Understanding FOMO in Trading Psychology

Fear of Missing Out—commonly known as FOMO—is one of the most destructive psychological forces in trading. While it may appear harmless at first, FOMO can significantly impair decision-making, override logic, and push traders into impulsive actions that are inconsistent with their trading plans.

In trading, FOMO is the emotional discomfort traders feel when they believe they are missing out on profitable opportunities or when they perceive that other traders are consistently performing better. This fear often leads to chasing price, entering trades too late, increasing position size unnecessarily, or abandoning risk management rules.

Traders who truly understand what FOMO is, where it originates, and how it manifests in their own behavior are far better positioned to neutralize it—because the root of FOMO lies not in the market, but in the trader’s own mindset.

This article will help you recognize FOMO, understand its psychological drivers, and apply practical techniques to manage—or even prevent—it altogether.

Where Does FOMO in Trading Come From?

FOMO is deeply rooted in human psychology and is amplified by the modern trading environment. Today’s traders are constantly exposed to social media, trading forums, chat rooms, and performance screenshots, all of which create the illusion that profitable opportunities are endless—and that everyone else is capitalizing on them.

Common emotional drivers of FOMO include:

- Fear of missing a large move

- Greed for quick profits

- Jealousy of other traders’ perceived success

- Impatience with slow or disciplined strategies

The fast-paced nature of financial markets—especially forex, indices, and cryptocurrencies—intensifies these emotions. Breaking news, sudden volatility spikes, and sharp price movements can all trigger FOMO within seconds, even in experienced traders.

Understanding the emotional roots of FOMO is the first step toward controlling it.

Breaking the FOMO Cycle: How to Deal with FOMO in Trading

Overcoming FOMO is not an overnight process. It requires deliberate changes in thought patterns, discipline, and self-awareness. Even seasoned professionals experience FOMO from time to time—but the difference is how they respond to it.

Below are five proven strategies to help traders deal with FOMO and build long-term consistency.

1. Accept That FOMO Exists

The first step toward managing FOMO is acknowledging it. Denial keeps traders trapped in a cycle of reactive behavior.

Warning Signs

Traders struggling with acceptance often think:

“FOMO? That doesn’t affect me. I’m fully in control.”

This mindset prevents self-improvement because it blocks honest reflection.

How Acceptance Helps

Recognizing that FOMO is a normal psychological response—experienced by traders at all levels—can be incredibly freeing. Open discussions in educational environments such as trading webinars or group mentoring sessions can help normalize these emotions.

At Prof FX, analysts such as Paul Robinson regularly address trading psychology, emotional discipline, and FOMO during live webinars, helping traders understand they are not alone in this challenge.

2. Strengthen Your Trading Psychology

FOMO is inseparable from trading psychology. When emotions take over, traders begin to question their systems, abandon patience, and focus only on immediate outcomes.

Warning Signs

Thoughts like:

“I can’t believe I missed that trade. Opportunities like this don’t happen often.”

This narrow focus on short-term outcomes often leads to overtrading and emotional exhaustion.

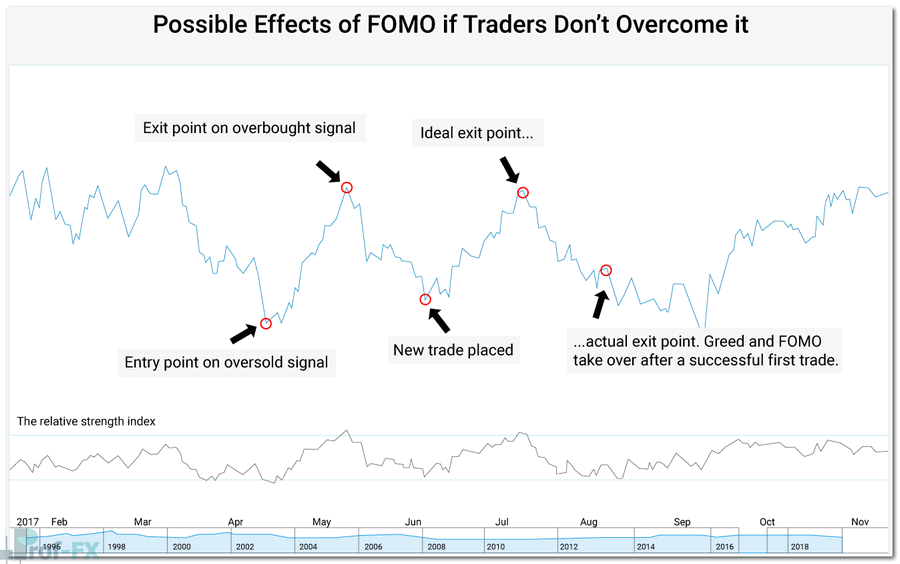

The chart above illustrates how FOMO-driven decisions can unfold. Using the Relative Strength Index (RSI) on the Japanese Yen, the example shows overbought and oversold conditions. In the highlighted section, the trader becomes overconfident, ignores sell signals, and holds on due to fear of missing further gains—only to suffer losses when price reverses.

How to Improve Trading Psychology

Improvement begins with honest self-assessment:

- Identify emotional triggers

- Review losing trades objectively

- Separate ego from outcomes

Educational resources such as the Prof FX Podcast provide valuable insights into emotional control, discipline, and long-term mindset development.

3. Control Your Social Media Exposure

While social media can be informative, it can also distort reality. Most traders only share winning trades—not losses—creating a false sense of constant success.

Warning Signs

If you frequently think:

“Everyone on Twitter is making money except me.”

It may be time to reassess how social media is influencing your mindset.

Practical Control Measures

You don’t need to disconnect entirely. Instead:

- Limit screen time during trading hours

- Follow educational accounts, not hype-driven ones

- Use social media for analysis, not validation

Following credible sources like @Prof FX can help shift focus toward learning rather than comparison.

4. Maintain a Detailed Trading Journal

A trading journal is one of the most effective tools for combating FOMO. It transforms subjective emotions into objective data.

Warning Signs

Thoughts such as:

“This feels like a good trade—I don’t want to miss it.”

Often indicate a lack of structured evaluation.

Why Journaling Works

A journal helps traders:

- Identify emotional entries

- Track rule violations

- Measure consistency over time

By reviewing past FOMO-driven trades, traders begin to see patterns—and correcting patterns is far easier than correcting emotions in real time.

5. Apply Strict Risk Management

FOMO can lure traders into oversized positions and poor entries. Risk management acts as a safety net when emotions flare.

Warning Signs

Thoughts like:

“Everyone is trading this—how risky can it be?”

Indicate emotional decision-making.

Risk Management as Emotional Control

Effective risk management:

- Limits losses regardless of emotional state

- Preserves capital during losing streaks

- Builds confidence through consistency

Understanding position sizing, stop placement, and capital exposure is essential for long-term survival in trading.

How to Prevent FOMO Before It Starts

The best way to deal with FOMO is to design your trading process to minimize it.

Key preventative strategies include:

Establish a Trading Routine

A consistent routine reduces impulsive behavior. Planning trades, reviewing charts, and journaling at fixed times helps traders remain focused and detached from noise.

Focus on Long-Term Growth

Every trader misses opportunities. Successful traders accept this as part of the game. Markets will always present new setups.

Tools like the market sentiment indicator can help traders stay forward-focused rather than emotionally attached to past trades.

Create and Follow a Trading Plan

A robust trading plan eliminates guesswork. When rules are clear, emotions lose influence.

A strong plan defines:

- Entry criteria

- Exit logic

- Risk parameters

- Market conditions to avoid

Enjoy the Trading Process

When traders feel confident in their skills and education, FOMO naturally diminishes. Continuous learning through structured educational resources strengthens independence and emotional resilience.

From FOMO to JOMO: A Healthier Trading Mindset

JOMO, or the Joy of Missing Out, represents a powerful mindset shift. It means being comfortable sitting out trades that don’t align with your strategy—and trusting that discipline pays off over time.

Embracing JOMO allows traders to:

- Trade selectively

- Reduce stress

- Improve consistency

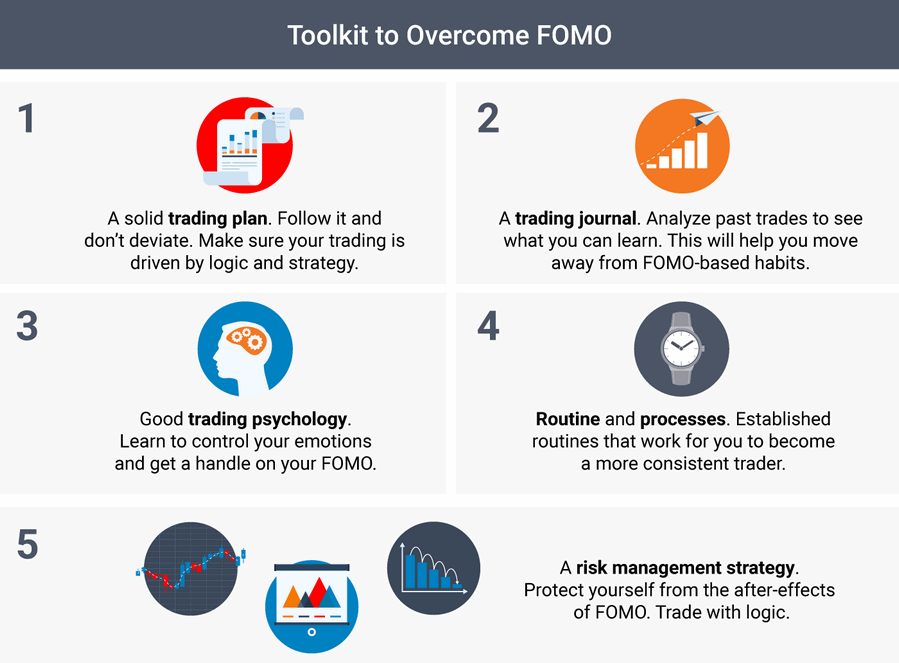

A Trader’s Toolkit for Managing FOMO

In summary, overcoming FOMO requires:

- Self-awareness

- Psychological discipline

- Structured planning

- Risk management

- Long-term perspective

Trading success is not about catching every move—it’s about executing your edge consistently.

Prof FX provides forex news, educational resources, and technical analysis to help traders navigate global currency markets with clarity and confidence.