Liquidity is often one of the first advantages that traders notice when entering the forex market. With an estimated daily trading volume exceeding $9.6 trillion (2025), according to the Bank for International Settlements (BIS), the foreign exchange market stands as the most liquid financial marketplace in the world. This high degree of liquidity allows traders to enter and exit positions with ease, making forex an attractive choice compared to equity, futures, or commodity markets.

However, despite its overall liquidity, the FX landscape is not uniform. Different currency pairs, sessions, and market conditions can drastically influence how easily trades are executed. In this expanded guide, we will break down the concept of forex liquidity, explain liquidity risk, and help traders understand how liquidity deeply affects execution quality, volatility, and risk management.

Understanding Forex Liquidity and Why It Matters

Liquidity in the forex market refers to the ability to buy or sell a currency pair on demand without materially affecting its exchange rate. When trading major currency pairs, you are generally operating in a deeply liquid environment supported by a large network of banks, financial institutions, electronic communication networks (ECNs), and liquidity providers.

Highly liquid markets enable:

- Tight bid–ask spreads

- Faster trade execution

- Reduced slippage

- Improved price stability during normal conditions

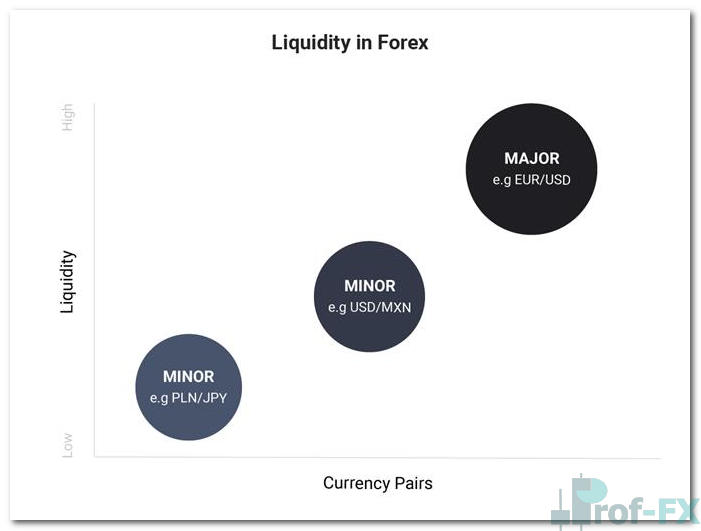

However, not all currency pairs share the same level of market depth. Liquidity typically decreases as you move from major pairs → minor pairs → exotic pairs, the latter of which may include emerging market currencies such as MXN, TRY, ZAR, PLN, or SGD.

High-Liquidity Currency Pairs: What Traders Should Know

A highly liquid currency pair can be traded in large volumes without significant price disruption. These pairs are heavily traded across global financial hubs and include:

- EUR/USD

- GBP/USD

- USD/JPY

- EUR/GBP

- AUD/USD

- USD/CAD

- USD/CHF

- NZD/USD

These pairs benefit from constant institutional flow, making them ideal for both beginners and professional traders who rely on consistent spreads and stable market behaviour.

Low-Liquidity Currency Pairs: Characteristics and Risks

Low-liquidity currency pairs often include exotic combinations, such as PLN/JPY, USD/TRY, EUR/ZAR, or other emerging market pairs. They typically experience:

- Wider bid–ask spreads

- Greater slippage

- Price jumps during economic releases

- Higher volatility during thin trading hours

Traders must exercise caution when dealing with low-liquidity environments, as risk management becomes more complex and unpredictable.

Wider Bid–Ask Spreads: When Transaction Costs Expand Beyond Expectations

Wider spreads are one of the defining characteristics of low-liquidity currency pairs. Unlike highly liquid majors—where spreads can be as tight as 0.1–0.5 pips—exotic pairs often experience spreads that can widen dramatically, especially during market stress or off-peak hours. This instantly increases transaction costs and makes precision-based strategies, such as scalping or intraday momentum trading, far less effective.

Example

“During the 2020 oil price crash, USD/RUB spreads on several global brokers widened from an average of 30–40 pips to more than 200 pips. Liquidity providers pulled back due to extreme geopolitical and commodity-market uncertainty, forcing traders to accept much worse entry conditions. Even institutional desks reported difficulty quoting stable prices during the first hours of the Asian session.”

Greater Slippage: Orders Filled at Unexpected and Less Favorable Prices

Slippage becomes significantly more pronounced when trading thin markets. Since fewer orders are resting in the book, price can skip multiple levels before finding a counterparty willing to take the other side of the trade. For retail traders, this often means stop-loss orders get filled at levels far worse than expected.

Example

“In March 2020, during COVID-driven market turmoil, EUR/MXN experienced severe liquidity gaps. Traders who placed stop-loss orders 50–80 pips away from current price saw their positions executed 200–400 pips lower as the pair gapped violently through multiple empty price levels. Even institutional clients reported slippage on market orders exceeding 150 pips.”

This demonstrates how slippage can turn a controlled risk environment into an unmanageable one—particularly in exotic currency pairs with thin depth.

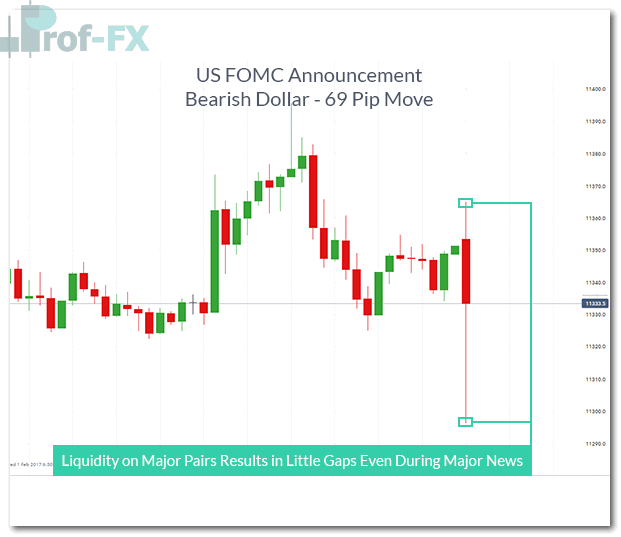

Price Jumps During Economic Releases: Volatility Amplified by Thin Books

Economic releases—especially surprises—tend to create outsized movements in low-liquidity markets. When liquidity is thin, even moderate news-driven order flow can trigger abrupt price jumps, creating volatility spikes that exceed normal expectations.

Example

“During South Africa’s unexpected GDP contraction announcement in June 2023, USD/ZAR jumped nearly 900 pips within minutes. The order book was too thin to absorb the sudden burst of demand for the U.S. dollar, causing the pair to leap from 18.90 to 19.79 without printing intermediate price levels. Traders relying on technical levels saw them invalidated almost instantly.”

Such jumps can make it nearly impossible for traders to manage risks using traditional tools like stop-loss orders or pending entries.

Higher Volatility During Thin Trading Hours: Market Fragility in Quiet Sessions

Low-liquidity pairs naturally become more volatile during off-peak trading hours—such as early Asia or late New York—when market participation drops significantly. With fewer limit orders on both sides of the market, even modest-sized transactions can produce disproportionately large moves.

Example

“Throughout 2022, USD/TRY frequently produced 30–50 pip spikes during the early Asian session. One institutional trader in Singapore noted that a single $5–10 million order was capable of moving the pair sharply due to the absence of Turkish and European market participants at that time. These sudden wicks were common, often trapping retail traders overnight.”

This thin-liquidity environment transforms the market into a fragile structure where prices can snap unexpectedly, creating risks that cannot be fully captured by conventional volatility measures.

Forex Liquidity vs Illiquidity: Key Warning Signs

From a trader’s perspective, illiquidity often shows up as erratic price movements, large jumps, or unstable spreads. In contrast, a highly liquid market behaves smoothly, often referred to as a deep market, where price action flows more naturally.

Here are three important signs of liquidity and illiquidity:

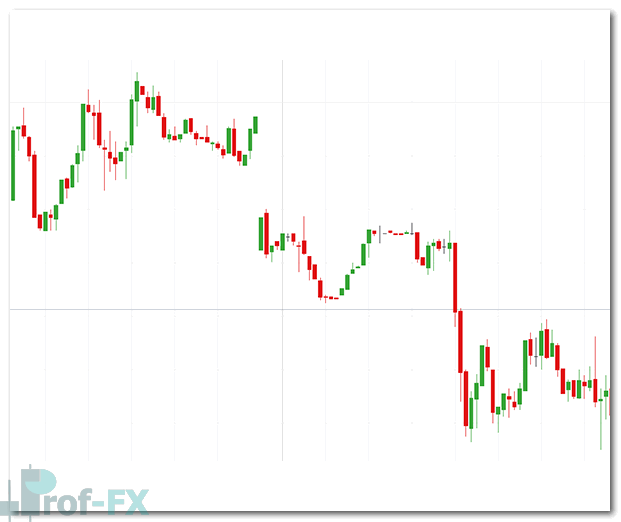

1. Price Gaps During Forex Trading

While forex is less prone to gaps than equities, gaps can still occur—especially around major interest rate decisions, geopolitical events, or unexpected macroeconomic news. Weekend gaps are common when events unfold outside trading hours.

In stock markets, such gaps are frequent due to limited trading hours.

Equity Markets and Their Gap Risk: FTSE 100

Forex Markets with little/No Gapping

Because the forex market trades 24 hours a day, liquidity remains comparatively higher, reducing the frequency and size of gaps.

2. Using the Forex Liquidity Indicator (Volume)

Most retail trading platforms display a volume indicator that can act as a proxy for liquidity. Each bar reflects trading activity during that time period.

Important considerations:

- Broker volume reflects that broker’s liquidity, not the entire interbank market.

- For retail traders, this still offers valuable insights into general market participation and momentum.

3. Liquidity Varies Across Different Trading Sessions

Liquidity is not constant throughout the day. Understanding session behaviour is crucial, especially for scalpers and short-term traders.

- Asian Session → Often range-bound, lower volatility

- London Session → Highest liquidity, frequent breakouts

- New York Session → Strong liquidity, especially when overlapping with London

The most active period of the trading day is the US morning session, which overlaps with London and accounts for more than 50% of daily global forex volume. Volatility typically tapers off during the US afternoon unless high-impact events such as FOMC releases occur.

Liquidity Risk vs Reward: A Necessary Part of Trading Strategy

Financial markets operate on a proportional relationship between risk and reward, and liquidity risk is a critical component of this equation.

A powerful example of liquidity risk is the Swiss Franc crisis in 2015, when the Swiss National Bank (SNB) unexpectedly removed its EUR/CHF exchange rate floor. This caused:

- A breakdown in interbank pricing

- Massive slippage across CHF pairs

- Brokerage failures and widespread retail account losses

These “Black Swan” events are rare but demonstrate why traders must respect liquidity risk.

How Retail Traders Can Manage Liquidity Risk

- Lower leverage during uncertain market conditions

- Use guaranteed stop-loss orders when available

- Avoid trading thin markets during major news releases

- Diversify exposure to avoid concentration risk in exotic pairs

Evaluating liquidity risk should become a permanent part of your daily trading analysis.

Lowering Leverage During Uncertain or Illiquid Market Conditions

One of the most effective ways retail traders can mitigate liquidity risk is by reducing leverage—especially when trading exotic currency pairs or during periods of heightened uncertainty. High leverage magnifies both gains and losses, but in low-liquidity environments, the risks compound dramatically because spreads widen, slippage increases, and stop-loss orders may not execute at intended levels.

Professional traders operating on institutional desks often cut leverage aggressively ahead of major macro events such as central bank decisions or geopolitical tensions. Retail traders should adopt a similar discipline by trading at only a fraction of their maximum allowable leverage when volatility is elevated or when liquidity is expected to deteriorate.

Reducing leverage does not eliminate risk, but it significantly slows the rate at which losses can accumulate during sudden market dislocations.

Using Guaranteed Stop-Loss Orders (GSLOs) When Available

Guaranteed stop-loss orders (GSLOs) are one of the safest defensive tools for traders who regularly interact with exotic or thinly traded currency pairs. Unlike traditional stop-losses— which may suffer from slippage during gaps or high-volatility jumps—GSLOs ensure that your exit price is honored regardless of market conditions.

Although GSLOs typically come with an additional premium or wider minimum distance requirements, the protection they offer can be invaluable. Major brokers in Europe, the U.K., and Australia commonly provide GSLOs to protect retail clients from extreme market moves.

For example, a trader holding a position in EUR/ZAR ahead of a surprise political announcement might face a 400–600 pip gap. A standard stop-loss might fail to trigger at the desired level, but a GSLO guarantees protection no matter how fast price jumps.

Avoiding Thin Markets During Major News Releases

Illiquid markets combined with economic news releases are a recipe for extreme volatility. Retail traders should avoid placing new trades—or avoid holding highly leveraged positions—during periods when both liquidity and market certainty are low.

This includes events such as:

- Non-Farm Payrolls (NFP)

- CPI inflation releases

- Emerging market GDP or interest rate decisions

- Unexpected geopolitical headlines

- Commodity-driven macro shocks that affect EM currencies

During these windows, exotic pairs like USD/MXN, USD/TRY, or EUR/ZAR often experience spreads widening by multiples and sharp price gaps that bypass technical levels entirely.

Institutional traders typically widen internal risk limits and reduce position sizes ahead of such events because they understand that thin liquidity can invalidate even the strongest technical setups. Retail traders must take the same precaution.

Diversifying Exposure to Reduce Concentration Risk in Exotic Pairs

Traders who concentrate too heavily on one or two exotic currency pairs face amplified risk from sudden liquidity distortions, political announcements, or commodity-driven shocks. Diversification reduces the impact of such unexpected events by spreading exposure across multiple markets, asset classes, or currency categories.

Instead of allocating the majority of capital to a pair like USD/TRY or USD/ZAR—both known for structural instability—retail traders should balance their trading portfolio with more stable instruments such as major pairs (EUR/USD, USD/JPY) or liquid cross pairs (EUR/GBP, AUD/JPY).

This approach mirrors institutional portfolio management standards, where traders rarely expose themselves to concentrated emerging-market risk without hedging or offsetting positions.

Diversification does not guarantee profitability, but it dramatically decreases the probability of catastrophic losses caused by liquidity-driven price shocks.

Making Liquidity Evaluation a Permanent Part of Your Daily Trading Routine

Assessing liquidity conditions should not be an afterthought—it must become a consistent, structured part of every trader’s daily analysis. Professional traders routinely evaluate:

- current and historical spreads

- market depth indicators

- the timing of upcoming economic releases

- the behavior of liquidity providers

- trading session overlaps

- volatility cycles in exotic pairs

Retail traders can adopt a simplified version of this institutional playbook by regularly checking spreads, execution speed, and price smoothness across sessions. Noting when liquidity thins out (for example, early Asian hours or pre-London open) helps traders avoid executing trades at suboptimal times.

Embedding liquidity assessment into your daily routine allows you to anticipate periods where price action becomes unstable and risk control becomes harder. It is one of the most underrated yet essential components of long-term trading survival—especially when navigating exotic and low-liquidity currency environments.

Further Reading: Advancing Your Forex Knowledge

The foreign exchange market has evolved over centuries and understanding this evolution provides context for today’s unprecedented liquidity. Continue your learning with these essential topics with Prof FX:

- A historical review of the development of the modern $9.6 trillion-a-day forex market

- Research insights based on 30 million+ live trades revealing habits of profitable traders

- Retail client sentiment data available on major platforms such as TradingView

- Comprehensive beginner guides for traders new to forex