Synopsis E-book: The MACD A Combo of Indicators

Moving averages are the easiest and most popular technical indicators. But they are trend-following indicators that work best in strong trending periods; in fact, moving average trading systems tend to lose money during periods of choppy trading.

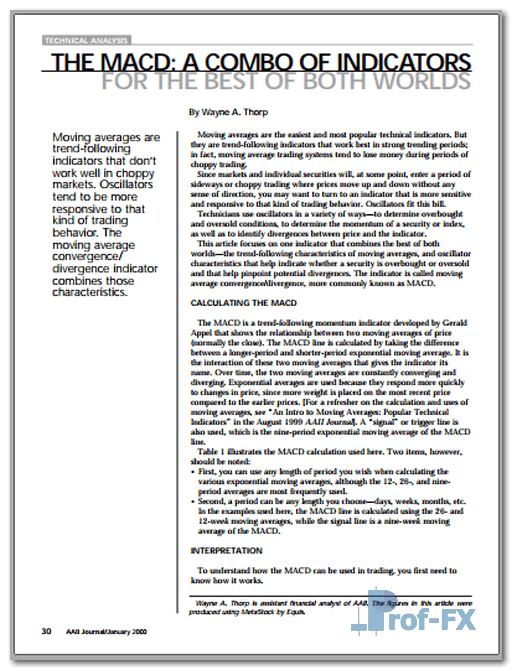

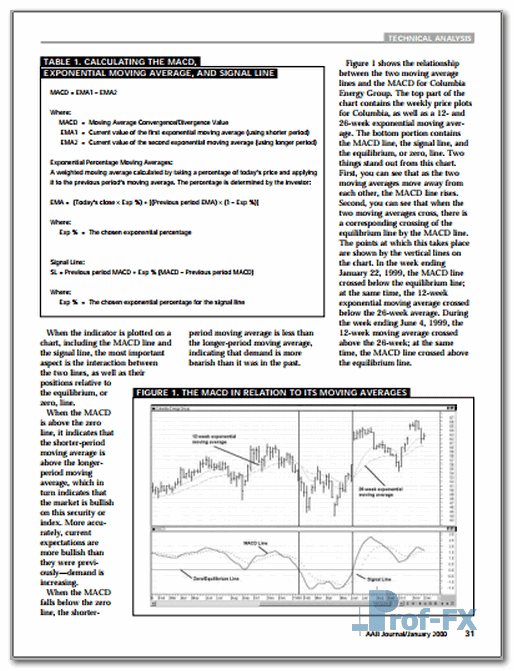

Since markets and individual securities will, at some point, enter a period of sideways or choppy trading where prices move up and down without any sense of direction, you may want to turn to an indicator that is more sensitive and responsive to that kind of trading behavior. Oscillators fit this bill. Technicians use oscillators in a variety of ways—to determine overbought and oversold conditions, to determine the momentum of a security or index, as well as to identify divergences between price and the indicator. This article focuses on one indicator that combines the best of both worlds—the trend-following characteristics of moving averages, and oscillator characteristics that help indicate whether a security is overbought or oversold and that help pinpoint potential divergences. The indicator is called moving average convergence/divergence, more commonly known as MACD.

Preview The MACD A Combo of Indicators

|

|

|

Download E-book The MACD A Combo of Indicators

- The-MACD-A-Combo-of-Indicators.pdf

- Size: 103 kb

- Author: Wayne A. Thorp | Language: English | Dir.: Part1 | Request Remove!