Understanding the Importance of the New York Forex Session

The New York forex session is widely recognized as one of the most liquid and actively traded sessions in the global foreign exchange market. This session represents the opening hours of the United States financial markets and plays a critical role in daily price movement—particularly for USD-based currency pairs.

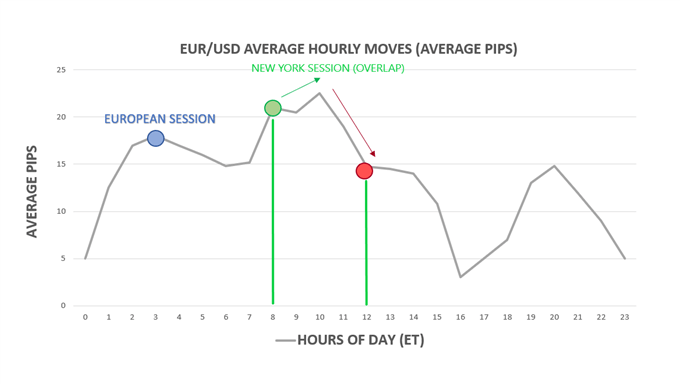

What makes the New York session especially important is its overlap with the London forex session. When these two major financial centers operate simultaneously, market participation increases sharply. As a result, liquidity rises, spreads often tighten, and volatility expands—creating favorable conditions for many trading strategies.

What Time Does the New York Forex Session Open?

The New York forex session opens at 8:00 AM Eastern Time (ET) and closes at 5:00 PM ET. The highly anticipated session overlap occurs when the New York session coincides with the London forex market session.

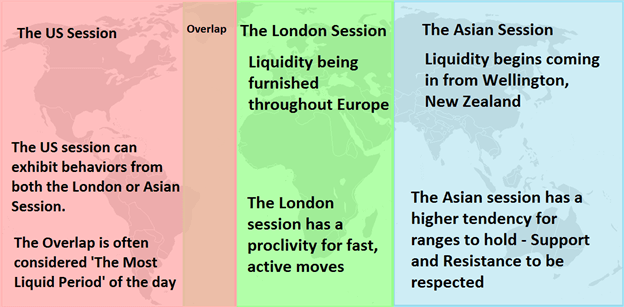

The London session opens at 3:00 AM ET and closes at 12:00 PM ET, which means the overlap takes place between 8:00 AM ET and 12:00 PM ET. During this four-hour window, trading activity often resembles the intensity and pace of the London session itself.

At the start of the New York session, volatility is typically higher than later in the day. This is due to a combination of fresh US economic data releases, institutional order flow, and continued participation from European traders. Depending on market conditions, traders can adapt their strategies to suit these varying levels of volatility.

New York Breakout Strategy: Trading the London–US Overlap

The overlap between the London and New York sessions represents the convergence of the two largest forex market centers in the world. During this period, a significant amount of liquidity enters the market, often resulting in large and rapid price movements—particularly in major currency pairs such as EUR/USD.

The chart below illustrates how, during the overlap (highlighted between the green vertical lines), the average hourly movement in EUR/USD reaches its highest levels.

To capitalize on this increase in volatility, traders often employ a breakout trading strategy. This approach is designed to take advantage of price expansion as the market breaks out of established technical patterns or key support and resistance levels.

In the example below, EUR/USD forms a triangle pattern prior to the overlap. As the overlap begins, price breaks out of this consolidation structure. Once risk management has been properly defined, a trader can plan an entry using technical confirmation—such as support and resistance, trendlines, or momentum indicators.

The key to trading breakouts successfully during the New York overlap is not prediction, but preparation. Traders must define their risk, identify valid technical structures, and allow volatility to work in their favor.

Trading the Later Part of the New York Session

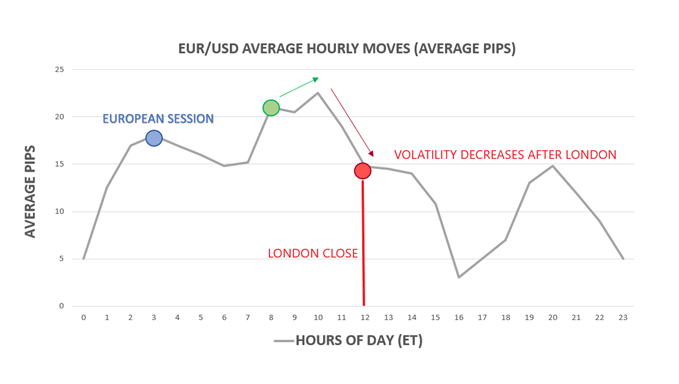

As the London market closes for the day, overall market participation begins to decline. This typically results in a noticeable reduction in volatility during the latter portion of the New York forex session.

Referring back to the same EUR/USD hourly volatility chart, we can observe a clear shift in behavior. Average hourly price movement becomes smaller and more contained as the US session progresses toward the close.

Because volatility is reduced during this phase, breakout strategies often become less effective. Instead, traders may consider adapting to a range trading strategy, which is better suited for quieter market conditions.

Using a Range Trading Strategy During Low Volatility

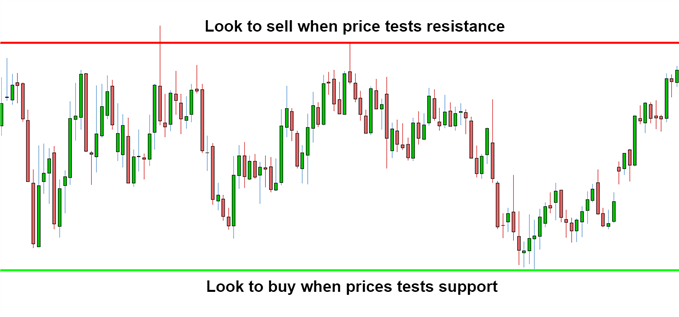

Range trading strategies focus on identifying clearly defined support and resistance levels. When price approaches the upper boundary of the range (often marked by a red line), traders may look for short opportunities. Conversely, when price moves toward the lower boundary (often marked by a green line), traders may look for buying opportunities.

The logic behind range trading is straightforward: when volatility declines, price is less likely to break through established levels. Instead, support and resistance are more likely to hold, making range-bound strategies more effective.

This approach requires patience and discipline, as traders must wait for price to reach key levels rather than chasing momentum.

Best Forex Pairs to Trade During the New York Session

The most suitable currency pairs to trade during the New York session are typically the major forex pairs, particularly those involving the US dollar. These pairs benefit from the highest liquidity and most consistent price action during US market hours.

Popular choices include:

- EUR/USD

- USD/JPY

- GBP/USD

- EUR/JPY

- GBP/JPY

- USD/CHF

Among these, EUR/USD is especially active during the London–New York overlap, often exhibiting strong directional moves and favorable trading conditions.

Liquidity, Spreads, and Trading Costs

Each forex trading session has its own unique characteristics. The London session transitions into the New York session, which is later followed by the Asian session. During the New York session—particularly the overlap—high liquidity often leads to reduced spreads, resulting in lower transaction costs for traders.

The combination of increased liquidity and elevated volatility during the overlap makes this period especially attractive for both short-term and intraday traders.

Advancing Your Forex Trading Knowledge

Understanding session behavior is a critical step toward becoming a consistent trader. If you are new to forex trading, educational resources that cover market structure, risk management, and trading psychology can significantly shorten your learning curve.

In addition, studying the traits of successful traders, based on large-scale trade data analysis, can help reinforce disciplined habits and realistic expectations—both essential components of long-term trading success.