Understanding how to take long and short positions is one of the most fundamental concepts every forex trader must master. At its core, forex trading is about expressing a view on whether one currency will appreciate or depreciate relative to another.

If a trader believes a currency will rise in value, they take a long position. If they expect it to fall, they take a short position. While this sounds simple, correctly applying these concepts in real market conditions requires clarity, discipline, and proper risk management.

In this article, I will walk you through what long and short positions mean in forex trading, how they work in practice, and when traders typically use them.

What Is a Position in Forex Trading?

A forex position represents exposure to price movements in a currency pair. This exposure can be held by an individual trader, a financial institution, or a corporate entity engaging in currency exchange.

Every forex position has three essential characteristics:

The Currency Pair

This is the underlying instrument being traded, such as EUR/USD, GBP/USD, or USD/JPY.

The Direction

The trader is either long (expecting price to rise) or short (expecting price to fall).

The Position Size

This refers to how much of the currency pair is being traded, typically measured in lots. Position size is closely linked to account equity, margin requirements, and leverage.

Traders can take positions across multiple currency pairs depending on their market outlook. However, using appropriate leverage is critical, as excessive leverage can magnify losses just as quickly as gains.

What Does It Mean to Go Long or Short in Forex?

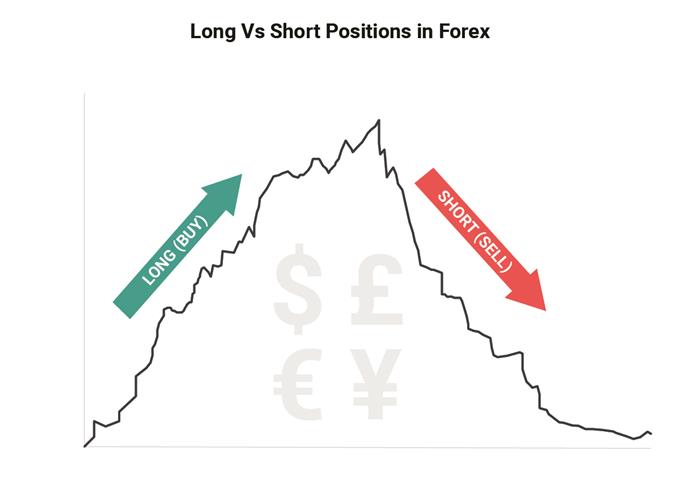

Going long or short simply reflects a trader’s directional bias. These two actions form the foundation of all trading strategies.

When a trader goes long, they hold a positive exposure to the currency pair and benefit if the price increases. When a trader goes short, they hold a negative exposure and profit if the price declines.

Unlike some other financial markets, forex trading makes it equally easy to profit from rising or falling prices, which is one of the reasons the FX market attracts traders globally.

What Is a Long Position and When Should Traders Use It?

A long position is opened when a trader buys a currency pair in anticipation of price appreciation. For example, buying USD/JPY means the trader expects the US dollar to strengthen relative to the Japanese yen.

If a trader buys two standard lots of USD/JPY, they are holding:

- Underlying: USD/JPY

- Direction: Long

- Size: Two lots

Long positions are commonly entered when traders identify bullish conditions, such as strong economic data, rising interest rate expectations, or supportive technical signals.

Identifying Buy Signals for Long Positions

Traders often rely on technical analysis to identify buy opportunities. Indicators, price patterns, and key price levels are frequently used to confirm long entries.

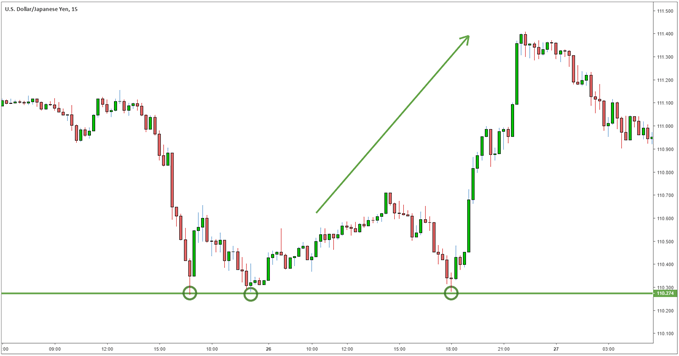

One common buy signal occurs near a support level—a price area where the currency has repeatedly found buying interest. When price falls toward this level and holds, traders may interpret it as a sign that demand is outweighing supply.

In the example below, USD/JPY declines toward 110.274 multiple times but fails to break lower. This repeated defense turns the level into a support zone and provides a potential buy signal.

Liquidity and Timing for Long Trades

The forex market trades nearly 24 hours a day, five days a week, offering flexibility for traders worldwide. However, liquidity varies depending on the trading session.

Many traders prefer to place long trades during major trading sessions, such as the London or New York session, when liquidity and volatility are higher. Increased liquidity often leads to tighter spreads and more efficient price movement.

What Is a Short Position and When Should Traders Use It?

A short position is the opposite of a long position. Traders enter a short position when they expect the underlying currency to depreciate.

To short a currency pair means selling it first, with the intention of buying it back later at a lower price. The profit comes from the difference between the higher selling price and the lower repurchase price.

For example, shorting USD/JPY involves selling US dollars and buying Japanese yen, anticipating USD weakness.

Identifying Sell Signals for Short Positions

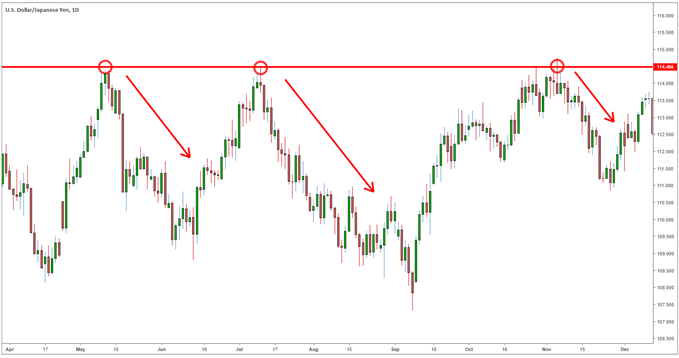

Just as traders look for support when buying, they look for resistance levels when selling. A resistance level is a price area where the market has repeatedly struggled to move higher.

In the example below, USD/JPY rises toward 114.486 but fails to break above it. This repeated rejection creates a resistance level and offers traders a potential sell signal when price approaches that area.

Short positions are often favored during bearish trends, periods of economic uncertainty, or when interest rate expectations shift against a currency.

Trading Sessions and Short Positions

Some traders choose to trade only during high-liquidity periods, while others take opportunities whenever conditions align with their strategy. Because the forex market operates continuously across global sessions, traders can execute short trades whenever valid setups appear.

What matters most is not the time of day, but whether market conditions support the trade idea.

Key Takeaways for Beginner Forex Traders

Long and short positions are the building blocks of forex trading. Every trade you place is ultimately an expression of whether you believe a currency pair will rise or fall.

Successful traders focus on:

- Understanding market direction

- Choosing appropriate position size

- Using leverage responsibly

- Aligning entries with clear technical or fundamental signals

Building a solid foundation in these concepts helps traders avoid common mistakes and approach the market with greater confidence.

Further Learning to Support Your Forex Trading

If you are new to forex trading, developing a strong understanding of market basics is essential. Learning how currency pairs move, how risk management works, and how to avoid common psychological pitfalls will significantly improve long-term outcomes.

Many traders also benefit from following professional market analysis, currency forecasts, and educational webinars to stay informed about evolving market conditions.