Since many people trade online, traders have continuously expanded their knowledge and expertise. Years ago, many traders would have struggled to define ECN/STP. However, thanks to the vast accessibility of information on the internet, most traders today understand the significance of selecting the right broker and distinguishing between market makers and ECN/STP brokerage models.

Unfortunately, scams evolve alongside knowledge. Since traders now actively seek ECN/STP brokers, many brokerage firms that once operated as market makers have rebranded themselves as ECN/STP brokers with only minor adjustments to their systems. However, not all of them are genuine ECN/STP brokers, and identifying the difference is crucial. So, what exactly separates a true ECN/STP broker from a deceptive one?

Understanding ECN and STP

ECN stands for Electronic Communications Network, a system where the broker’s platform is directly linked to a network of international banks or liquidity providers. Trading through an ECN broker means you are interacting with the actual foreign exchange market, rather than trading against the broker.

STP, or Straight Through Processing, ensures that all trade orders, from execution to closure, are handled electronically without manual interference.

Can Any Broker Claim to Be ECN/STP?

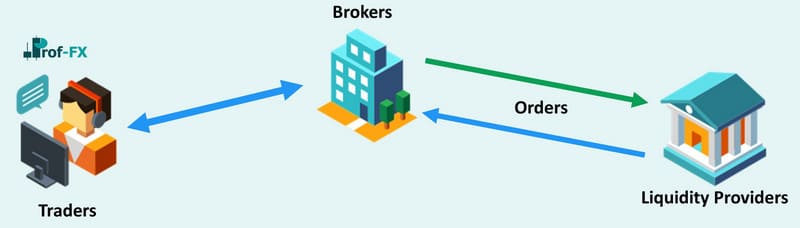

From a purely technical standpoint, a broker that connects your trading platform electronically to a liquidity provider without manual intervention is considered an ECN/STP broker. However, the key question is: who is the liquidity provider?

Some so-called ECN/STP brokers route orders to liquidity providers that are, in reality, affiliated entities—either another market maker operating under a different name or a sister company. This allows them to manipulate pricing, share profits, and ultimately work against traders. In essence, they are moving money within their own ecosystem rather than executing trades in the actual forex market. Traders may believe they are dealing with an ECN/STP broker, but in reality, they are still trading within a closed market-making system.

Why Do Brokers Engage in This Deception?

The primary reason is branding. These brokers want to market themselves as ECN/STP brokers rather than market makers. While they technically fit the definition from an electronic standpoint, their underlying business model still operates on the principles of a market maker—profiting when traders lose.

What Defines a True ECN/STP Broker?

A legitimate ECN/STP broker is directly connected to multiple reputable liquidity providers, such as Bank of America, Goldman Sachs, JP Morgan, Citi Bank, Nomura, and HSBC. These institutions are entirely independent of brokerage firms, ensuring there is no conflict of interest.

In this setup, the liquidity provider earns revenue through the spread and swap, while the broker profits from the commission charged to traders. Traders pay the spread and swap to the liquidity provider and the commission to the broker, ensuring transparency in transaction costs.

Most genuine ECN/STP brokers connect to several liquidity providers simultaneously. When a trader places an order, the system automatically selects the provider offering the most competitive price, ensuring optimal trade execution. This multi-provider setup also prevents any single entity from targeting specific traders, as orders are distributed among multiple liquidity providers. As a result, liquidity providers compete with each other to offer tighter spreads, ultimately benefiting retail traders.

Hidden Fees Even True ECN/STP Brokers Might Charge

While some brokers operate as true ECN/STP brokers, they still engage in unethical practices by marking up spreads in addition to charging commissions. The extra cost imposed on spreads is known as a markup. Though brokers are required to disclose such fees, many do not, misleading traders by claiming that higher spreads are part of normal market conditions.

To avoid falling into such traps, always verify whether an ECN/STP broker applies markups. Directly ask the broker about this and request proof of their pricing model. If they refuse to provide clear answers, it’s best to look elsewhere.

Conclusion

When selecting a forex broker, the priority should be ensuring they are a genuine ECN/STP broker with direct connections to reputable liquidity providers. Additionally, always inquire about potential hidden fees, such as markups on spreads. Transparency is crucial in forex trading, and if a broker hesitates to provide clear information, it’s a major red flag. By staying informed and asking the right questions, traders can protect themselves from deceptive brokers and navigate the forex market with confidence.