The Forex market is an exciting, fast-paced, 24-hour bonanza of billion-dollar trades, macroeconomic forces, and global geopolitical tensions.

Incredible profits can materialize and then vanish again in the space of a few seconds. It is an unforgiving, zero-sum game kind of market, and yet it stands with its arms wide open, waiting for you to build up enough courage to jump in.

Isn’t that exciting? We think it is.

However, you shouldn’t just jump into the Forex market willy-nilly.

As we pointed out in the Introduction, diving into the Forex market without a plan and without taking the time to figure out what makes this global market tick is a recipe for disaster.

It will land you squarely among the 66 percent of traders who lose money in this market, and that is not the place you want to be.

So how do you go about getting ready to embark on a successful adventure as a Forex trader? You should be asking yourself and discovering the answers to the following two questions:

- Why do currencies move the way they do?

- How can I profit from that movement?

In fact, we organized this book around those two basic questions.

Why Do Currencies Move the Way They Do?

Understanding why currencies move the way they do is fundamental to your success as a Forex trader because once you understand why they move, you can start to predict where they will move under certain circumstances.

And once you can start to predict where currencies are going to move, you have arrived as a currency trader.

The first part of this book answers the question of why currencies move the way they do.

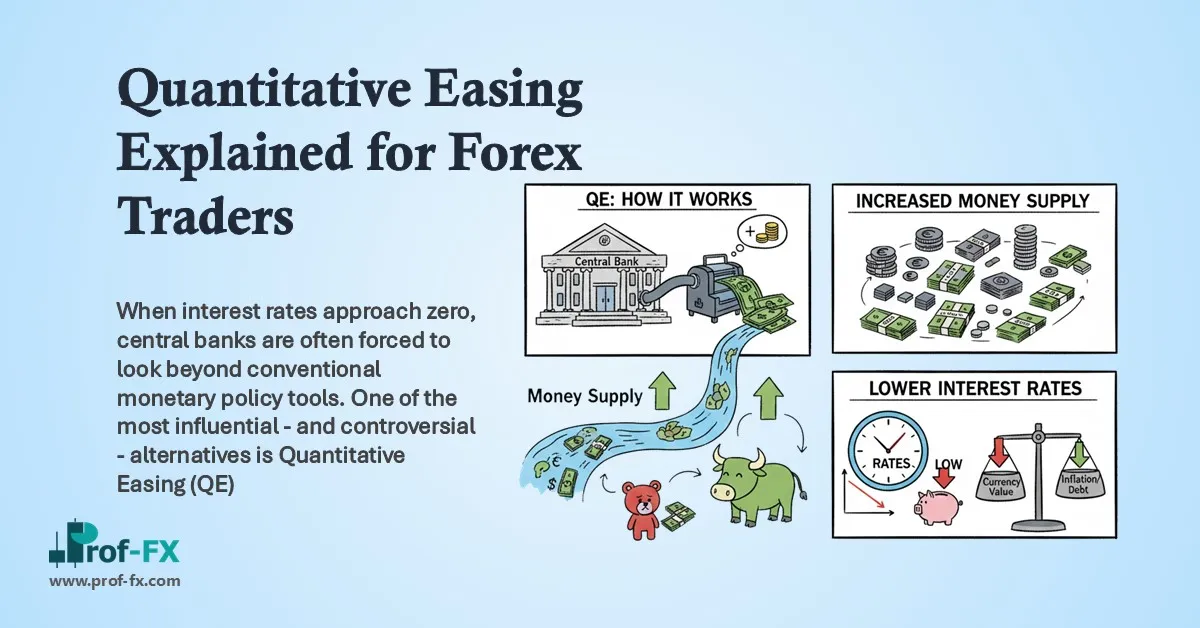

What drives currency prices: We start off with a discussion of the fundamental forces of supply and demand that drive currency prices and the global factors that influence those basic forces. This will lay the foundation of your analysis.

Who drives currency prices: Once you understand what drives currency prices, it’s time to turn your attention to who is driving those prices. After all, even though the market itself may seem like a cold, unfeeling place, it is driven by hot-blooded, emotional traders who aren’t always rational. The more you understand these individuals and their motivations, the easier it will be for you to place intelligent trades.

The individual personality of each currency: While the same general forces tend to have an impact on all currencies, the severity of the impact will vary depending on the currency. Just like snowflakes, no two currencies are alike, so it is important for you to understand their individual personalities.

How currencies react to economic announcements and other news: Economic announcements and other news events are the wild cards in the Forex market. There is no way to predict when news is going to explode, but understanding how different currencies tend to react to various news events will enable you to make quick and nimble adjustments to your portfolio.

Which indicators you should be watching: Finally, Forex traders are lucky because there are a number of indicators they can watch that will give them early warning signs of where a currency may be headed. Some of these indicators are based on market forces that actually move the Forex market, and some of them are merely correlated with those movements. Either way, it’s always nice to have something to watch on the horizon.

How Can I Profit from That Movement?

Once you have a handle on what makes currencies move the way they do, you can start to place trades and make investments that will make you money.

Where you can invest your money: It used to be that if you wanted to invest in the Forex market, you literally had to exchange one currency for another at the bank.

Nowadays, you have a stellar selection of asset classes and investment vehicles to choose from if you want to trade currencies.

You can trade spot Forex, buy an exchange-traded fund (ETF), sell a futures contract, and more. The choice is yours, but it is important that you understand the pros and cons of each investment before you sink any money into it.

How to execute short-term trading strategies: Because of the fast pace and high leverage that are available in the Forex market, many traders are drawn to short-term trading strategies. The rapid-fire nature of getting into and out of a trade quickly can be intoxicating.

If you’re not careful, though, it can also be deadly. We’ll cover what you need to know to give yourself a fighting chance as a short-term trader.

How to invest for the longer term: For those who are drawn to the Forex market by the promise of quick riches, investing for the longer term may seem counterintuitive.

However, the nature of the fundamental moves that take place in the Forex market makes it an ideal environment for longer-term trades. We’ll show you what to look for and how to stay the course.

How the currency market functions and how you can protect yourself: Understanding how the Forex market works and who is regulating the market can help you avoid some of the pitfalls that have tripped up many traders who have gone before you.

In fact, regulatory and technological changes in the Forex market have done a lot to level the playing field for individual investors, like you. It’s a great time to be a Forex trader.