Using margin in forex trading is a new concept for many traders – and one that is often misunderstood. Put simply, margin is the minimum amount of capital required to open a leveraged position. When used correctly, margin can be a useful risk management and capital efficiency tool. When misunderstood, however, it can become extremely costly.

Closely related to margin is the concept of a margin call, an outcome every trader works hard to avoid. A lack of understanding around margin mechanics can quickly lead to forced position closures, which is why every forex trader – especially beginners—must have a solid grasp of how margin works before placing a trade.

In this guide, I will explain what forex margin is, how it relates to leverage, how to calculate margin and margin level, and how traders can manage margin risk responsibly.

What Is Forex Margin?

Forex margin is a good-faith deposit that a trader sets aside as collateral to open a leveraged trade. It represents the minimum amount of equity required in a trading account to initiate and maintain a position.

Margin is typically expressed as a percentage of the notional value (total trade size). The portion of the trade not covered by margin is effectively borrowed from the broker, allowing the trader to control a larger position with less capital.

Importantly, margin is not a transaction cost or fee. It is a portion of your own account equity that is temporarily allocated while the position remains open.

FX Margin Example

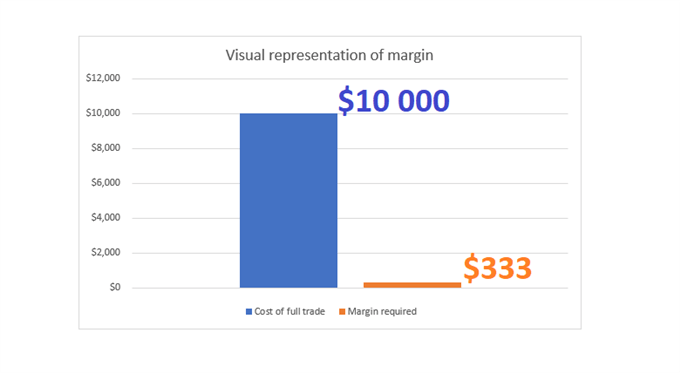

Below is a simplified illustration of how margin relates to total trade size:

- Trade size: $10,000

- Margin requirement:33%

In this case, the trader needs to allocate $333 as margin to control a $10,000 position. The remaining exposure is provided through leverage.

The Relationship Between Margin and Leverage

To fully understand margin, traders must also understand leverage. These two concepts are directly connected.

- Higher margin requirement = lower leverage

- Lower margin requirement = higher leverage

This is because a higher margin requirement forces the trader to fund more of the trade using their own capital, reducing the amount borrowed from the broker.

Leverage can magnify both profits and losses, which is why it must be used responsibly. Leverage limits vary by broker and jurisdiction, in line with regulatory standards.

Below is a typical comparison between margin requirements and maximum leverage:

| Margin Required | Maximum Leverage |

| 50% | 2:1 |

| 3.33% | 30:1 |

| 2.00% | 50:1 |

| 0.5% | 200:1 |

Understanding Forex Margin Requirements

Forex margin requirements are set by brokers and are based on:

- The level of default risk they are willing to assume

- Regulatory constraints in their operating jurisdiction

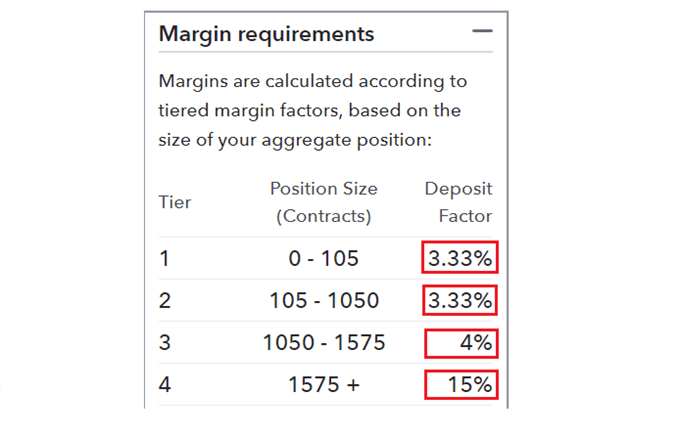

Below is an example of margin requirements for GBP/USD, often shown under a label such as Deposit Factor on a trading platform:

As trade size increases, traders may move into higher margin tiers, where the monetary margin requirement increases. In many cases, the first tiers may share the same percentage requirement, before escalating at higher exposure levels.

Brokers may also temporarily increase margin requirements during:

- Periods of high market volatility

- Ahead of major economic data releases

- During unexpected geopolitical or financial events

Margin Requirement Increases During High Market Volatility

During periods of elevated market volatility, brokers often raise margin requirements to protect both themselves and traders from rapid price swings. Volatility can cause prices to move aggressively within a short time frame, increasing the likelihood of sudden losses that exceed available account equity.

When volatility rises, stop-loss orders may experience slippage, and spreads can widen significantly. To compensate for this increased risk, brokers require traders to commit more margin per position, effectively reducing the maximum leverage available. This encourages traders to reduce position size and limits the probability of margin calls caused by sharp, unexpected price movements.

Common examples of high-volatility conditions include flash crashes, sudden risk-off market sentiment, and extreme movements following surprise central bank decisions.

Increased Margin Requirements Ahead of Major Economic Data Releases

Brokers frequently increase margin requirements in the lead-up to high-impact economic data releases. Events such as Non-Farm Payrolls (NFP), inflation (CPI) reports, GDP data, and central bank interest rate decisions can cause explosive market reactions within seconds of release.

Liquidity often thins just before major announcements as market makers pull orders to manage risk. This reduction in liquidity increases the chance of sharp price gaps and slippage. By increasing margin requirements ahead of time, brokers reduce the risk of traders becoming over-leveraged during these unpredictable moments.

Traders who are not specifically trading news events should be cautious during these periods and consider reducing exposure or waiting until market conditions stabilize and margin requirements return to normal levels.

Temporary Margin Adjustments During Geopolitical and Financial Shock Events

Unexpected geopolitical or financial shock events can prompt brokers to implement immediate and sometimes substantial margin increases. Events such as geopolitical conflicts, sanctions, sovereign debt crises, banking system instability, or emergency policy interventions can disrupt normal market functioning.

During such events, markets may experience extreme price gaps, reduced liquidity, and disorderly trading conditions. Brokers respond by increasing margin requirements to limit exposure to rapid, unhedgeable losses that could otherwise result in negative account balances.

For traders, this highlights the importance of maintaining sufficient free margin at all times. Accounts that are already heavily leveraged are most vulnerable when sudden margin changes occur, often leading to forced position closures even without large adverse price movements.

Margin Is Not a Fee

A common misconception among new traders is that margin is a cost. This is incorrect.

Margin is:

- Not deducted

- Not paid to the broker

- Returned to free margin once positions are closed

It is simply capital that is set aside to keep positions open.

Forex Margin Level: Avoiding Margin Calls

After understanding margin requirements, traders must ensure their account remains sufficiently funded to avoid a margin call. One of the most important metrics to monitor is the forex margin level:

Forex Margin Level = (Equity ÷ Used Margin) × 100

Example:

- Account equity: $10,000

- Used margin: $8,000

Margin level = (10,000 ÷ 8,000) × 100 = 125%

A margin level above 100% generally allows normal trading activity. If the margin level falls below 100%, most brokers will:

- Restrict opening new positions

- Issue a margin call

If the margin level falls further, brokers may begin liquidating open positions to protect against negative account balances.

Understanding a broker’s margin close-out rule is essential to avoid forced liquidation.

Key Forex Margin Terminology

To trade confidently with margin, traders should be familiar with the following terms:

- Equity: Account balance adjusted for open profits and losses

- Margin Requirement: The deposit needed to open a leveraged trade

- Used Margin: Equity allocated to maintain open positions

- Free Margin: Equity available for new trades

- Margin Call: Triggered when equity falls below broker-defined limits

- Margin Level: A percentage indicating account health

- Leverage: A tool allowing increased market exposure using borrowed funds

What Is Free Margin in Forex?

Free margin is the portion of equity not currently tied up in open positions. It represents the capital available to open new trades or absorb losses.

Example:

- Equity: $10,000

- Margin used: $8,000

Free margin = $10,000 − $8,000 = $2,000

Maintaining healthy free margin is crucial for avoiding margin calls and ensuring flexibility during volatile market conditions.

Managing the Risks of Margin Trading

Margin trading requires discipline and planning. Traders should always:

- Understand how to calculate margin requirements per position

- Recognize how increasing margin requirements reduce available leverage

- Monitor major economic releases using an economic calendar

- Keep a large portion of equity as free margin

Professional traders consistently aim to preserve free margin so they can:

- Withstand short-term drawdowns

- Avoid forced liquidation

- Act quickly when high-probability setups appear

Managing the Risks of Margin Trading

Margin trading can significantly amplify both profits and losses, which makes risk management a non-negotiable component of long-term trading success. Traders who use margin effectively focus less on maximizing leverage and more on preserving capital, flexibility, and emotional control.

Below are the key risk management principles every margin trader should follow.

Understand How to Calculate Margin Requirements Per Position

A fundamental skill for margin traders is the ability to calculate margin requirements before entering a trade. This ensures that the account is sufficiently funded and prevents unexpected margin calls.

Margin requirements depend on:

- Trade size (lot size or notional value)

- Margin percentage set by the broker

- Instrument being traded

- Market conditions at the time of execution

By calculating margin manually, traders gain full awareness of how much equity will be locked as used margin and how much free margin will remain available. This prevents overexposure and allows traders to adjust position sizes proactively rather than reactively.

Recognize How Higher Margin Requirements Reduce Available Leverage

Margin and leverage are inversely related. When brokers increase margin requirements, the effective leverage available to traders is automatically reduced.

For example:

- A 3.33% margin requirement allows up to 30:1 leverage

- A 10% margin requirement reduces leverage to 10:1

Failing to recognize this relationship can lead to unintended over-leveraging. Traders may open positions assuming previous leverage limits still apply, only to find that less free margin is available than expected. Professional traders adapt position sizing immediately when margin conditions change.

Monitor Major Economic Releases Using an Economic Calendar

Economic data releases are one of the primary triggers for sudden volatility and margin requirement changes. Traders should regularly consult an economic calendar to stay informed about upcoming high-impact events.

Key releases to monitor include:

- Central bank interest rate decisions

- Inflation data (CPI, PCE)

- Employment reports (NFP, unemployment rate)

- GDP releases

- Emergency policy announcements

By being aware of these events, traders can reduce position sizes, close trades in advance, or avoid opening new positions during periods of heightened uncertainty.

Maintain a Large Portion of Equity as Free Margin

Free margin acts as a safety buffer in margin trading. It allows traders to absorb temporary adverse price movements without triggering margin calls or forced liquidation.

A well-funded account with ample free margin provides:

- Greater resilience during drawdowns

- Lower emotional stress

- Flexibility to manage trades strategically

Professional traders rarely operate with tight margin levels. Instead, they intentionally leave a large portion of their equity unused, prioritizing account longevity over short-term gains.

Preserve Free Margin to Withstand Short-Term Drawdowns

Even high-probability trades can experience temporary losses before moving in the intended direction. Adequate free margin ensures that traders can remain in valid trades without being forced out by minor market fluctuations.

Short-term drawdowns are a natural part of trading. Accounts with insufficient free margin often fail not because the trade idea was wrong, but because the trader lacked the capital buffer to stay in the position.

Avoid Forced Liquidation Through Proactive Margin Management

Forced liquidation occurs when account equity falls below the broker’s required margin level. This typically results in automatic position closures at unfavorable prices.

Traders can avoid this by:

- Using conservative position sizing

- Avoiding excessive leverage

- Monitoring margin levels continuously

- Closing losing trades early when conditions invalidate the setup

Proactive margin management keeps control in the trader’s hands rather than the broker’s system.

Maintain Flexibility to Act on High-Probability Trade Setups

One of the most overlooked advantages of preserving free margin is the ability to act quickly when high-probability opportunities arise.

Markets often present the best setups during volatile conditions when poorly managed accounts are already margin-restricted. Traders with available free margin can enter these opportunities confidently without the need to close existing positions under pressure.

Professional traders treat free margin as strategic capital — not idle cash.

Final Thoughts for Beginner Forex Traders

Margin is neither good nor bad—it is a tool. Used responsibly, it allows traders to participate efficiently in global currency markets. Used carelessly, it can quickly lead to account failure.

The key to long-term success is not maximizing leverage, but managing risk, understanding broker policies, and maintaining sufficient free margin at all times.

Helpful Resources to Advance Your Forex Trading

- Start with the forex in our Forex Courses

- Learn how to avoid common mistakes in our New to Forex Trading Guide

- Use stop-loss orders, including guaranteed stops where available, to manage downside risk

- Always review a broker’s margin policy before trading

A strong understanding of margin is a cornerstone of professional forex trading. Master it early, and it will serve you throughout your trading journey.