) – Inflation at the Production Level

PPI measures the average change in prices that domestic producers receive for their output.

This index acts as a leading indicator of consumer inflation because production costs often pass through to retail prices.

PPI tends to be more volatile than CPI due to rapid fluctuations in raw material prices, energy costs, and supply chain conditions.

GDP Deflator – A Broad Measure of Price Changes

The GDP deflator measures price changes in all domestically produced goods and services, unlike CPI, which includes imported goods.

Formula:

GDP Deflator = (Nominal GDP / Real GDP) × 100

Its flexibility—as it is not tied to a fixed basket—makes it useful for capturing full economic inflation.

PPI vs CPI vs GDP Deflator

Source: World Bank

Each index offers unique insights, and no single measure is inherently superior. Economists and policymakers often analyze all three to form a comprehensive view of inflationary pressures.

Sources of Inflation: What Drives Prices Higher?

Inflation can emerge from several channels, often simultaneously. Key sources include:

1. Exchange Rate Movements

A weaker domestic currency raises the cost of imported goods.

This “imported inflation” passes directly to consumers, especially in economies with heavy reliance on foreign goods or commodities.

2. Essential Commodity Prices

Industries depend on core commodities like oil, metal, and agricultural inputs.

When these costs rise, manufacturers adjust final prices upward—leading to cost-push inflation.

3. Interest Rates

Low interest rates stimulate borrowing and spending, boosting aggregate demand and potentially increasing prices.

4. Government Debt Levels

High government debt may require higher yields to attract investors.

As more public funds go toward interest payments, overall consumer welfare can decline.

Businesses may raise prices to compensate for reduced government spending—another catalyst for inflation.

Demand-Pull vs. Cost-Push Inflation

- Demand-Pull Inflation arises when aggregate demand exceeds supply.

- Cost-Push Inflation results from rising production costs that reduce supply and lift prices.

Both mechanisms often interact, creating complex inflation dynamics.

Consequences of Inflation

Depreciation of Money Value

Rising inflation means consumers can purchase less with the same amount of money—a direct hit to real income.

Impact on Wealth Distribution

Inflation affects individuals differently.

Borrowers benefit from repaying loans with “cheaper” money, while savers may see their real wealth decline.

Inflation Volatility and Market Uncertainty

Unpredictable inflation complicates pricing strategies, contract negotiations, and long-term investments.

Volatility also increases hedging costs, reducing foreign investor confidence—particularly in emerging markets.

How Central Banks Target Inflation

Many central banks adopt inflation targeting frameworks, often aiming for 1–2% annual inflation.

To achieve this, they adjust monetary policy tools such as interest rates and liquidity measures.

A deviation beyond ±1% of the target usually triggers policy intervention.

How Governments Control Inflation

Governments and central banks use several tools to reduce inflationary pressure:

1. Reducing Money Supply

By increasing interest rates or issuing higher-yield government bonds, authorities remove liquidity from the economy.

2. Increasing Reserve Requirements

Higher reserve ratios limit the amount banks can lend, reducing money circulation and slowing spending.

3. Raising Policy Interest Rates

Higher borrowing costs discourage loans and reduce consumption and investment.

This is one of the most effective tools to curb inflation.

Global Inflation Dynamics and Key Economic Relationships

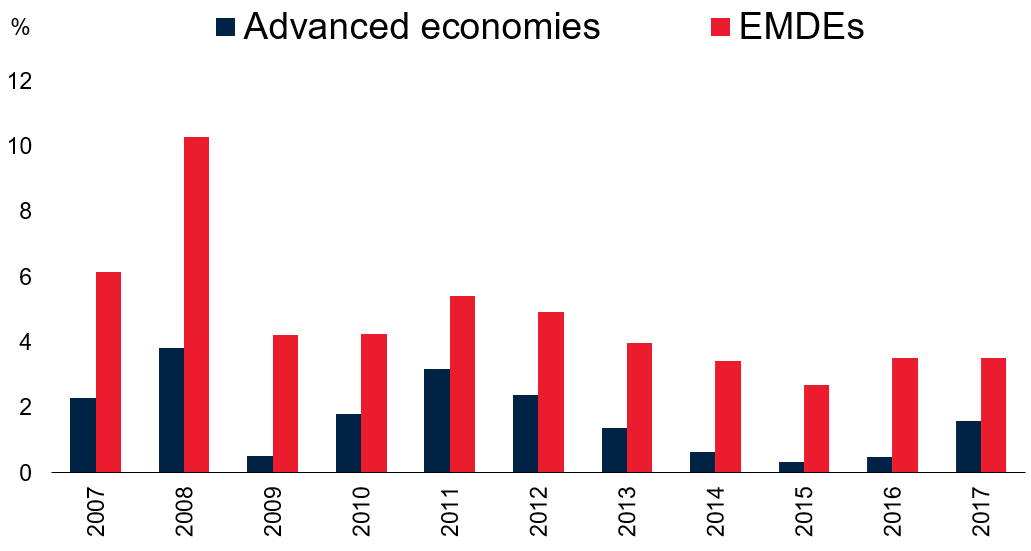

Advanced vs. Developing Economies

Source: World Bank

Emerging and Developing Economies (EMDE) typically experience higher inflation due to:

- Faster economic growth and higher demand

- Greater currency volatility, complicating monetary policy and pricing stability

Meanwhile, advanced economies generally maintain lower, more stable inflation.

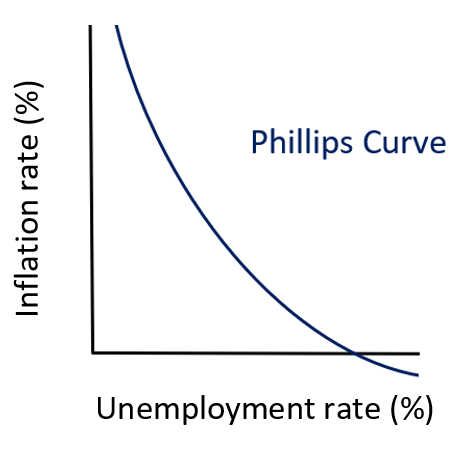

The Phillips Curve: The Inflation–Unemployment Trade-Off

Historically, inflation and unemployment have displayed an inverse relationship.

Higher demand increases production, reduces unemployment, and pushes prices upward—forming the basis of the Phillips Curve.

Conclusion: Why Inflation Matters for Traders and the Global Economy

Inflation’s impact spans households, corporations, investors, and governments.

For traders, especially in the forex market, inflation figures can move currencies, trigger policy shifts, and reshape market expectations within seconds.

Understanding inflation empowers traders to anticipate market reactions and build stronger macro-based strategies.

Further Reading

- Track global rate decisions on our Central Bank Calendar

- Learn how U.S. labor data moves the forex market: What is NFP and How to Trade It

- Explore deeper insights: How Interest Rates Affect Forex