Key Concepts for Trading with the Hammer Candlestick Pattern

The hammer candlestick pattern is one of the most recognizable reversal signals in the forex market, often appearing at the end of a downtrend. However, simply spotting the candle is not enough. Traders must analyze price action, context within the existing trend, and the candle’s location relative to support levels to validate its strength.

This guide explains:

- What the hammer candlestick pattern is

- Advantages and limitations of using hammer candles

- How to apply the hammer pattern in real market conditions

- Additional learning resources for candlestick-based trading

What Is a Hammer Candlestick Pattern?

A hammer candlestick forms at the bottom of a downtrend and signals a potential bullish reversal. The most common version is the bullish hammer, characterized by:

- A small real body

- A long lower wick

- Little to no upper wick

- A shape that visually resembles a “hammer”

This structure reflects strong rejection of lower prices as buyers enter the market after initial selling pressure.

Another related pattern is the inverted hammer, which carries similar bullish implications but has an opposite structure.

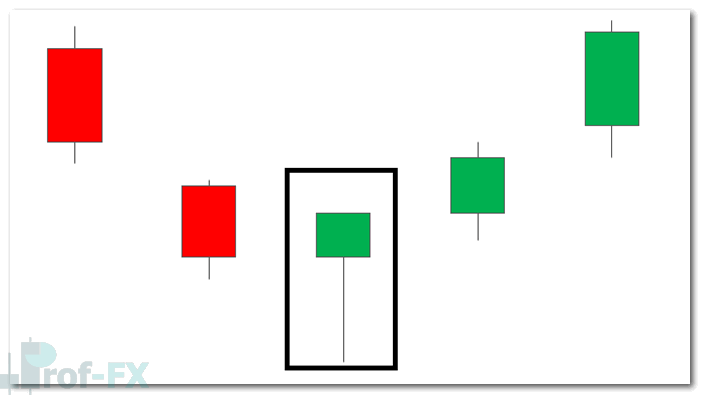

Hammer Candlestick (Bullish)

A bullish hammer appears after a downward move and suggests that sellers drove prices to fresh lows, but buyers quickly stepped in—pushing the price back toward the open. The long lower wick demonstrates rejection of those lows, hinting at a possible reversal.

This makes the hammer an important pattern in both forex trading and broader technical analysis, especially when it aligns with key support levels or psychological zones.

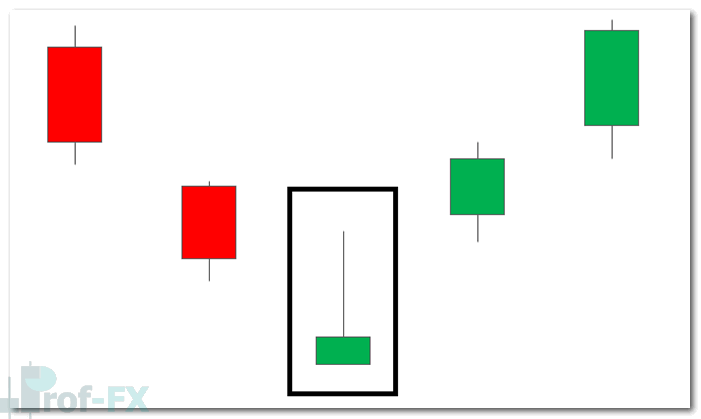

Inverted Hammer Candlestick (Bullish)

The inverted hammer also signals potential bullish reversal but takes the opposite shape:

- Long upper wick

- Small real body

- Little to no lower wick

- Appears at the bottom of a downtrend

In this pattern, price opens lower, buyers push price upward (forming the long upper wick), and then the market settles slightly above the open. This shows early buying interest—often confirmed if subsequent candles continue higher.

Advantages and Limitations of Using Hammer Candlestick Patterns

Hammer candles provide useful information, but like all technical tools, they have strengths and weaknesses. Traders should always evaluate confluence before entering a trade.

Advantages

- Reversal Signal:

The hammer signals rejection of lower prices. In a downtrend, this may suggest that selling pressure is weakening, allowing the market to stabilize or reverse upward. - Exit Signal for Short Trades:

Traders holding existing short positions often view a hammer as an indication that bearish momentum is fading, making it an appropriate point to secure profits.

Limitations

- No Trend Context:

A hammer pattern alone does not account for the overall trend environment. Without confirmation, it may produce misleading signals—especially in strong downtrends. - Requires Supporting Evidence:

To increase trade probability, traders should confirm the hammer with other technical factors such as:- Major support zones

- Pivot points

- Fibonacci retracement levels

- Overbought/oversold readings from indicators like RSI, CCI, or Stochastic Oscillator

These elements help validate whether the market is truly ready to reverse.

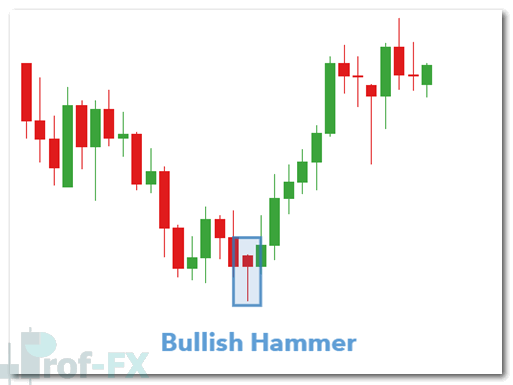

How to Use Hammer Candlestick Patterns in Technical Analysis

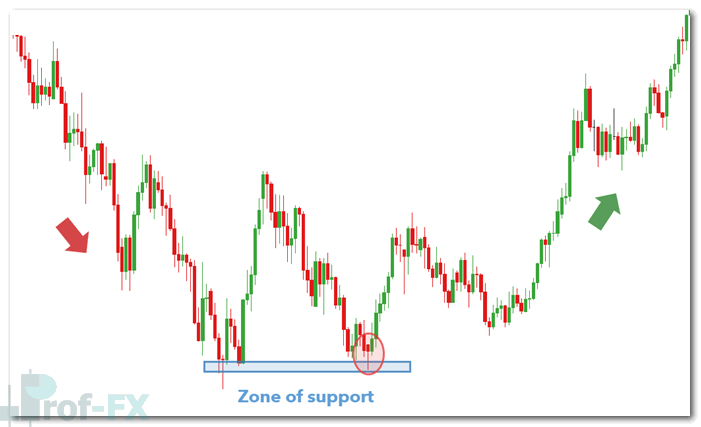

The example below illustrates how a hammer candle can be applied to a weekly EUR/USD chart to identify potential reversal opportunities.

A broader view of the chart reveals that price created a new low before bouncing upward. The zone around those lows acts as a support level, adding credibility to the bullish hammer signal.

Practical Application

- Entry:

Traders may consider entering long positions once the hammer candle is confirmed by subsequent bullish price action. - Stop-Loss Placement:

Stops can be placed below the support zone or the hammer’s low to limit risk. - Targets:

Profit targets can be set at recent resistance levels, ensuring a positive risk-to-reward ratio.

Continue Learning About Hammer Candles and Candlestick Trading

- If you are new to trading, begin with the essentials in the New to Forex trading guide.

- The hammer candle is just one reversal signal—expand your skills by exploring the Top 10 Candlestick Patterns that every trader should know.

- For deeper understanding, read the full breakdown in Trading the Bullish Hammer Candle.

Prof FX delivers forex news, market insights, and technical analysis focused on global currency trends.