What Is Slippage in Forex Trading? A Professional Explanation for New Traders

Slippage is a natural and recurring phenomenon in forex trading, yet many traders—especially beginners—misinterpret its mechanics and implications. By understanding how slippage occurs and why it happens, traders can not only minimize unwanted negative slippage but also position themselves to capture potential positive slippage, which can improve trade outcomes.

This guide provides a clear, structured, and academically grounded explanation of slippage, leveraging principles from market microstructure, liquidity dynamics, and order execution models used by major liquidity providers and institutional participants.

Defining Slippage: A Core Component of Market Execution

Slippage occurs when a trade is executed at a price different from the trader’s originally requested price. This frequently happens during periods of elevated market volatility or when the liquidity pool cannot match an order at the preferred price level.

While slippage is often viewed negatively, it is important to recognize that it is a normal feature of all financial markets, including forex, equities, and commodities. In the forex market—where prices are decentralized and liquidity is provided by major banks, institutional market makers, and electronic communication networks (ECNs)—slippage can be both advantageous or unfavorable, depending on market conditions.

When a trader submits an order, it is routed to a liquidity provider, and the execution engine fills that order at the best available price, regardless of whether the fill is more favorable or less favorable than the initial request.

To illustrate, let’s consider a simple numerical scenario.

Illustrative Examples of Forex Slippage Outcomes

Outcome 1: No Slippage

You submit a buy order on EUR/USD at 1.3650.

If the best available buy price in the market is exactly 1.3650, your order is executed at the requested level—resulting in no slippage.

Outcome 2: Positive Slippage

You submit the same buy order at 1.3650.

However, during order routing, the best available price improves to 1.3640, giving you a 10-pip improvement.

The order executes at 1.3640, resulting in positive slippage.

Outcome 3: Negative Slippage

You submit the buy order at 1.3650.

If liquidity disappears or volatility increases, the next available price may shift to 1.3660, a 10-pip increase.

The order fills at 1.3660, resulting in negative slippage.

Any time the executed price differs from the requested price, the difference is classified as slippage.

Why Does Slippage Occur in Forex?

To understand slippage, traders must appreciate the fundamental structure of a real market: for every buyer, there must be a seller, and both sides must agree on price and quantity.

If you place a 100,000-unit buy order on EUR/USD at 1.3650 but there are not enough sellers at that exact price, the execution system must search for the next best available price in the liquidity ladder. This is particularly common when:

- Market conditions change rapidly

- Liquidity becomes thin

- Institutional traders absorb available orders

- Major news events trigger fast price repricing

Rapid Shifts in Market Conditions

When market conditions change suddenly—often within milliseconds—pricing engines at liquidity providers must re-quote prices to reflect the new market reality. During these rapid repricing cycles:

- Bid/ask spreads may widen without warning.

- Execution queues can become congested as multiple orders hit the market simultaneously.

- The original quoted price may no longer be available by the time your order reaches the liquidity pool.

This mismatch between the requested price and the new market price creates a higher probability of slippage.

Periods of Thin or Depleted Liquidity

Liquidity becomes thin when fewer market participants are willing to trade at a given price level. This typically occurs during:

- Off-peak trading hours (e.g., the Asian session for EUR/USD).

- Market holidays affecting major financial centers.

- Pre-news uncertainty when traders withdraw orders from the book to avoid risk.

When liquidity thins out, the depth of each price level decreases, meaning even relatively small orders may consume available liquidity and “walk the book” into higher or lower prices—resulting in slippage.

Institutional Order Flow Absorbing Available Liquidity

Large institutions such as banks, hedge funds, and algorithmic trading firms often place high-volume orders that quickly absorb available liquidity at multiple price levels. When this happens:

- Retail and smaller traders may find their orders pushed to less favorable levels.

- Market prices may jump as liquidity providers re-evaluate risk.

- Execution engines may fill orders at the next available price, especially during high-frequency order flow surges.

This institutional dominance in the order book is a core reason why slippage occurs even in major currency pairs.

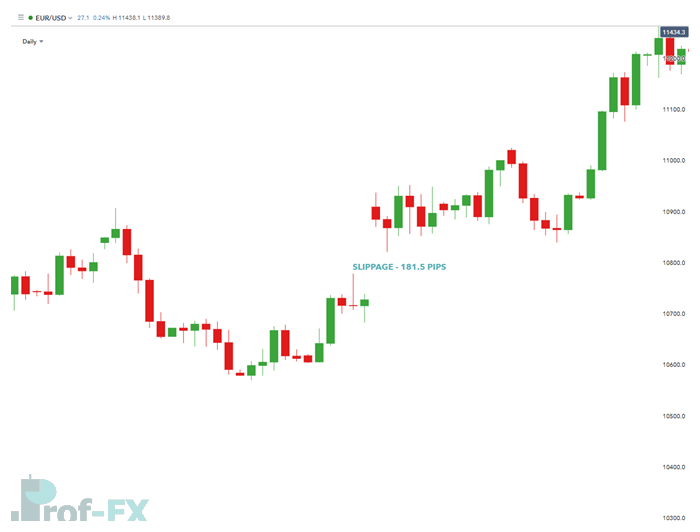

Major News Events Triggering Immediate Price Repricing

High-impact economic events—such as NFP, CPI, central bank rate decisions, or geopolitical developments—can cause instant market reactions. During these volatile moments:

- Price feeds update multiple times per second.

- Liquidity is withdrawn as market makers attempt to avoid exposure to sudden price gaps.

- Order books become fragmented, displaying inconsistent pricing across providers.

As a result, the price requested by the trader is rarely available, and slippage becomes an unavoidable part of execution during these time-sensitive events.

When available liquidity exists below your requested price, you get positive slippage; when liquidity exists above your price, you experience negative slippage.

Slippage can also appear on stop loss orders, where the specified stop level cannot be honored due to a rapid price gap. To mitigate this, some brokers offer Guaranteed Stop Loss Orders (GSLOs), which promise execution at the exact price level but typically require an additional premium.

Which Currency Pairs Experience the Least Slippage?

Under typical market conditions, major currency pairs—such as EUR/USD, USD/JPY, and GBP/USD—tend to experience less slippage due to higher liquidity, narrower spreads, and deeper order books.

However, during extreme market volatility—often triggered by economic news releases such as:

- Non-Farm Payrolls (NFP)

- Consumer Price Index (CPI)

- Federal Reserve or ECB monetary policy announcements

—even highly liquid pairs may experience notable slippage as bid-ask quotes update rapidly.

For traders who frequently operate during such periods, it is essential to understand volatility behavior and adapt execution strategies accordingly.

How to Reduce Forex Slippage: Practical Risk Management Tips

Slippage cannot be avoided entirely, but traders can manage it through smart execution strategies:

1. Avoid trading during major high-impact news events

Events such as NFP, CPI releases, rate decisions, or geopolitical announcements may dramatically widen spreads and reduce liquidity.

2. Trade high-liquidity sessions

The most stable periods are usually during the London and New York sessions, particularly during their overlap.

3. Use limit orders when appropriate

Limit orders specify a maximum (or minimum) acceptable price, helping eliminate negative slippage—but note that they do not guarantee execution if price moves away.

4. Choose brokers with reliable execution systems

Execution quality varies across brokers. ECN brokers and brokers partnered with top-tier liquidity providers generally produce more consistent fills.

5. Utilize Guaranteed Stop Loss Orders (GSLOs) if risk is a priority

Though these come with premium costs, they can prevent unexpected losses during fast-moving markets.

Further Learning to Strengthen Your Forex Trading Skills

To further improve your understanding of slippage and market execution:

- Join live trading webinars focused on macroeconomic news, central bank decisions, and technical market structure.

- Study risk management principles, including optimal position-sizing and capital allocation.

- Read guides on Traits of Successful Traders to anticipate common behavioral pitfalls.

- Explore different forex order types, including market, limit, stop, and pending orders, to better understand how execution interacts with slippage.