Central bank intervention is one of the most powerful – and often misunderstood – forces in the foreign exchange market. When a central bank steps into the FX market, price movements can be sudden, aggressive, and highly volatile. For forex traders, understanding why and how central banks intervene is essential for managing risk and identifying potential trading opportunities.

This article explains what foreign exchange intervention is, why central banks use it, how different intervention methods work, and what traders should consider before trading around these events.

Foreign Exchange Interventions by Central Banks: Key Points

Central banks may intervene in the forex market to protect the value of their national currency or to realign exchange rates with economic objectives. Intervention can take the form of direct buying or selling of foreign exchange reserves, or it can be as subtle as public statements suggesting that a currency is overvalued or undervalued.

In many cases, central banks rely on the market itself to react once such signals are given. Understanding these dynamics allows traders to better anticipate unusual price behavior and volatility.

What Is Foreign Exchange Intervention?

Foreign exchange intervention occurs when a central bank buys or sells foreign currency with the intention of influencing the exchange rate. The goal may be to stabilize excessive volatility, correct misalignments, or support broader economic objectives.

Often, this intervention is accompanied by an adjustment to the domestic money supply to prevent unwanted side effects such as excessive inflation or tightening of liquidity. When the central bank offsets the liquidity impact of intervention, the process is known as sterilized intervention, which will be explained in more detail later.

How Forex Traders Can Trade Central Bank Intervention

Trading around central bank intervention requires caution. When central banks enter the market, price action can become extremely volatile, spreads may widen, and liquidity can temporarily disappear.

For this reason, traders must:

- Use conservative position sizing

- Set realistic risk-to-reward ratios

- Avoid overleveraging

Central banks typically intervene when the prevailing market trend is moving against their desired exchange rate level. As a result, trading intervention often resembles reversal trading, rather than trend-following.

It is also important to understand that the forex market frequently anticipates intervention. Traders may observe price movements against the dominant trend in the moments or days leading up to official action. However, there is no guarantee that the new trend will emerge cleanly or immediately after intervention.

Why Do Central Banks Intervene in the Forex Market?

Central banks generally intervene to support economic stability or protect national competitiveness. One common reason is to prevent excessive currency appreciation.

When a local currency strengthens too much, exports become more expensive for foreign buyers, which can hurt domestic growth. In such cases, central banks may sell the local currency and buy foreign currency to weaken the exchange rate and support exporters.

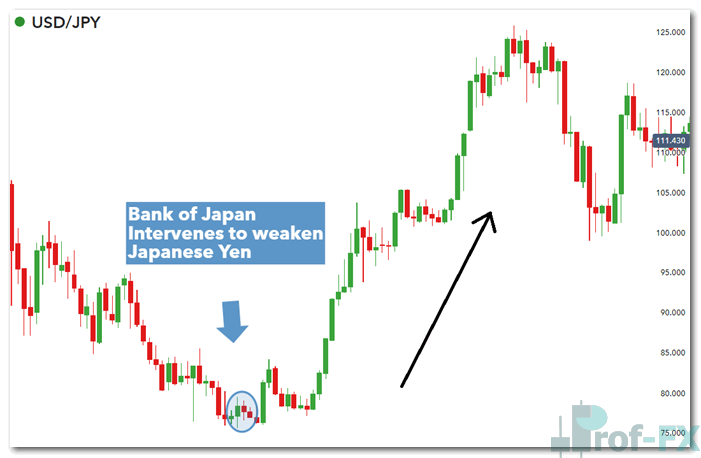

Example: Bank of Japan Intervention

A clear example of successful intervention occurred when the Japanese yen strengthened rapidly against the US dollar. The Bank of Japan judged the exchange rate to be unfavorable and intervened aggressively to weaken the yen. As a result, the USD/JPY pair moved sharply higher shortly after the intervention period.

When Central Bank Intervention Fails

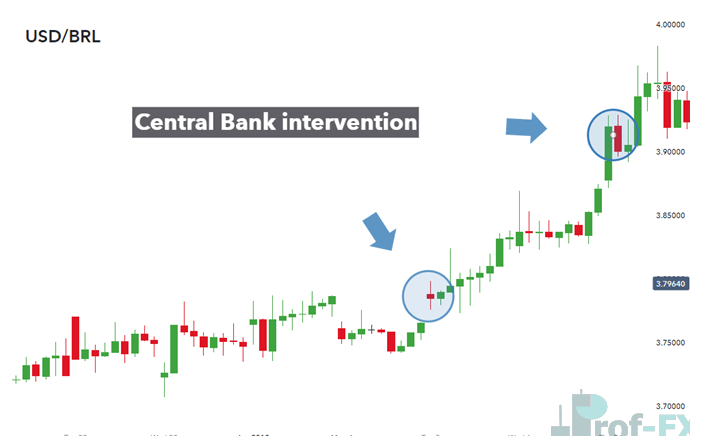

Although central bank intervention is often effective, it does not always succeed—especially when it runs counter to strong macroeconomic forces.

An example can be seen in USD/BRL, where the Brazilian central bank attempted multiple interventions to support the Brazilian real. Despite these efforts, the US dollar continued to strengthen as broader market forces dominated, highlighting the limitations of intervention when fundamentals are misaligned.

This demonstrates an important lesson for traders: intervention works best when aligned with underlying economic conditions, and may fail when it is not.

How Does Currency Intervention Work?

Central banks can choose between direct and indirect intervention methods, depending on urgency and market conditions.

| Type of Intervention | Direct or Indirect |

| Jawboning | Indirect |

| Operational Intervention | Direct |

| Concerted Intervention | Direct & Indirect |

| Sterilized Intervention | Direct |

Operational Intervention (Direct Intervention)

Operational intervention is what most traders think of as classic central bank intervention. It involves the outright buying or selling of foreign and domestic currencies in large volumes.

These transactions move the market primarily through their size and immediacy, often overwhelming short-term supply and demand.

Jawboning: Indirect FX Intervention

Jawboning is a form of verbal intervention. Central banks may publicly state that a currency is overvalued or suggest they are prepared to intervene if certain levels are reached.

Although no actual transactions occur, this method can be surprisingly effective. Once the market believes a central bank is willing to act, traders often adjust positions proactively, driving the exchange rate back toward levels deemed acceptable.

Concerted Intervention: Strength in Coordination

Concerted intervention combines communication and action, often involving multiple central banks. This method is particularly effective when exchange rate imbalances affect more than one economy.

When several central banks express shared concerns—and at least one follows through with operational intervention – the credibility and impact of the action increase significantly.

Sterilized Intervention Explained

Sterilized intervention is a more sophisticated approach that allows a central bank to influence the exchange rate without altering the domestic money supply.

This process involves two simultaneous actions:

- Buying or selling foreign currency in the FX market

- Conducting open market operations of equal size (buying or selling government securities)

By neutralizing the liquidity impact, the central bank can target the exchange rate while maintaining control over inflation and interest rates.

Historical Examples of Central Bank Intervention in Forex

To better understand how powerful central bank intervention can be, it is useful to examine real-world historical cases. These examples demonstrate both the effectiveness and risks of intervention, as well as the importance of coordination and credibility in influencing currency markets.

Swiss National Bank (SNB) Intervention – 2015

Background: EUR/CHF Peg Policy

One of the most dramatic examples of central bank intervention occurred in January 2015, when the Swiss National Bank (SNB) abandoned its long-standing currency peg.

Following the European sovereign debt crisis, the Swiss franc became a safe-haven currency. Heavy capital inflows caused the CHF to appreciate rapidly, threatening Switzerland’s export-driven economy. In response, the SNB introduced a minimum exchange rate of 1.20 in EUR/CHF, committing to unlimited intervention to defend this level.

The Shock Event and Market Impact

On January 15, 2015, the SNB unexpectedly removed the peg without warning. Within minutes, the Swiss franc appreciated by more than 30%, triggering extreme volatility across the forex market.

Liquidity vanished, spreads widened dramatically, and several brokers and hedge funds suffered catastrophic losses. This event highlighted a critical lesson for traders: central bank credibility matters—until policy abruptly changes.

Key Takeaway for Traders

The SNB event demonstrates that even the most credible intervention policies can be reversed. For forex traders, this underscores the importance of managing leverage and understanding that central bank support is not guaranteed indefinitely.

The Plaza Accord – Coordinated Global Intervention

What Was the Plaza Accord?

The Plaza Accord, signed in 1985, is one of the most famous examples of concerted central bank intervention. The agreement involved the United States, Japan, Germany, France, and the United Kingdom.

At the time, the US dollar had appreciated significantly, creating large trade imbalances and economic strain on US exports. Policymakers agreed that coordinated intervention was necessary to weaken the dollar in an orderly manner.

How the Intervention Worked

Central banks jointly sold US dollars and bought other major currencies in the open market. This coordinated effort sent a powerful signal to global investors and successfully reversed the dollar’s long-term uptrend.

Over the following years, the US dollar depreciated substantially against the Japanese yen and German Deutsche Mark.

Why the Plaza Accord Still Matters

The Plaza Accord illustrates how multi-central bank coordination can significantly amplify the effectiveness of intervention. It remains a benchmark case for understanding how policy alignment across nations can reshape long-term forex trends.

Bank of Japan and Federal Reserve Coordination

Managing Yen Strength Through Policy Alignment

Another important example involves periods of implicit and explicit coordination between the Bank of Japan (BoJ) and the Federal Reserve. Historically, sharp yen appreciation has posed challenges for Japan’s export-dependent economy.

During times of global stress or financial instability, coordinated messaging and aligned policy actions between the BoJ and Fed have helped stabilize USD/JPY.

Impact on USD/JPY and Market Expectations

When the Federal Reserve tightens policy while the Bank of Japan maintains accommodative or ultra-loose monetary conditions, the resulting interest rate differential naturally weakens the yen. In some cases, this divergence is reinforced by verbal intervention or direct market action by Japanese authorities.

This coordination has often reduced the need for aggressive unilateral intervention, as policy alignment alone can influence capital flows.

Lesson for Forex Traders

For traders, this example highlights the importance of relative monetary policy, not just isolated decisions. Currency pairs respond to the interaction between two central banks, making policy divergence a key driver of long-term trends.

What These Historical Interventions Teach Forex Traders

Across all these examples, a few consistent themes emerge:

- Central bank intervention can be extremely powerful—but not infallible

- Credibility and communication are just as important as actual market action

- Coordinated intervention is typically more effective than unilateral efforts

- Traders must respect intervention risk, especially when leverage is involved

Understanding these historical cases allows traders to better contextualize modern intervention threats and policy signals.

Key Takeaways for Forex Traders

Central bank intervention represents one of the strongest non-technical forces in the forex market. While it can create trading opportunities, it also introduces heightened risk.

Successful traders focus on:

- Understanding the motivation behind intervention

- Aligning intervention analysis with macroeconomic fundamentals

- Applying strict risk management during high-volatility periods

Monitoring major institutions such as the Federal Reserve, European Central Bank, Bank of England, Swiss National Bank, and Bank of Japan is essential for traders who want to anticipate potential intervention events.