What is the NFP?

The Non-Farm Payroll (NFP) report is one of the most critical economic indicators for the U.S. economy. It measures the number of jobs added during the previous month, excluding farm workers, government employees, private household staff, and nonprofit organization employees. This data provides a clear snapshot of the U.S. labor market, making it a vital tool for forex traders and economists alike.

NFP releases often trigger significant volatility in the forex market. The report is published monthly, typically on the first Friday at 8:30 AM ET. In this article, we’ll explore the economic significance of the NFP, its impact on forex trading, and how you can incorporate NFP data into your trading strategy.

How Does the NFP Impact Forex Market?

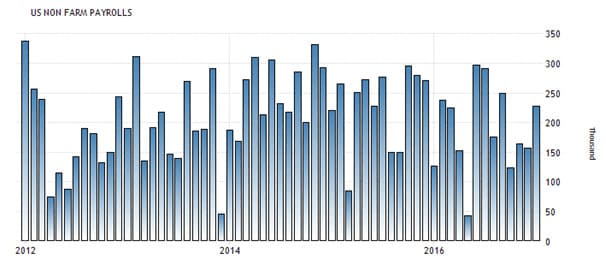

The NFP report is a key barometer of the U.S. economy’s health. Released by the Bureau of Labor Statistics, it offers timely insights into employment trends, which are closely monitored by the Federal Reserve. Employment levels influence the Fed’s monetary policy decisions. For instance, high unemployment often leads to expansionary policies, such as lowering interest rates to stimulate economic growth.

When interest rates are low, the U.S. Dollar tends to weaken as investors seek higher yields elsewhere. Conversely, strong NFP data can boost the Dollar by signaling economic strength and potential rate hikes. This dynamic makes the NFP a pivotal event for forex traders.

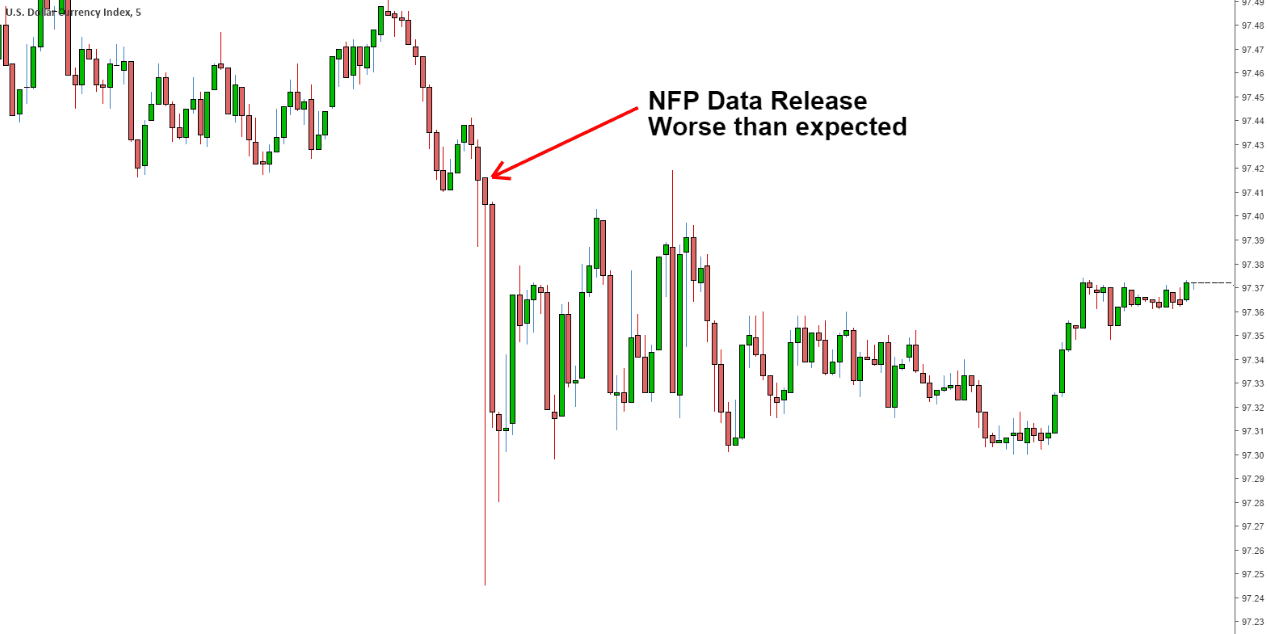

For example, on March 8, 2019, the NFP report showed only 20,000 jobs added, far below the expected 180,000. This disappointing result caused the Dollar Index to drop sharply, illustrating how NFP data can drive market movements.

Which Currency Pairs Are Most Affected by NFP News?

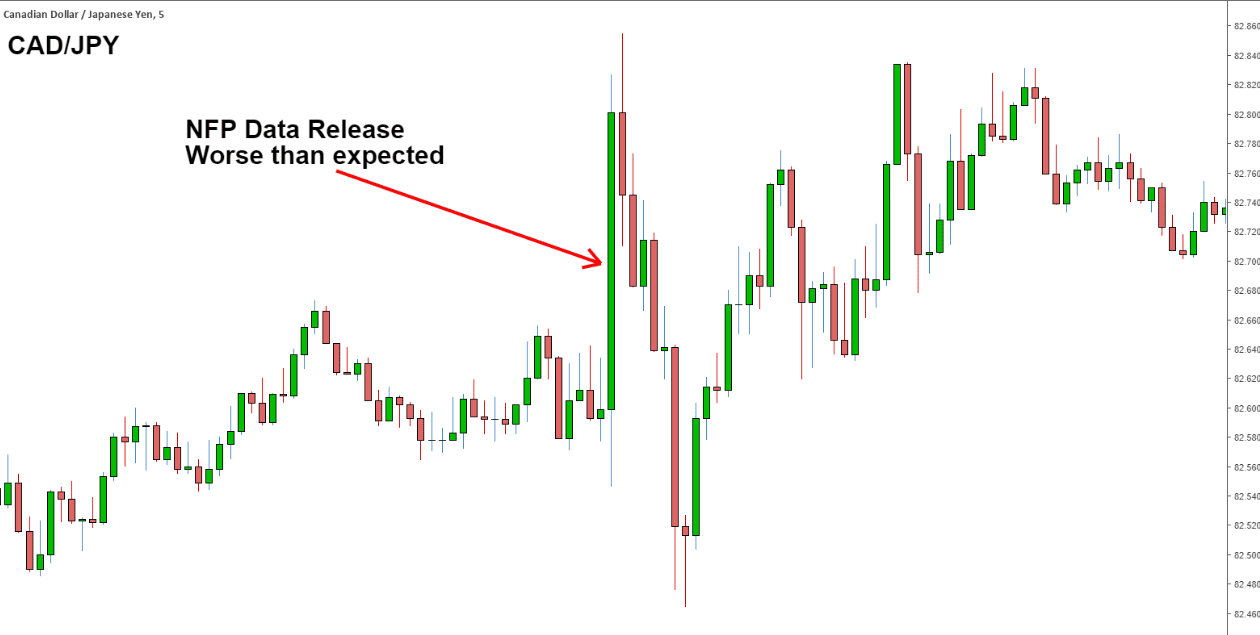

Since the NFP reflects U.S. employment data, currency pairs involving the U.S. Dollar (such as EUR/USD, USD/JPY, GBP/USD, AUD/USD and XAUUSD ) are most directly impacted. However, the ripple effects of NFP releases can also increase volatility in other pairs, such as CAD/JPY, even if they don’t include the Dollar.

Traders must remain cautious during NFP releases, as heightened volatility can lead to wider spreads and potential margin calls. Proper risk management is essential to navigate these conditions effectively.

When is the NFP Released?

The NFP report is typically published on the first Friday of each month at 8:30 AM ET. You can find the exact dates on the Bureau of Labor Statistics website or through an economic calendar.

Trading Strategies for NFP Releases

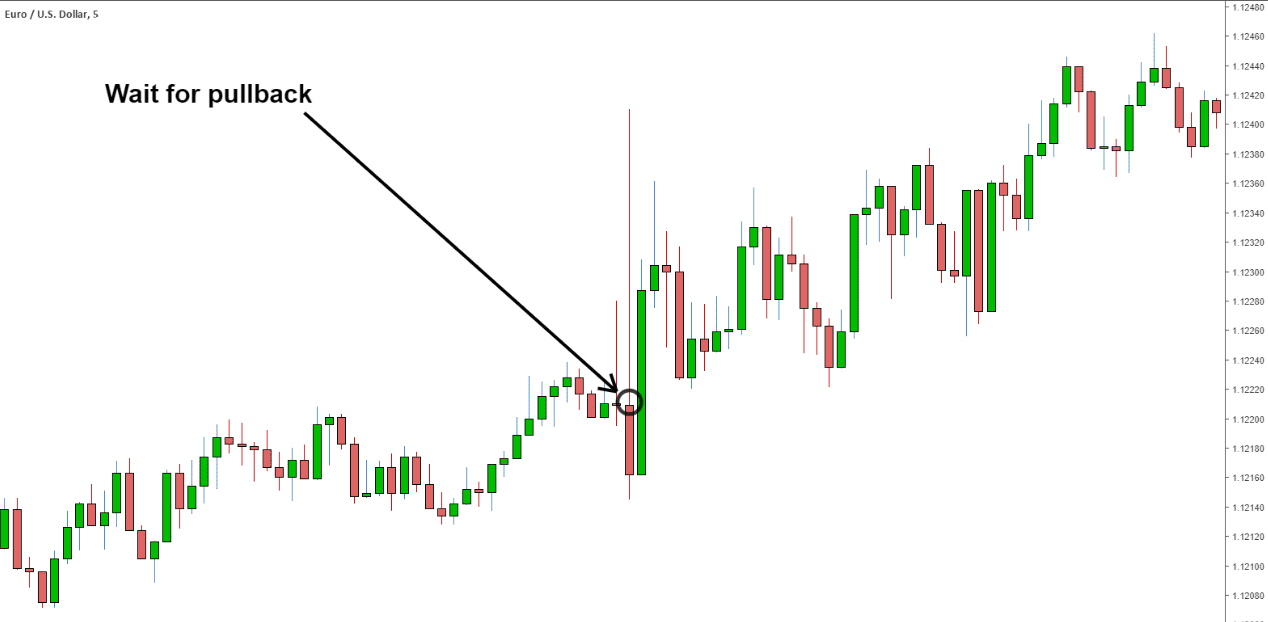

Given the volatility surrounding NFP releases, a pullback strategy is often more effective than a breakout approach. For example, if the NFP data disappoints (e.g., 20k jobs added vs. 180k expected), traders might anticipate a weaker Dollar and look for opportunities to buy EUR/USD after a retracement.

Top Tips for Trading NFP Data

- Timing is Key: NFP data is released on the first Friday of every month at 8:30 AM ET.

- Expect Volatility: Be prepared for sudden price swings and wider spreads.

- Monitor Non-USD Pairs: Even currency pairs not directly tied to the Dollar can experience increased volatility.

- Use Proper Leverage: High leverage can amplify risks during volatile events. Consider reducing leverage or trading without it.

Other Important Economic Indicators

While the NFP is a major market mover, other data releases like CPI (inflation), GDP growth, and Federal Reserve interest rate decisions also play crucial roles in forex trading. Staying informed about these indicators can help you build a more comprehensive trading strategy.

Further Reading on Forex Fundamentals

To deepen your understanding of forex trading, explore resources on central bank policies, interest rates, and economic calendars. Bookmark tools like the Prof FX economic calendar to stay updated on key data releases and central bank announcements.