In forex trading, not all profits and losses come solely from price movements. One often overlooked but highly important concept – especially for traders who hold positions overnight – is forex rollover. Understanding how rollover works can help traders manage costs, optimize strategies, and in some cases, even generate additional income from interest differentials.

This article explains what forex rollover is, how it works, how it is calculated, and how traders can use rollover strategically in real-world trading.

What Is Forex Rollover?

Forex rollover refers to the interest paid or earned for holding a spot forex position overnight, meaning after the official market close at 5:00 PM Eastern Time (ET).

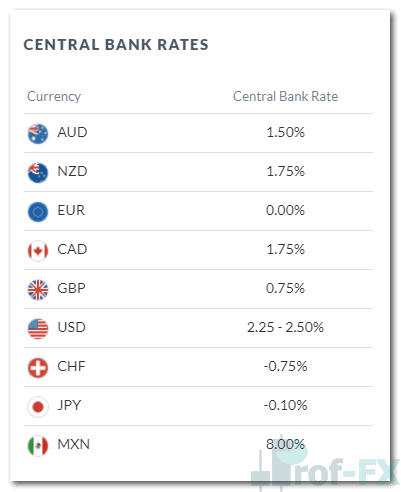

Every currency in the forex market has an associated overnight interbank interest rate, set indirectly through central bank monetary policy. Because forex trading always involves currency pairs, each trade is exposed to two different interest rates at the same time.

As a result, when a trader holds a position overnight, the broker applies a rollover adjustment—either a credit or a debit—based on the interest rate differential between the two currencies in the pair.

In simple terms:

- You earn rollover if the currency you buy (long) has a higher interest rate than the currency you sell (short).

- You pay rollover if the currency you buy has a lower interest rate than the one you sell.

How Forex Rollover Works in Practice

When a forex position remains open past 5:00 PM ET, it is automatically rolled over to the next trading day. At that moment, the interest rate differential between the two currencies is applied to the trading account.

These adjustments are commonly referred to as:

- Forex rollover rates

- Currency rollover rates

- Overnight swap rates

If the long currency’s interest rate exceeds the short currency’s rate, the trader receives a rollover credit. Conversely, if the long currency yields less than the short currency, the trader incurs a rollover debit.

Central bank benchmark rates for major currencies can be monitored on reputable market data platforms such as Prof FX or central bank publications.

Example: Negative Rollover

If a trader goes long EUR/USD while:

- EUR overnight interest rate is lower

- USD overnight interest rate is higher

The trader will pay the interest rate difference each night the position remains open.

For traders who routinely hold positions overnight, monitoring rollover rates is essential. Under normal market conditions, rollover rates tend to remain relatively stable. However, during periods of financial stress—such as liquidity shortages or heightened credit risk—rollover rates can fluctuate significantly from day to day.

Rollover and Carry Trade Strategies

Some trading strategies are designed specifically to benefit from rollover. One of the most well-known is the carry trade strategy, where traders aim to earn positive rollover consistently.

Carry trades involve:

- Going long a currency with a high interest rate

- Going short a currency with a low interest rate

This allows traders to potentially profit from both:

- Favorable price movement

- Daily interest earned from rollover

Understanding the mechanics of long and short positions is essential before attempting such strategies.

How to Avoid Paying Negative Rollover

Rollover is only applied to positions that are open at 5:00 PM ET. Traders who want to avoid negative rollover can simply close positions before the rollover cutoff time.

However, changes in central bank interest rates can dramatically affect rollover costs or credits. This is why traders should closely monitor the central bank calendar, especially during rate decision weeks.

How to Calculate Forex Rollover Rates

To estimate the rollover amount on a position, traders need three key variables:

- Position size

- Currency pair

- Interest rates of both currencies

While the calculation provides an estimate, the actual rollover applied by brokers may differ slightly due to market conditions and interbank spreads.

Example 1: Negative Rollover (AUD/USD)

Assumptions:

- Pair: AUD/USD

- Price: 72

- Position size: 10,000 units (10k)

- AUD interest rate: 5%

- USD interest rate: 5%

- Position: Long AUD/USD

Annual interest earned on AUD:

10,000 × 1.5% = 150 AUD

Daily: 150 ÷ 365 = 0.4109 AUD

Annual interest paid on USD:

7,200 × 2.5% = 180 USD

Daily: 180 ÷ 365 = 0.4932 USD

Convert AUD interest to USD:

0.4109 × 0.72 = 0.2960 USD

Rollover calculation:

0.2960 − 0.4932 = –0.1972 USD

Result: The trader pays a rollover cost each night.

Example 2: Positive Rollover (EUR/AUD Carry Trade)

Assumptions:

- Pair: EUR/AUD

- Price: 60

- Position: Short EUR/AUD

- AUD interest rate: 5%

- EUR interest rate: 0%

- Position size: 10,000 units

Interest earned on AUD:

10,000 × 1.6 = 16,000 AUD

16,000 × 1.5% = 240 AUD annually

Daily: 240 ÷ 365 = 0.65 AUD

Convert AUD to EUR:

0.65 ÷ 1.6 = 0.41 EUR

Result: The trader earns a positive rollover gain each night.

When Is Forex Rollover Booked?

Rollover is applied daily at 5:00 PM ET.

Key timing rules:

- A trade opened at 4:59 PM ET is subject to rollover immediately.

- A trade opened at 5:01 PM ET is rolled over the next day.

Global Rollover Times

- United States: 5:00 PM ET

- United Kingdom: 10:00 PM GMT

- Australia: 9:00 AM AEST

How Weekends Affect Forex Rollover

Banks are closed on Saturdays and Sundays, but interest still accrues. To account for this, the forex market applies three days’ worth of rollover on Wednesdays.

Using the previous AUD/USD example:

- Daily rollover cost: –0.1972 USD

- Wednesday rollover: –0.1972 × 3 = –0.59 USD

How Holidays Affect Rollover Rates

There is no rollover applied on holidays themselves. Instead, an extra day of rollover is usually booked two business days before the holiday.

If either currency in a pair has a major public holiday, the rollover adjustment applies to all related pairs. For example:

- US Independence Day (July 4)

- Extra rollover is applied on July 1 at 5:00 PM ET for all USD pairs

If this adjustment falls on a weekend, it may be added to Wednesday’s rollover, resulting in four or five days’ worth of interest.

3 Practical Tips to Use Forex Rollover to Your Advantage

Forex rollover does not need to be a hidden cost. With proper planning, it can be incorporated into a broader trading strategy.

1. Avoid Large Negative Rollover

Close positions before 5:00 PM ET when rollover costs are expected to be unusually high, especially when trading exotic or emerging market currencies.

2. Hold Positions with Positive Rollover

If the rollover is positive and aligns with your market bias, consider holding the trade overnight to benefit from daily interest credits.

3. Monitor Central Bank Events

Changes in interest rate expectations can cause rollover rates to shift dramatically. Staying updated with the central bank calendar is essential.

Final Thoughts on Forex Rollover

Forex rollover is a fundamental concept that every trader should understand—especially those who hold trades overnight or longer. While rollover can increase trading costs, it can also become an additional source of returns when used correctly.

By understanding interest rate differentials, central bank policy, and rollover timing mechanics, traders can make more informed decisions and avoid unnecessary surprises in their trading accounts.

To deepen your understanding of forex fundamentals and concepts like rollover, interest rates, and leverage, consider studying our New to Forex Trading Guide.