One of the most common questions among beginner forex traders is simple yet misleading: how many pips should be targeted per day? At first glance, this sounds like a logical goal. After all, pips are the basic unit of price movement in the foreign exchange market. However, focusing on a fixed daily pip target often leads traders in the wrong direction.

In this article, I will explain why targeting a specific number of pips per day is unrealistic, how professional traders actually approach performance, and what traders should focus on instead if they want long-term consistency in the forex market.

Key Talking Points About Daily Pip Targets

Many traders enter the market believing that collecting a fixed number of pips each day is the path to success. In reality, professional trading works very differently. There are three important principles every forex trader must understand:

First, targeting a fixed number of pips per day is unrealistic because the market does not move in a consistent or predictable way.

Second, professional forex traders focus on executing a proven trading strategy rather than chasing pip numbers.

Third, consistent returns are achieved over time through disciplined risk management and appropriate use of leverage.

Understanding these points early can prevent many costly mistakes.

Why Targeting a Fixed Number of Pips Per Day Is Unrealistic

It is not uncommon for forex traders to approach the market with the goal of collecting “X pips per day.” Some even build strategies specifically designed to stop trading once a daily pip target is reached. Unfortunately, this mindset introduces several serious problems.

The foreign exchange market is dynamic. Volatility, liquidity, macroeconomic releases, central bank decisions, and institutional order flow all influence price movement. Because of this, daily pip opportunities vary significantly from one session to another. Trying to force the market to deliver a fixed number of pips every day often results in overtrading and emotional decision-making.

Rather than asking how many pips per day should I make?, traders should be asking am I trading under the right market conditions for my strategy?

How Many Pips Do Professional Forex Traders Make?

Professional traders do not trade with a specific daily pip target in mind. This is a crucial distinction between retail traders and experienced market participants.

Markets do not offer the same opportunities every day. As a result, professional traders allow the market to determine how many pips are available, not the other way around. Performance varies depending on:

- The trading strategy being used

- Market volatility and structure

- Time horizon and session traded

- Individual risk parameters and account size

For example, scalping strategies typically aim for smaller pip gains but execute many trades throughout the day. On the other hand, swing traders and position traders may capture larger pip movements, but over longer time frames and fewer trades. Each approach has different expectations, but none rely on a fixed daily pip quota.

Understanding how pips function within different trading styles is far more important than chasing a daily number.

The Hidden Risk of Daily Pip Targets

One of the biggest dangers of setting a daily pip goal is that it encourages traders to behave irrationally. Traders must accept that not every trade will be profitable. Losses are part of the business.

A fixed pip target often causes traders to trade more aggressively when conditions are poor and less when conditions are ideal—which is the exact opposite of disciplined trading.

Consider this scenario: a trader reaches their daily pip target early in the session and stops trading. Later, optimal market conditions appear, but the trader avoids high-quality setups because the “goal” has already been met. Over time, this habit limits the strategy’s true potential.

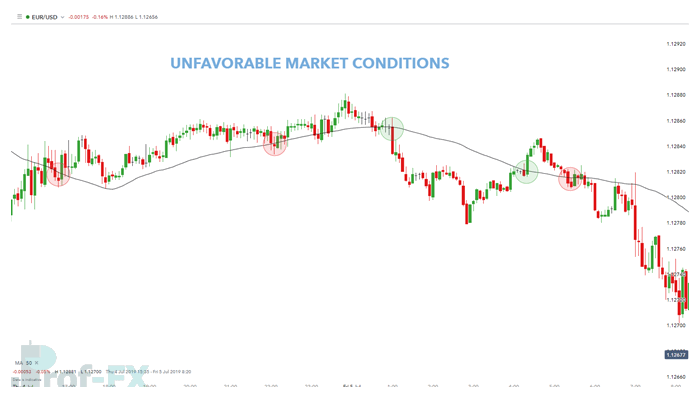

Example of Forgone Returns in Unfavorable Market Conditions

To illustrate this concept, consider the following EUR/USD example using a moving average crossover strategy. The trader targets 20 pips per trade.

When price crosses above the moving average, a buy position is opened. When price crosses below, a sell position is initiated. In unfavorable market conditions, price frequently whipsaws around the moving average, producing false signals.

The red circles represent losing trades caused by poor market conditions, while the green circles show successful trades where price moved cleanly in the intended direction. This example demonstrates how targeting a fixed pip amount during unfavorable conditions often leads to frustration, revenge trading, and unnecessary losses.

Example: EUR/USD unfavorable market conditions

What Traders Should Focus on Instead of Pips

Rather than obsessing over pip totals, traders should focus on what they can actually control. In trading, this means flawless execution of a well-defined strategy.

Once a strategy has been tested and validated, the trader’s primary responsibility is to follow it consistently—without emotion, hesitation, or overconfidence. Successful traders do not increase position sizes impulsively after wins, nor do they avoid valid setups after losses.

This mindset helps traders avoid one of the most destructive behaviors in trading: revenge trading. When traders fall behind a daily pip goal, they often overtrade in an attempt to “make it back.” This typically results in even larger losses and psychological fatigue.

Confidence in a strategy means understanding that individual wins or losses are irrelevant. What matters is long-term expectancy.

Pips Versus Long-Term Profitability

Chasing a specific number of pips per day may sound appealing, but it is not a sustainable trading objective. Market conditions change constantly, pushing strategies in and out of their optimal environments without warning.

The most effective goals in forex trading are process-oriented, not outcome-oriented. Traders should focus on:

- Proper risk management

- Consistent strategy execution

- Maintaining discipline during drawdowns

- Trading only during suitable market conditions

For those still developing their skills, starting with a risk-free demo account using real-time pricing data is highly recommended. This allows traders to refine execution without emotional pressure.

If you want deeper insights into market structure, major currency pairs like EUR/USD, GBP/USD, and USD/JPY, and macroeconomic drivers such as central bank policy and inflation data, professional trading guides can provide valuable long-term education.