|

|

|

|

What Is the Boom and Crash Reversal Indicator

The Boom and Crash Reversal Indicator is a custom-built tool specifically designed for traders operating in the Boom and Crash synthetic indices. These indices, such as Boom 1000, Boom 500, Crash 1000, and Crash 500, are known for their high volatility and sudden price spikes. Unlike traditional currency pairs, these markets offer unique price behaviors, including frequent upward or downward spikes that occur at random intervals, making them ideal for scalping and short-term trading strategies.

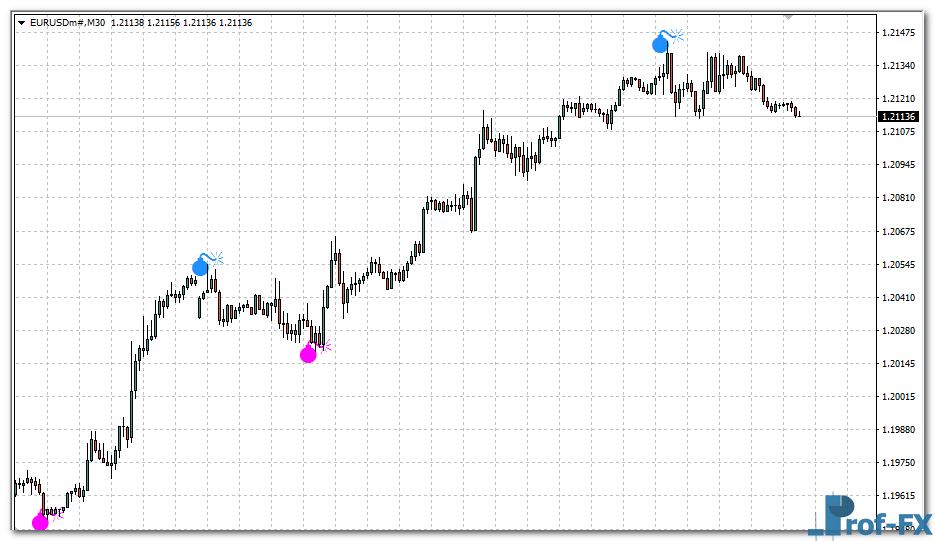

This indicator focuses on detecting reversal points in these highly reactive markets. It provides traders with early signals when a price movement is likely to shift direction—either upward in a crash index or downward in a boom index. The tool displays arrows, alerts, or markers on the chart that indicate a potential reversal zone, allowing traders to enter or exit trades with higher precision.

The Boom and Crash Reversal Indicator has gained popularity due to its ability to work in real-time with minimal lag. It is often referred to as a spike-catching tool, as it identifies conditions where a price spike is imminent. This makes it valuable for those who want to capitalize on fast movements, particularly in synthetic markets where traditional technical indicators often underperform.

What separates this indicator from more generic tools is its specialized calibration for Boom and Crash behavior patterns. It does not rely on lagging indicator signals such as moving averages or oscillators. Instead, it uses volatility dynamics, price reaction zones, and trend exhaustion metrics to highlight areas where market sentiment is about to shift. If you’re not yet familiar with the difference between lagging and leading indicators, be sure to read our article: “Leading vs Lagging Indicators: Which One Should You Choose for Trading?“

Whether you’re a new trader exploring synthetic indices or an experienced intraday trader looking for high-probability setups, the Boom and Crash Reversal Indicator serves as a valuable guide. It helps remove emotional decision-making by offering objective, chart-based insights that are actionable and repeatable.

How It Works – Boom and Crash Reversal Indicator

The core function of the Boom and Crash Reversal Indicator is to detect momentum exhaustion and reversal signals in volatile market conditions. The indicator scans recent price action and volatility behavior to determine whether the market is preparing to spike in the opposite direction.

In a Boom market, prices typically climb steadily and then experience a sharp downward spike. In contrast, a Crash market features a steady decline followed by sudden upward spikes. This behavior makes conventional trend-following indicators less effective, as they often lag behind real-time shifts. The Boom and Crash Reversal Indicator addresses this by focusing on entry signals at the point of reversal.

Key Functional Features:

- Non-repaint arrows: Once a signal appears, it stays fixed on the chart, offering confidence in its reliability.

- Real-time spike alerts: The indicator can provide instant notifications via pop-up, email, or mobile alerts when it detects a potential reversal.

- Market structure analysis: It evaluates patterns in price movement to identify areas where previous reversals occurred, using this historical data to project future behavior.

The indicator works best in combination with price action strategies such as support and resistance, psychological levels, and candlestick confirmations. For instance, when a reversal signal aligns with a key resistance zone in a Boom index, the probability of a downward spike increases significantly.

Many versions of this indicator use volatility filters, which reduce false signals by confirming that a real momentum shift is occurring. These filters may include internal buffers that measure the average length and speed of previous candles to detect unusual behavior, such as a slowdown after a strong move—often a precursor to a reversal.

Additionally, the indicator supports multi-timeframe analysis, allowing traders to view higher-timeframe trends within a lower-timeframe chart. For example, a trader using the 5-minute chart may also receive trend confirmation from the 1-hour chart, improving the context for decision-making.

Several premium versions of the Boom and Crash Reversal Indicator claim accuracy rates between 90% to 95%, especially when used correctly. However, as with any indicator, these figures depend on factors like market conditions, the trader’s experience, and whether additional trading tools are used for confirmation.

Boom and Crash Reversal Indicator Settings

The flexibility of the Boom and Crash Reversal Indicator is another reason for its growing popularity. Most versions of the indicator allow for user-defined settings to accommodate different trading styles, risk tolerances, and timeframes.

Here are the typical settings available:

1. Signal Sensitivity

This parameter controls how reactive the indicator is to price changes. Lower sensitivity filters out noise and only shows strong reversal points, while higher sensitivity produces more frequent signals—ideal for scalping.

- Recommended for scalpers: High sensitivity

- Recommended for swing traders: Medium to low sensitivity

Every trader needs a strategy that matches their personality and goals. Discover which trading style is right for you in this article: “Scalping, Day Trading, Swing Trading, and Position Trading Explained.”

2. Spike Confirmation Filter

Some versions include filters that prevent the indicator from signaling during flat or low-volatility periods. This ensures that alerts only appear when price action confirms a potential spike or reversal.

- Useful in ranging markets to avoid false positives.

3. Alert Configuration

The indicator can be configured to send real-time alerts in different formats:

- Pop-up notifications

- Mobile push alerts (MT4 mobile)

- Email notifications

This allows traders to act immediately, even if they’re not actively monitoring the chart.

4. Multi-Timeframe Mode

This setting enables users to track trends from higher timeframes while executing trades on a lower timeframe. This is especially useful for confirming that a reversal signal is not against the broader market direction.

- Example: Use the 1H timeframe trend with 5M entry signals.

5. Arrow/Signal Display Options

Traders can adjust how the signals appear on their charts—color, size, position—allowing for easy integration with other tools or indicators already in use.

6. Template Compatibility

The indicator often comes with a template file (.tpl) that automatically loads the appropriate chart layout. This is particularly helpful for new users.

Compatibility Notes:

- Works on Metatrader 4, not Metatrader 5

Compatible with Boom/Crash 500/1000 - Usually delivered as .ex4 compiled file (non-editable)

Best Practices for Setup:

- Use on M1 or M5 timeframes for spike trading

- Combine with support/resistance zones

- Test on a demo account before applying in live conditions

- Maintain a minimum risk-to-reward ratio of 1:2

Final Thoughts

The Boom and Crash Reversal Indicator is a powerful addition to any volatility-based trading strategy. It is especially effective for traders operating in synthetic indices where price action is unpredictable and conventional tools fall short. By offering real-time, non-repaint reversal signals, the indicator provides a significant edge in identifying high-probability trade setups.

Still, no indicator guarantees success. It should be used as part of a comprehensive trading strategy that includes risk management, proper position sizing, and disciplined execution. When combined with a solid understanding of market structure and emotional control, the Boom and Crash Reversal Indicator can be a game-changer for serious traders.

Free Download Boom or Crash Reversal indicator for Metatrader 4

- boom-or-crash-reversal.zip

- Size: 33.3 kb

- Platform: MT4 | Format: .mql4/.ex4 | File: dir3mt4 | Request Remove!

How to Instal “Boom or Crash Reversal” Indicator for Metatrader 4

- Open your Metatrader 4 platform.

- Download and save the “Boom or Crash Reversal” indicator to your desktop or any other folder located on your local computer.

- Choose “File” then “Open Data Folder” (Ctrl + Shift + D) on your Metatrader 4 platform.

- Explore the following folder: MQL4 > Indicators.

- Copy and paste the “Boom or Crash Reversal” indicator into this folder.

- Restart Metatrader 4.

- “Boom or Crash Reversal” indicators are stored by default in the custom indicator folder.

- To access these indicators, go to Top Menu > Insert > Indicators > Custom.

- In order to add a “Boom or Crash Reversal” indicator to any of your Metatrader 4 charts, you will need to select a forex chart with one mouse click, then go to Top Menu > Insert > Indicators > Custom > click the “Boom or Crash Reversal”.

- Done!

See a complete guide How To Install Metatrader 4 Custom Indicators