Monitoring what is happening throughout the day in the Forex market is much more difficult than monitoring what is happening in the U.S. stock market, for instance, because the Forex market never sleeps. There is no opening or closing bell.

Trading activity simply follows the sun as it moves from one financial center to the next around the globe. The trick is knowing which financial center is likely to be most active at different times of the day, because knowing who is awake and trading in the currency market at any given point in time will give you added insight into why a particular currency pair is moving the way it is.

Technically, the trading day starts in New Zealand and Australia. Shortly after that, the Japanese markets come online, followed by Singapore, Hong Kong, and the other Asian markets. Next, Europe starts to join in the fun as Switzerland, Germany, and he United Kingdom wake up and get to work. Lastly, after the Asian markets have wound up their trading day, the United States jumps into action. And then, of course, the entire process starts all over again.

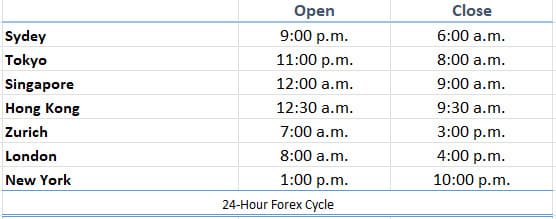

Table below gives a breakdown of when the major markets open each trading day; all times are in Greenwich mean time (GMT).

Of course, when daylight saving rolls around, you will need to make the necessary adjustments by shifting Sydney, Zurich, London and New York ahead one hour, but this should give you a good idea of which markets are most active during different parts of the trading day.

Although currency trading takes place in financial centers around the world, the bulk of the trading is clustered in a few cities. According to the Bank for International Settlements (BIS),8 more than half of all Forex transactions take place in either the United Kingdom or the United States. Here’s the breakdown:

- London: 36.7 percent

- New York: 18 percent

- Tokyo: 6 percent

- Singapore: 5 percent

- Zurich: 5 percent

- Hong Kong: 5 percent

- Sydney: 4 percent

So what does all this mean? What should we be watching? Here are a few things:

- The London and New York markets are both open between 1:00 p.m. and 4:00 p.m. GMT, which means that there is going to be a lot of liquidity in the market during that period.

- The transition between the close of the trading day in New York and the opening of the trading day in Tokyo is a relatively quiet time in the market.

- Liquidity in the euro picks up when the European markets open, and liquidity in the U.S. dollar picks up when the U.S. market opens.

The most important thing for you to take from all of this is the fact that currency pairs trade differently depending on the time of day. So as you get started, try to trade at the same time each day so that you can get used to how the market reacts during those trading hours.