Currency volatility is one of the most defining characteristics of the forex market. Sharp and frequent price movements create both opportunity and risk for traders. Understanding what forex volatility truly represents, how to measure it accurately, and how to adapt trading strategies accordingly is a foundational skill for any trader seeking long-term consistency.

In this guide, we will explore currency volatility from a professional trading perspective—explaining what it is, how to identify it, which currency pairs are most affected, and how traders can adjust their approach to trade volatile markets more effectively.

What Is Volatility in Currency Trading?

In forex trading, volatility refers to the degree and frequency of price fluctuations in a currency pair over a given period of time. Technically, volatility measures how far price deviates from its average value, often quantified through statistical tools such as standard deviation or Average True Range (ATR).

A currency pair with high volatility experiences large and rapid price movements, while a low-volatility pair tends to move more gradually within tighter price ranges.

From a trader’s perspective:

- Higher volatility = higher potential reward, but also higher risk

- Lower volatility = smaller price movements, often requiring patience and precision

Volatility itself is neither good nor bad—it simply defines the environment in which a trader must operate.

Visualizing Volatility Using Technical Indicators

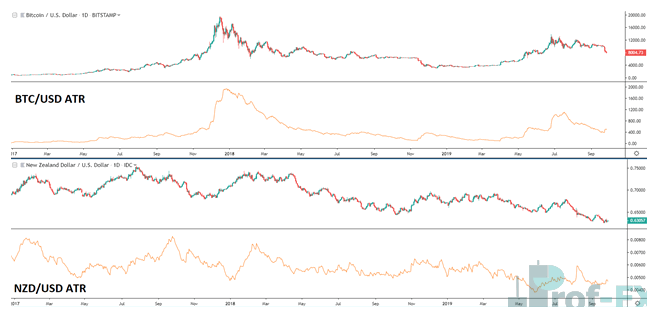

One of the most widely used indicators to measure volatility is the Average True Range (ATR). ATR does not indicate market direction; instead, it shows how much price typically moves during a given period.

Below is a comparative illustration between BTC/USD and NZD/USD, with ATR applied to both:

As the chart demonstrates:

- BTC/USD shows consistently high ATR values, reflecting extreme volatility

- NZD/USD exhibits relatively stable ATR readings, indicating lower volatility and smoother price action

This contrast highlights why strategy selection must align with the volatility profile of the asset being traded.

How to Identify Currency Volatility in Forex Markets

Volatility can never be predicted with certainty, but it can be measured, observed, and anticipated using several analytical methods.

Historical Volatility

Historical volatility refers to price movement that has already occurred. Traders identify it by examining:

- Sharp price spikes

- Expanding price ranges

- Increased ATR readings

- Larger candlestick bodies and wicks

Historical volatility is visible directly on price charts and provides context for how aggressively a currency pair has behaved in the past.

Implied Volatility

Implied volatility reflects market expectations for future price movement, derived primarily from options pricing. While forex spot traders may not trade options directly, implied volatility offers valuable insight into market sentiment and uncertainty.

In institutional markets, implied volatility is tracked through indices such as those published by the Chicago Board Options Exchange (CBOE), which reflect expectations surrounding currency movement.

Professional traders often compare historical and implied volatility to determine whether markets are underestimating or overestimating future price movement.

Trading High-Volatility Currencies vs Stable Currency Pairs

Not all currency pairs behave the same. Volatility is heavily influenced by liquidity, economic stability, political risk, and central bank credibility.

High-Volatility Currency Pairs

Currency pairs involving emerging markets or politically sensitive economies tend to exhibit higher volatility, such as:

- USD/ZAR (US Dollar / South African Rand)

- USD/TRY (US Dollar / Turkish Lira)

- USD/BRL (US Dollar / Brazilian Real)

- USD/RUB (US Dollar / Russian Ruble)

These currency pairs are often influenced by a combination of macroeconomic fragility and external shocks, which makes their price movements more aggressive and less predictable than major currency pairs. The most important contributing factors include:

- Inflation instability

- Political uncertainty

- Commodity price dependency

- Capital flow volatility

Inflation Instability

High-volatility currency pairs are frequently associated with countries experiencing unstable or persistently high inflation. When inflation is difficult to control, it erodes purchasing power and undermines confidence in the local currency. Central banks in these economies may respond with aggressive or unexpected interest rate adjustments, which can trigger sharp movements in exchange rates.

For forex traders, inflation instability often results in:

- Sudden repricing of interest rate expectations

- Increased sensitivity to CPI and inflation-related economic data

- Large intraday swings following central bank statements or policy shifts

As a result, currencies exposed to inflation uncertainty tend to react more violently to both domestic and global economic developments.

Political Uncertainty

Political risk is another major driver of volatility in emerging market currency pairs. Changes in government leadership, fiscal policy disputes, geopolitical tensions, or concerns over institutional independence can significantly weaken investor confidence.

Political uncertainty can lead to:

- Capital flight from local markets

- Reduced foreign direct investment (FDI)

- Sudden risk-off sentiment toward the affected currency

In forex markets, this often manifests as abrupt price gaps, extended trends, or erratic price behavior that disregards traditional technical levels.

Commodity Price Dependency

Many high-volatility currencies belong to economies that are heavily dependent on commodity exports, such as energy, metals, or agricultural products. Currency valuation in these countries is closely tied to global commodity prices rather than purely domestic economic conditions.

For example:

- Energy exporters are sensitive to oil price fluctuations

- Metal exporters react strongly to changes in industrial demand

- Agricultural exporters depend on seasonal and weather-driven factors

When commodity prices rise or fall sharply, the associated currencies often move in tandem, amplifying volatility—especially during global supply shocks or changes in demand expectations.

Capital Flow Volatility

Emerging market currencies are particularly sensitive to international capital flows, which can shift rapidly in response to changes in global risk appetite, interest rate differentials, or monetary policy decisions in major economies such as the United States.

Capital flow volatility typically occurs when:

- Global investors shift funds toward safe-haven assets

- Interest rate expectations change in developed markets

- Risk sentiment deteriorates during economic or financial stress

These sudden inflows or outflows of capital can cause sharp currency revaluations, leading to fast and often unpredictable price movements in forex markets.

Why This Matters for Forex Traders

Understanding these underlying drivers allows traders to:

- Anticipate periods of elevated volatility

- Adjust position size and stop-loss placement

- Avoid overexposure during unstable macroeconomic conditions

For developing traders, recognizing why a currency pair is volatile is just as important as knowing how to trade it. Volatility driven by structural factors tends to persist longer and requires more conservative risk management compared to volatility caused by short-term technical imbalances.

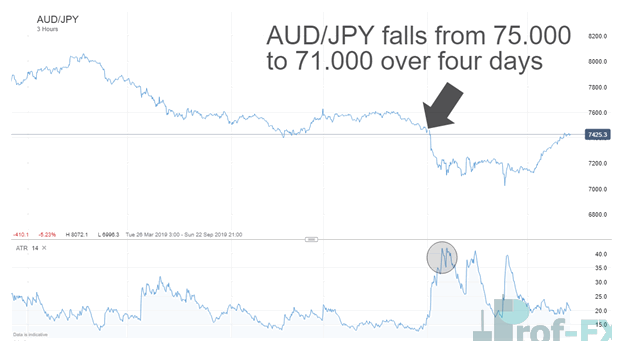

AUD/JPY: A Classic Volatility Pair

The AUD/JPY pair is traditionally viewed as a high-volatility pair due to its sensitivity to:

- Global risk sentiment

- Interest rate differentials

- Commodity cycles

The chart below highlights periods where ATR expanded significantly as price declined sharply:

Low-Volatility Currency Pairs

More stable currency pairs usually involve major economies with strong liquidity, including:

- EUR/USD

- USD/CHF

- EUR/GBP

- NZD/USD

These pairs often respond more predictably to technical levels, making them suitable for range-based and mean-reversion strategies.

Choosing Indicators Based on Volatility Conditions

Different volatility environments require different analytical tools.

Indicators Commonly Used in Low-Volatility Markets

- Support and resistance levels

- Range boundaries

- Moving averages

- Price action at key levels

These tools work well when price respects technical zones and moves gradually.

Indicators Commonly Used in High-Volatility Markets

- Bollinger Bands

Help identify price expansion and contraction, as well as overbought or oversold conditions. - Average True Range (ATR)

Used to size stop losses dynamically and manage trailing stops. - Relative Strength Index (RSI)

Measures momentum extremes, especially useful during sharp price movements.

Volatility vs Risk: Understanding the Difference

A common misconception among beginner traders is assuming volatility and risk are the same. They are not.

- Volatility is a market condition—outside your control

- Risk is a position management decision—fully within your control

While volatile markets increase the potential for risk, traders can mitigate exposure through:

- Position sizing

- Stop-loss placement

- Leverage control

High volatility magnifies both gains and losses, making disciplined risk management essential.

Behavioral Risk: Herd Mentality in Volatile Markets

Volatile markets often trigger emotional decision-making. When traders see large price moves, they may enter trades impulsively, influenced by crowd behavior rather than structured analysis.

This herd mentality can result in:

- Chasing price at poor levels

- Panic selling during sharp pullbacks

- Overexposure during market stress

Professional traders remain detached, trading planned setups, not emotional reactions.

Forex Volatility Trading Tips for Consistency

Trading volatile markets successfully requires preparation, discipline, and adaptability.

Key Volatility Trading Principles

- Trade with charts and indicators, not emotions

- Be aware of economic news and events

- Always use stop-loss orders

- Keep position sizes modest

- Follow a predefined trading plan

- Maintain a trading journal

Trade Around News and Economic Events

Major economic releases—such as:

- Interest rate decisions

- CPI and employment data

- Central bank speeches

often act as volatility catalysts. Traders may choose to:

- Avoid trading during news

- Trade post-news volatility

- Reduce exposure before major releases

Using an economic calendar is essential for volatility awareness.

Use Stop Losses Strategically

Stop losses are non-negotiable in volatile markets. Wider price swings demand:

- ATR-based stop placement

- Reduced position size to compensate

- Avoiding tight stops that get hit by noise

Leverage amplifies volatility risk, so caution is critical.

Keep Position Size Low

A widely accepted professional guideline is to risk no more than 1–5% of account equity per trade. In volatile markets, erring on the lower end helps preserve capital and psychological stability.

Keep a Trading Journal

A trading journal allows traders to:

- Track volatility conditions

- Review emotional decisions

- Identify strategy strengths and weaknesses

Over time, journaling builds self-awareness—one of the most overlooked skills in trading.

Final Thoughts on Trading Currency Volatility

Currency volatility is unavoidable in forex trading, but it does not have to be destructive. When understood and respected, volatility becomes a tool rather than a threat.

By aligning strategies with volatility conditions, managing risk intelligently, and maintaining discipline, traders can navigate both calm and turbulent markets with confidence.

Further Reading on Forex Volatility

- Explore the most volatile currency pairs

- Stay informed with daily currency market news

Learn how volatility affects other asset classes, including stocks and indices