The Strategic Role of Central Banks in the Forex Market

Central banks play a critical role in shaping economic stability by managing inflation, supporting sustainable growth, and safeguarding the financial system. When necessary, these institutions intervene in financial markets through a clearly defined Monetary Policy Framework. Every decision – from adjusting interest rates to conducting open market operations – is closely monitored by forex traders who seek to capitalize on currency volatility driven by central bank actions.

This article provides an in-depth look at major global central banks and explains how their policies influence currency valuations and market behavior across the international forex market.

What Is a Central Bank?

A central bank is an independent public institution tasked with overseeing a nation’s financial and banking system. Its core responsibilities include managing commercial banks, setting key interest rates, guiding monetary policy, and maintaining financial stability throughout the economy.

Central banks intervene in financial markets through several mechanisms:

Open Market Operations (OMO)

Open market operations refer to the buying and selling of government securities in the open market. This activity is used to either inject liquidity into the banking system (expansion) or withdraw liquidity (contraction), ultimately affecting money supply and interest rates.

The Central Bank Rate

The central bank rate – often referred to as the discount rate or federal funds rate—is strategically set by the monetary policy committee to either stimulate or cool economic activity. While it may seem counterintuitive, reducing an overheating economy helps control inflation, one of the main priorities of central banks.

Lender of Last Resort

Central banks also serve as a lender of last resort. When a government faces temporary liquidity constraints and struggles to raise funds via bond auctions, the central bank can provide emergency financing. This support improves investor confidence, ensuring markets trust that the government can meet its debt obligations, which in turn helps lower borrowing costs.

Forex traders can track upcoming monetary announcements through a dedicated central bank calendar.

Major Global Central Banks

Federal Reserve (United States)

The Federal Reserve – commonly called “The Fed” – governs the world’s most actively traded currency, the U.S. dollar. Its decisions influence global capital flows and the valuation of numerous currencies. The Fed’s mandate centers on maintaining stable prices, achieving maximum sustainable employment, and supporting moderate long-term interest rates.

European Central Bank (European Union)

The European Central Bank (ECB) is unique because it acts as the central bank for all Eurozone member nations. Its primary goal is preserving the value of the euro and maintaining price stability. As the second most traded currency globally, the euro’s movements generate significant interest among forex traders.

Bank of England (United Kingdom)

The Bank of England (BoE) serves as the UK’s central bank and is responsible for monetary and financial stability. The UK follows a “Twin Peaks” regulatory framework: the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). The BoE ensures that financial institutions hold sufficient capital and maintain robust risk management practices.

Bank of Japan (Japan)

The Bank of Japan (BoJ) prioritizes price stability and smooth settlement operations within the financial system. It is well-known for its long-standing experiment with negative interest rates, a strategy intended to stimulate economic activity by lowering borrowing costs. However, negative rates also discourage savings, as deposits may incur fees.

Core Responsibilities of Central Banks

While mandates vary by country, most central banks focus on several universal responsibilities:

- Price Stability

Central banks maintain the purchasing power of their currency by keeping inflation within a sustainable range. - Financial System Stability

Commercial banks undergo routine stress tests to minimize systemic risk and prevent financial crises. - Balanced and Sustainable Economic Growth

Governments can stimulate the economy through fiscal policy, while central banks apply monetary policy when additional support is needed—especially when fiscal resources are constrained. - Supervision and Regulation of Financial Institutions

Central banks oversee and regulate commercial banks to ensure they operate safely and in the public’s interest. - Reducing Unemployment

Some central banks, such as the Federal Reserve, incorporate employment targets into their broader monetary policy objectives.

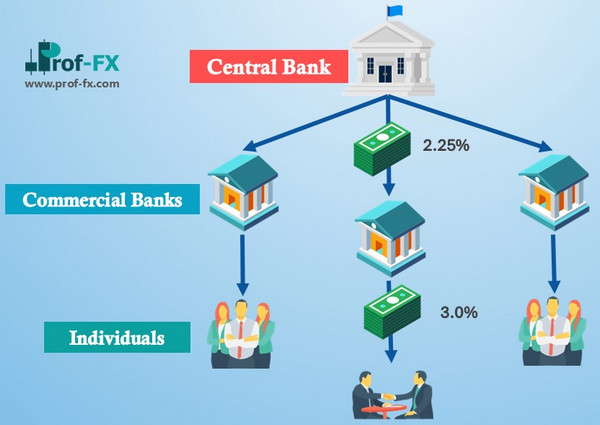

Central Banks and Interest Rates

Central banks set the benchmark interest rate that influences nearly every other interest rate within an economy – personal loans, mortgages, credit cards, and business financing all stem from this base rate. Commercial banks borrow from the central bank at the overnight rate, which is directly tied to the central bank’s official interest rate.

Under the modern system of Fractional Reserve Banking, commercial banks accept deposits and extend loans, but must retain a certain percentage of deposits as reserves. If a bank falls below this required reserve threshold, it can borrow from the central bank at the overnight rate. The difference between the interest earned from loans and the interest paid on deposits represents the bank’s primary source of revenue.

Forex traders closely watch interest rate decisions because higher yields attract global investment. This dynamic means that interest rate changes can dramatically impact currency demand and overall forex market flows.

How Central Banks Directly Impact Forex Prices

Central banks influence forex prices not only through actual interest rate decisions but also through communication strategy. In modern financial markets, what central bank officials say can be just as powerful as what they do. As a result, forex traders pay close attention to speeches, press conferences, meeting minutes, and official statements released by monetary authorities.

Even minor changes in wording can shift market expectations, triggering immediate reactions in currency prices long before any formal policy adjustment takes place.

Central Bank Language and Market Expectations

During press conferences and policy statements, traders analyze the tone and phrasing used by central bank leaders, such as the Federal Reserve Chair, the ECB President, or the Governor of the Bank of England. Words related to inflation risks, labor market strength, or economic resilience are carefully dissected.

When a central bank emphasizes rising inflation pressures, strong economic data, or the need to “remain vigilant,” the market may interpret this as a signal that tighter monetary policy is approaching. Conversely, references to slowing growth, economic uncertainty, or the need for “accommodation” often suggest a shift toward looser policy conditions.

This process of shaping expectations through communication is known as forward guidance.

Hawkish vs. Dovish: Understanding the Signals

Central bank communication is often categorized using two key terms: hawkish and dovish.

A hawkish stance indicates concern about inflation and a willingness to raise interest rates or reduce monetary stimulus. Hawkish language tends to support a stronger currency, as higher interest rates attract foreign capital seeking better returns.

A dovish stance reflects concern about economic growth or financial stability, signaling a preference for lower interest rates or continued stimulus. Dovish communication generally weakens a currency, as lower yields reduce its attractiveness to investors.

These interpretations are rarely based on a single sentence. Instead, traders compare current statements with previous communications to detect subtle shifts in tone.

Why Forex Markets Move Before Policy Changes

Forex markets are forward-looking by nature. Prices reflect expectations about future economic conditions rather than current realities. Because of this, currencies often move before interest rates are actually adjusted.

For example, if traders believe a central bank is preparing to begin a rate-hiking cycle, they may start buying that currency weeks or even months in advance. By the time the rate hike is officially announced, much of the move may already be priced in.

This explains why, on some occasions, a currency may fall after a rate hike or rise after a rate cut – because the market had already anticipated the outcome.

How Traders Position Themselves Based on Central Bank Signals

Traders who interpret central bank communication as signaling higher future interest rates often look to go long on that currency, positioning themselves ahead of expected capital inflows. Conversely, traders anticipating a dovish shift may short the currency, expecting lower yields and potential capital outflows.

Professional traders combine forward guidance analysis with macroeconomic indicators such as inflation data, employment figures, GDP growth, and bond yields to strengthen their conviction.

This approach highlights the importance of understanding central bank messaging, as it directly shapes short-term volatility and longer-term trends in the forex market.

Interest Rate Differentials and Carry Trades Explained

One of the most direct ways central bank policy influences the forex market is through interest rate differentials, which form the foundation of the carry trade strategy. This approach is widely used by institutional investors, hedge funds, and experienced retail traders when market conditions are stable.

At its core, a carry trade involves buying a currency with a relatively high interest rate while simultaneously selling a currency with a lower interest rate. By holding this position overnight, traders earn the interest rate difference – often referred to as the rollover or swap – credited to their trading account.

For example, if a trader buys a currency backed by a central bank with a higher policy rate and sells a currency issued by a central bank maintaining ultra-low or negative rates, the trader benefits from that yield gap as long as the position remains open.

The Role of Central Banks in Carry Trade Opportunities

Carry trades exist almost entirely because of divergence in central bank monetary policy. When one central bank is tightening policy through interest rate hikes while another remains accommodative, the resulting yield differential attracts capital flows toward the higher-yielding currency.

This is why currencies such as the US dollar, Australian dollar, or New Zealand dollar have historically been popular on the long side of carry trades during periods of higher interest rates. Conversely, currencies like the Japanese yen and Swiss franc – often associated with prolonged low or negative interest rates—are frequently used as funding currencies.

Forex traders closely monitor central bank statements, inflation data, and employment figures to anticipate whether these rate differentials are likely to widen or narrow.

Why Carry Trades Work Best in Certain Market Conditions

While carry trades can be profitable, they are not suitable for all market environments. This strategy performs best during periods of low volatility, stable economic growth, and predictable monetary policy.

When market uncertainty rises – such as during financial crises, geopolitical tensions, or sudden risk-off events – carry trades can unwind rapidly. In these situations, investors tend to exit higher-risk positions and move capital into safe-haven currencies, causing sharp reversals in exchange rates.

This behavior highlights why understanding central bank credibility and forward guidance is critical. A sudden shift from a hawkish to a dovish stance can significantly impact the sustainability of carry trade positions.

Carry Trades and Long-Term Forex Positioning

Carry trades are often used as medium-to long-term positioning strategies rather than short-term trades. Traders may hold positions for weeks or months, benefiting from both favorable exchange rate movement and consistent overnight interest accrual.

However, it is important to note that carry trades involve risk. Adverse price movements can quickly outweigh accumulated interest gains. For this reason, professional traders combine carry strategies with strong risk management, macroeconomic analysis, and careful monitoring of central bank policy shifts.

Ultimately, carry trades demonstrate how deeply central bank interest rate decisions are embedded in forex market behavior. Changes in policy not only influence short-term price movements but also shape longer-term capital flows across global currency markets.

Why Forex Traders Monitor Central Bank Rates

Forex traders closely follow central bank interest rate decisions because capital tends to flow toward higher-yielding currencies. When interest rates rise, foreign investment often increases, strengthening the currency. Conversely, rate cuts can weaken a currency as yields become less attractive.

This yield-seeking behavior explains why interest rate differentials are a central driver of forex trends.

Learn More About Forex Fundamentals

- Prof FX offers a comprehensive central bank calendar listing all scheduled rate announcements for leading central banks worldwide.

- Stay informed with our economic calendar, which highlights key data releases and central bank updates that may drive volatility in the FX market.

- Because news-driven price action can be unpredictable, risk management is crucial. Learn how to trade the news effectively to protect your capital.

- If you’re new to forex trading and want a structured introduction, follow our free Forex Courses and take your first step into the global markets.