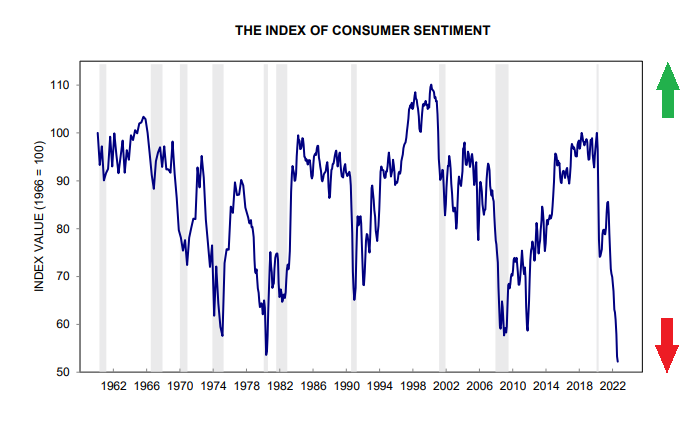

What Is Consumer Sentiment and Why It Matters for Traders?

Consumer sentiment – often referenced as consumer confidence or the Index of Consumer Sentiment (ICS) – serves as a key barometer of overall economic health from the perspective of households. Financial markets rely heavily on this metric because it reflects how consumers perceive their personal financial conditions as well as broader economic prospects, covering previous, current, and expected future conditions.

The index also incorporates consumer expectations around inflation, making it a valuable component for traders evaluating macroeconomic trends.

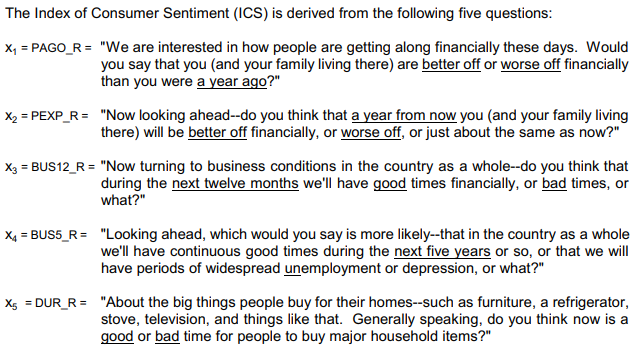

Traditionally, economic survey teams directly interviewed consumers, asking structured questions similar to those used today. These questions aim to uncover how households feel about their financial well-being—and feelings often drive real economic decisions.

The modern version of the U.S. consumer sentiment survey originates from research by Dr. George Katona, a pioneer at the University of Michigan, who developed the approach in 1946. Unlike conventional quantitative indicators, this survey intentionally captures the emotional and behavioral tendencies of consumers—hence the well-known term Michigan Consumer Sentiment. The questionnaire was designed to be timeless, applicable to both a consumer in the 1960s and one in today’s digital economy.

How to Read and Interpret the Consumer Sentiment Index (ICS)

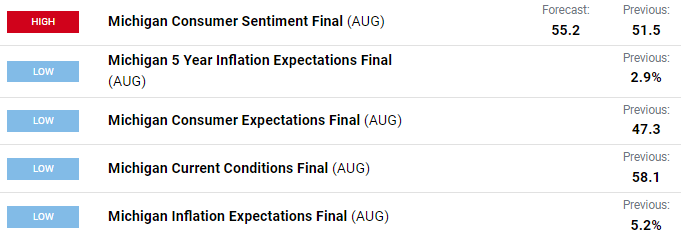

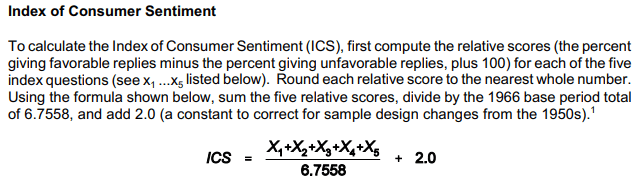

Understanding ICS is straightforward, even for beginning traders. Data gathered from survey responses is compiled and processed using a standardized formula—seen below—to produce the main sentiment reading. While component formulas may vary slightly, our focus remains on the headline ICS figure commonly referenced by analysts, economists, and traders.

Once calculated, the results are presented graphically, often alongside recession periods. These visuals help traders recognize patterns—consumer sentiment frequently declines ahead of economic downturns, which is why the index is regarded as a leading indicator.

In general:

- A higher ICS value = stronger consumer confidence

- A lower ICS value = rising pessimism or financial stress

For traders, these shifts frequently signal changes in spending, saving, and borrowing behavior, which ripple across markets—from equities to currencies.

How Consumer Sentiment Interacts With Inflation Dynamics

Periods of rising inflation can significantly undermine consumer confidence. As observed during 2020–2022, rapid increases in consumer prices aligned with sharp drops in sentiment, intensifying recession fears across financial markets. This presents a unique challenge for central banks.

Classical monetary policy suggests raising interest rates to combat inflation. However, higher rates also increase borrowing costs for consumers, which can further dampen sentiment. This creates a delicate balancing act for policymakers such as the Federal Reserve.

When households believe inflation will continue climbing, their instinctive response is to accelerate purchases—buying goods now before prices rise further. Ironically, this fear-driven behavior can fuel even greater inflation. Therefore, central banks must communicate clearly and convincingly to help anchor inflation expectations.

Effective central bank messaging, often scrutinized by traders during speeches from figures like the Federal Reserve Chair, becomes crucial in shaping market reactions and consumer psychology.

Trading Strategies: How Consumer Sentiment Impacts Markets

MICHIGAN CONSUMER SENTIMENT VS S&P 500 INDEX VS DXY (2017–2022)

The chart above highlights the dynamic interaction between U.S. consumer sentiment, the U.S. Dollar Index (DXY), and the S&P 500 (SPX). To understand how traders can leverage this information, let’s break down the relationships.

Consumer Sentiment and the Stock Market: A Contrarian Signal

Historically, the relationship between ICS and the S&P 500 often shows an inverse pattern. When consumer sentiment experiences sharp declines, equity markets—especially the S&P 500—frequently stage strong recoveries afterward.

Why?

Because fear-driven markets create discounted opportunities. When retail investors panic and sentiment falls, sophisticated institutional investors often accumulate positions at cheaper valuations. Conversely, when sentiment is excessively positive, experienced traders may become cautious, anticipating a correction as overly optimistic investors drive prices into overbought territory.

In short:

Consumer sentiment can serve as a contrarian indicator for stock market positioning—especially during extreme readings.

Of course, broader macro conditions can override this pattern, so sentiment should complement—not replace—other analytical tools.

Consumer Sentiment and the Forex Market

In the foreign exchange market, consumer sentiment tends to have a positive correlation with the U.S. dollar under normal economic conditions.

The theoretical reasoning:

- Falling sentiment → weaker economic outlook → looser monetary policy → lower interest rates → weaker USD (DXY)

- Rising sentiment → stronger outlook → potentially tighter monetary policy → stronger USD

However, markets do not always behave uniformly. The year 2022 serves as a notable exception. During this period, the economy faced:

- Multi-decade-high inflation

- Recessionary risks

- Geopolitical instability

- Sharp declines in consumer sentiment

Despite collapsing sentiment, the Federal Reserve continued aggressive interest rate hikes to combat inflation. This led the U.S. dollar to strengthen, supported by safe-haven flows and higher yield differentials.

For forex traders, this highlights the importance of considering broader macroeconomic context when interpreting sentiment-based signals.

Conclusion: Why Consumer Sentiment Matters for Every Trader

Consumer sentiment offers powerful insights into consumer behavior, economic expectations, and early signs of market shifts. Whether you trade based on fundamentals or rely heavily on technical analysis, ICS can enhance your understanding of macroeconomic conditions.

As one of the leading U.S. indicators, it helps traders:

- Anticipate potential recessions

- Gauge consumer spending behavior

- Understand shifts in risk appetite

- Predict policy responses from central banks

- Manage market sentiment in equities and forex

At its core, consumer sentiment is a window into the psychology driving economic activity—an invaluable resource for traders seeking a deeper understanding of market cycles. If certain concepts still feel unclear, feel free to revisit educational materials or ask for further clarification. A strong grasp of indicators like ICS will significantly strengthen your long-term trading strategy.