Why Integrating Fundamental and Technical Analysis Creates a More Complete Trading Strategy

Fundamental and technical analysis are often compared as if they were competing approaches, but in practice, the strongest trading decisions frequently come from combining the two. Each method offers unique insights: fundamentals explain why price moves, while technicals help identify where and when to act.

Although there is no definitive evidence that one style is superior, blending both approaches can help traders make more structured, confident, and higher-probability trade decisions.

This article explains practical ways to merge fundamental and technical analysis using real market examples.

Practical Methods to Combine Fundamental and Technical Analysis

There are several effective ways to bring both analytical styles together. Below are three commonly used combinations that help traders gain deeper insights:

- Integrating range-bound trading with fundamental analysis

- Integrating breakout strategies with fundamental analysis

- Using oscillators alongside fundamental indicators

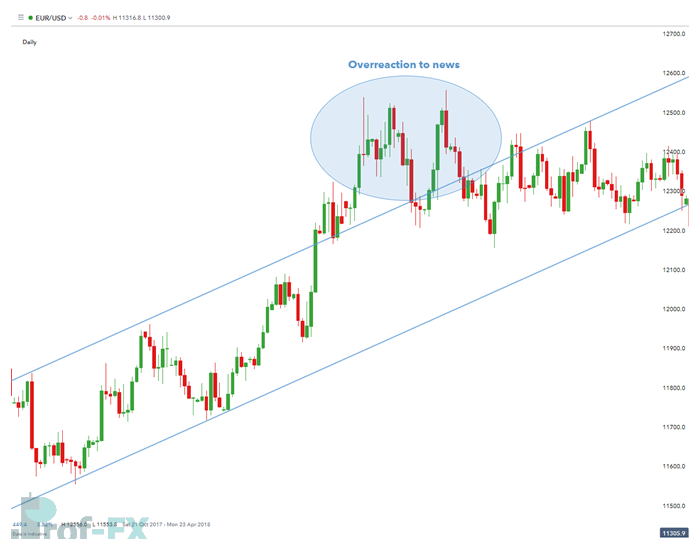

Using Range-Bound Trading Strategies Together With Fundamental Analysis

Range-bound trading focuses on identifying a clear price channel, allowing traders to buy near support and sell near resistance. This approach becomes particularly attractive in trending markets—such as the strong bullish trend seen in EUR/USD—where traders aim to enter at the lowest possible pullback to maximize upside potential.

However, even the most well-defined ranges can be disrupted by fundamental events. Economic releases such as retail sales, durable goods orders, or other US macroeconomic indicators can introduce sudden volatility.

In the chart example, these data points briefly disrupt the existing EUR/USD range before price eventually returns to its prior channel.

Traders using a range-bound strategy should be cautious about holding open positions during major news events, as volatility can temporarily invalidate technical setups.

Breakout Trading Enhanced by Fundamental Analysis

A breakout strategy aims to capture price movement as it pushes beyond a clearly defined range. These breakouts are frequently triggered by news events or unexpected shifts in macroeconomic sentiment.

While range traders may avoid trading during high-impact news due to increased volatility, breakout traders can use this volatility to their advantage. Strong data surprises—whether positive or negative—can:

- Push price forcefully through support or resistance

- Trigger pending buy-stop or sell-stop orders

- Accelerate momentum toward a profit target

Traders can wait for key data releases to push price into support or resistance, then execute trades based on how the market reacts. For example, a sharp deviation in employment data, inflation figures, or central bank commentary can generate breakout opportunities aligned with the broader trend.

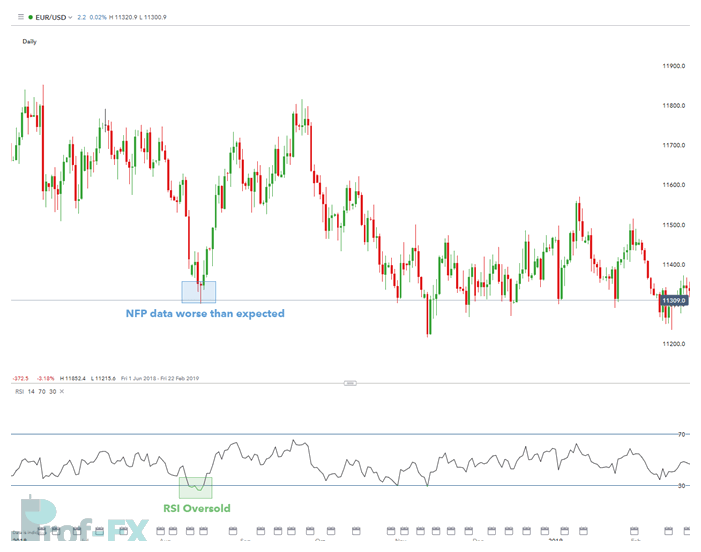

Using Oscillators Together With Major Fundamental Indicators

Oscillators are widely used to identify short-term overbought or oversold conditions. When combined with major fundamental catalysts, they become even more powerful.

Consider the example involving the RSI indicator during a Non-Farm Payrolls (NFP) release—one of the most influential economic reports affecting the USD.

A weaker-than-expected NFP number led to USD weakness and a strong bullish reaction in EUR/USD. When traders anticipate such an outcome—based on prior data trends or macroeconomic conditions—they can prepare for heightened volatility.

Here’s how oscillators enhance this setup:

- RSI oversold readings can signal early buying opportunities before a fundamental release

- RSI overbought readings can warn traders to manage risk or scale out of trades

- Oscillators improve timing for entries and exits around volatile events

This balanced approach helps traders react more precisely to major macroeconomic news while maintaining technical discipline.

Summary: Why Combining Both Approaches Strengthens Your Trading

Technical analysis offers clear chart-based signals for timing trades, while fundamentals explain the broader market direction. When used together, they form a robust analytical framework.

Benefits of Using Both Fundamental and Technical Analysis

| Fundamental Analysis | Technical Analysis |

| Determines market value (undervalued/overvalued) | Helps refine entry & exit timing |

| Builds strong understanding of economic drivers | Works across most trading instruments |

| Suitable for medium- to long-term positioning | Ideal for short-term and intraday trading |

| Requires deep research | Reflects all current market information |

Experimenting with both analytical styles helps traders discover the right balance based on personality, risk tolerance, and preferred timeframes. Before applying strategies in live markets, it is wise to test them in a demo account.

Improving Your Trading Skills Further

- Fundamental traders focus on economic releases and often aim to trade the news. Because volatility can spike instantly after major announcements, risk management is essential. Watching a dedicated webinar on risk management can help refine this skill set.

- Technical traders have a variety of methods, including different styles and strategies. Explore multiple chart patterns, indicators, and timeframes to determine which approach best fits your temperament.

- New traders can start with the basics using a structured beginner’s guide like the Forex Beginners resource to build foundational knowledge before advancing to combined analytical methods.