Market movements are inherently unpredictable. Even the most carefully planned trade can move against you due to unexpected economic data, central bank decisions, or sudden shifts in market sentiment. This is why stop loss orders are one of the most essential risk management tools available to forex traders.

In this article, I will walk you through what a stop loss is, why it plays a critical role in long-term trading success, and how traders can apply different stop loss strategies—from static stops to trailing stops—in a practical and professional way. The explanation is designed to be clear and accessible, especially for traders who are still building their foundation in forex trading.

What Is a Stop Loss in Forex Trading?

A forex stop loss is a function provided by brokers that allows traders to limit potential losses when the market moves against an open position. This is done by setting a predefined stop loss level at a specific number of pips away from the trade’s entry price.

Once price reaches that level, the position is automatically closed. Stop loss orders can be applied to both long and short trades, making them a universal risk control tool regardless of your trading strategy or market bias.

In simple terms, a stop loss defines how much you are willing to lose on a single trade before entering the market. Without it, losses can quickly spiral beyond what most traders can emotionally or financially tolerate.

Why Stop Loss Orders Are Essential for Forex Traders

The importance of stop loss orders can be summarized in one fundamental truth: no trader can predict the future with certainty.

Even when a setup looks perfect—supported by technical analysis, fundamental data, and strong market momentum—future currency price movements remain unknown. Every trade carries risk, and stop loss orders exist to control that risk before it controls you.

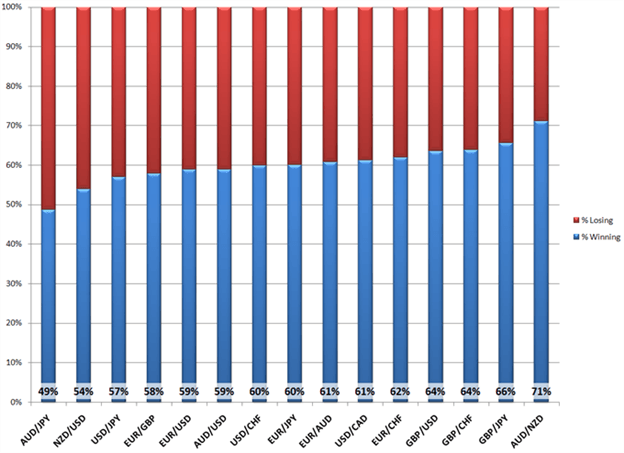

Research highlighted in Prof FX Traits of Successful Traders revealed an interesting insight:

many traders actually win more than half of their trades, especially in major currency pairs.

However, despite having a decent win rate, many of these traders still lost money overall. The reason was not poor entries—it was poor money management.

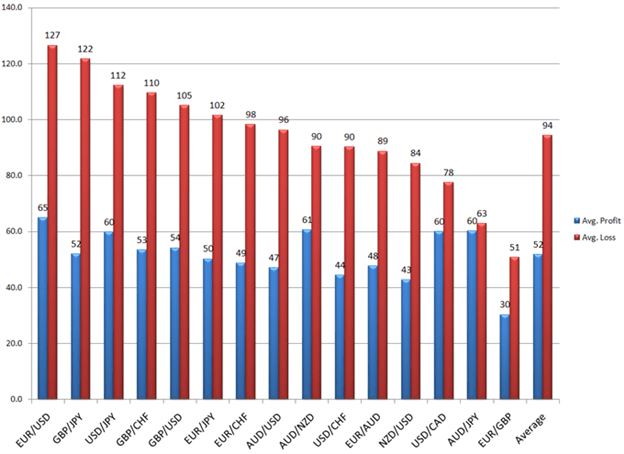

When traders were wrong, their losses (shown in red) were significantly larger than the profits they made when they were right (shown in blue).

This imbalance creates a negative expectancy. Even with a solid strategy, poor stop loss placement can undermine long-term profitability.

As explained by David Rodriguez in Why Do Many Traders Lose Money, traders can begin addressing this issue by ensuring that their profit target is at least equal to the stop loss distance.

For example, if a trader uses a 50-pip stop loss, the minimum profit target should also be 50 pips.

By maintaining a 1:1 risk-to-reward ratio, a trader who wins just over 50% of their trades—such as 51%—can already begin generating consistent net profits. This principle alone represents a major step forward for most retail forex traders.

Forex Stop Loss Strategies Every Trader Should Understand

Below are five widely used stop loss strategies that traders can apply depending on their trading style, time horizon, and level of experience.

1. Setting Static Stop Loss Orders

A static stop loss is placed at a fixed price level and remains unchanged until either the stop loss or the profit target is reached. This approach is popular among traders because of its simplicity and structure.

Static stops help traders clearly define risk before entering a trade and make it easier to maintain a consistent risk-to-reward ratio, such as one-to-one or one-to-two.

Practical Example

Consider a swing trader based in California who opens trades during the Asian session, expecting increased volatility during the European or US sessions.

To balance flexibility and capital protection, the trader decides to use a static stop loss of 50 pips on every trade. Each position also includes a profit target of at least 50 pips, maintaining a minimum 1:1 risk-to-reward ratio.

If the trader prefers a 1:2 risk-to-reward ratio, they simply keep the stop loss at 50 pips and set the profit target at 100 pips. This consistency helps eliminate emotional decision-making during live market conditions.

2. Using Static Stops Based on Technical Indicators

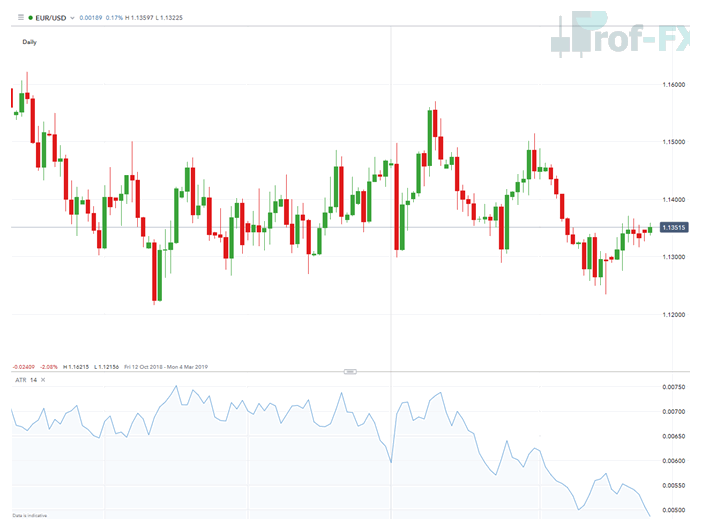

Some traders refine static stop placement by using technical indicators such as Average True Range (ATR), pivot points, or recent price swings.

The advantage of this approach is that the stop loss is based on actual market volatility, rather than an arbitrary number of pips.

A 50-pip stop can mean very different things depending on market conditions:

- In a quiet market, 50 pips may represent a significant move

- In a volatile market, the same 50 pips could be relatively small

By using Average True Range, traders can adapt their stop loss distance to recent price behavior, improving accuracy in risk management.

Average True Range helps traders align stop placement with current volatility

This concept is explained in more detail in professional risk management discussions such as Managing Risk with ATR (Average True Range).

3. Manual Trailing Stop Loss Orders

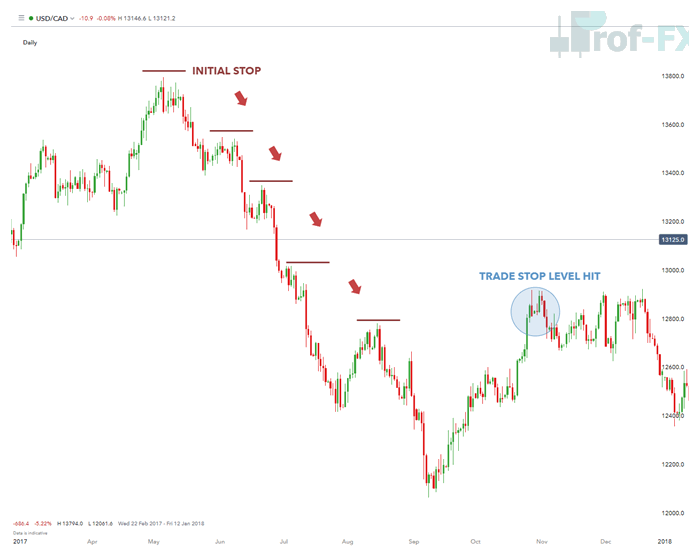

For traders who want maximum control, stop losses can be adjusted manually as the trade moves in their favor.

In this approach, the trader actively moves the stop loss to lock in profits while allowing the trade room to develop. This method is often used in trending markets.

The example below illustrates a short position where the trader moves the stop loss lower as price continues to make lower highs. When the trend eventually reverses, the trade is closed by the adjusted stop.

Manually trailing stops using lower swing highs in a downtrend

This technique is explored further in strategies such as Trading Trends by Trailing Stops with Price Swings and is especially useful for experienced traders who closely monitor market structure.

4. Using Trailing Stop Loss Orders

Trailing stops are dynamic stop loss orders that automatically adjust as the trade moves in the trader’s favor. In some jurisdictions, brokers provide this feature directly within the trading platform.

Trailing stops help traders reduce downside risk while allowing profits to run.

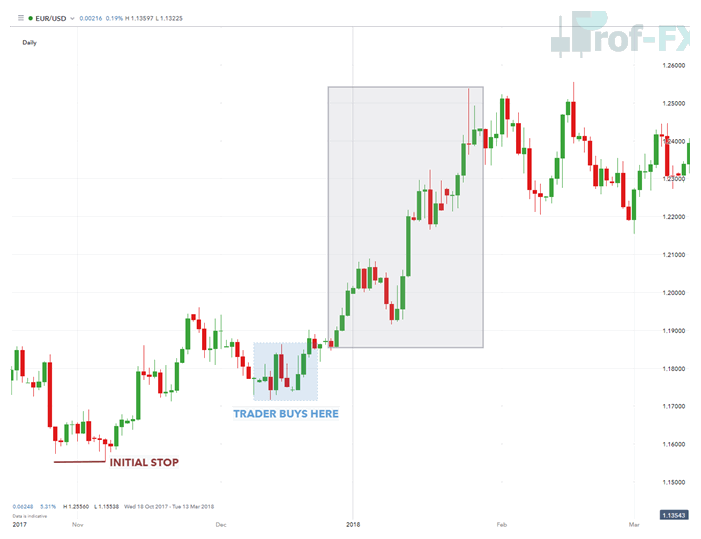

Example

Suppose a trader opens a long EUR/USD position at 1.1720 with an initial stop loss at 1.1553 (167 pips). If price moves favorably, the trader may adjust the stop loss up to the entry level at 1.1720.

This creates a break-even stop, meaning the trader has eliminated the initial risk from the trade. If EUR/USD reverses, the position will close without a loss.

Break-even stops allow traders to remove initial risk from open positions

Once risk is removed, the trader can either redeploy that risk into another opportunity or simply allow the protected position to continue running.

5. Fixed Trailing Stop Loss Strategy

A fixed trailing stop moves incrementally based on a predefined pip distance.

For example, a trader buys EUR/USD at 1.3100 with an initial stop at 1.3050. The trader sets a trailing stop to adjust every 10 pips:

- At 1.3110, the stop moves to 1.3060

- At 1.3120, the stop moves to 1.3070

This process continues automatically until the stop is triggered or the trader closes the position manually.

Fixed trailing stops adjust in predefined increments

If the market reverses at this point, the trader exits at 1.3070 instead of the original 1.3050—effectively saving 20 pips through disciplined stop management.

Final Thoughts for Forex Traders

Stop loss orders are not just a defensive tool—they are a core component of professional forex trading. Whether you choose static stops, indicator-based stops, or trailing stops, the goal remains the same: protect capital, manage risk, and stay in the market long enough to let probability work in your favor.

For beginner traders especially, mastering stop loss placement is one of the most important steps toward consistency and long-term profitability.