Trendline trading is one of the most fundamental—and powerful—techniques used by technical forex traders. Trendlines can be applied to any currency pair and across all time frames, making them a versatile tool for identifying high-probability entries and exits.

In this guide, I will explain trendline trading the way I teach it to beginner traders: simple, structured, and grounded in real market behavior. While the concept is straightforward, applying trendlines correctly is what separates random lines on a chart from actionable trading levels.

Article Overview: What You’ll Learn

In this article, we will cover:

- What a trendline is and why it matters in forex trading

- How to draw valid trendlines that the market respects

- Three professional tips to improve trendline accuracy

- How to trade trendline bounces in trending markets

What Is a Trendline in Forex Trading?

A trendline is one of the most basic tools in a technical trader’s toolbox. By definition, a trendline is a straight line that connects two or more swing lows or two or more swing highs, projected forward into future price action.

Traders use trendlines to identify:

- Areas of support in uptrends

- Areas of resistance in downtrends

Ideally, traders wait for price to react around these projected lines, often looking to trade a bounce when price revisits the trendline.

The beauty of trendlines is their simplicity. They can be used alongside price action, indicators, chart patterns, and support/resistance analysis without conflict.

Tip #1: Connect Swing Lows to Swing Lows (or Swing Highs to Swing Highs)

The foundation of accurate trendline trading begins with correctly identifying swing highs and swing lows.

Swing highs and lows are simply the peaks and valleys created by zig-zagging price movement. To draw a valid trendline:

- Connect two or more swing lows for a bullish trendline

- Connect two or more swing highs for a bearish trendline

However, there is one critical rule:

Price must not break through the trendline between the connecting points.

In the first example, although two swing lows are connected, price cuts through the line between those points. This invalidates the trendline.

In the second example, price respects the line cleanly between the two swing lows. This creates a valid trendline that can now be projected into the future.

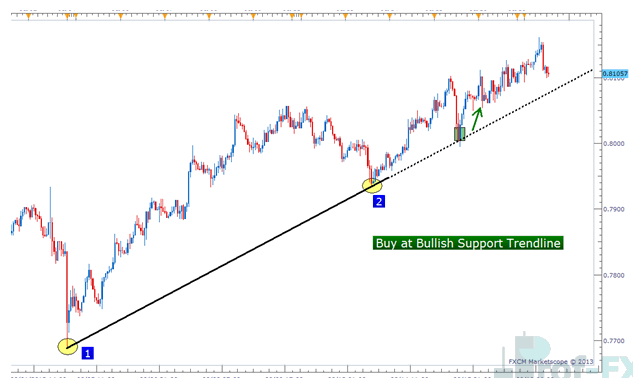

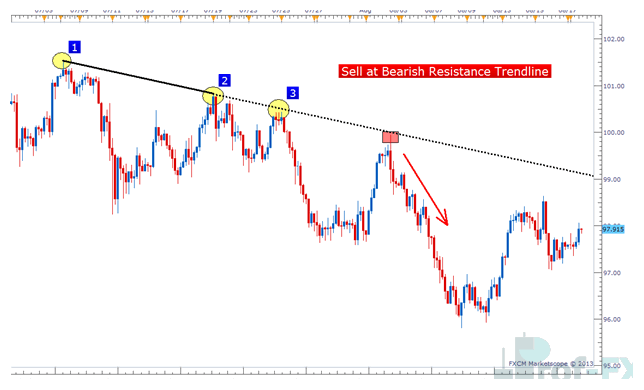

Trading Trendline Bounces with Entry Orders

Once a valid trendline is established, traders often look for bounce setups when price revisits the line.

A practical way to trade this setup is by using Entry orders:

- Place buy entries a few pips above a bullish support trendline

- Place sell entries a few pips below a bearish resistance trendline

This approach accounts for the reality that many traders watch the same levels. When orders cluster around a trendline, price may react before reaching the exact line. Placing entries slightly ahead increases the probability of participation in the move.

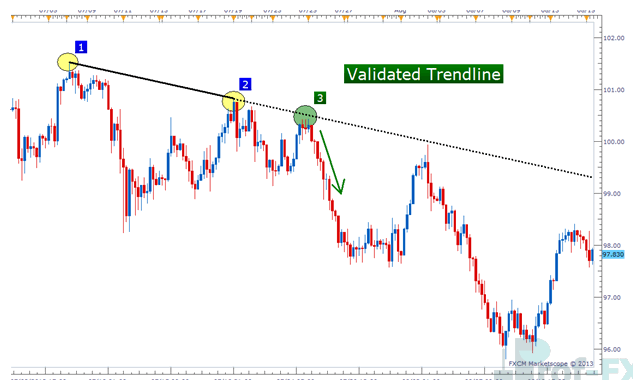

Tip #2: The More Connecting Points, the Stronger the Trendline

While a trendline can be drawn using just two points, two points only create a potential trendline.

To truly validate a trendline, traders want to see price react to it again after it has been projected forward. In practical terms, this means:

- Two points create a potential trendline

- A third touch or bounce confirms the trendline’s importance

The reason this matters is simple: you can draw a line between any two points on a chart. That does not mean the market recognizes it. When price reacts a third time, it suggests that other traders are seeing and respecting the same level.

As a general rule:

- The more times a trendline is respected

- The more significant it becomes

However, trendlines do not last forever. After multiple bounces, traders should expect a break at some point, which is why proper stop-loss placement is essential.

Tip #3: Buy Bullish Trendlines, Sell Bearish Trendlines

One of the oldest rules in trading is simple:

“The trend is your friend.”

This rule applies directly to trendline trading.

Buying Bullish Trendlines

An upward-sloping trendline indicates a bullish market. In this environment:

- Traders should only look for buying opportunities

- Buys occur when price pulls back toward the bullish support trendline

The goal is to enter at areas where price has previously bounced higher, aligning trades with the dominant trend.

Selling Bearish Trendlines

A downward-sloping trendline signals a bearish market. In this case:

- Traders should focus on selling opportunities

- Sells occur when price rallies toward bearish resistance trendlines

Trading in the direction of the trend allows traders to capitalize on momentum rather than fighting it.

By consistently buying bullish trendlines and selling bearish trendlines, traders improve the odds that winning trades deliver larger pip gains than trades taken against the trend.

Note: Trading trendline breaks instead of bounces is also possible, but this is a more advanced technique and best covered separately.

Connecting the Dots: Putting Trendline Trading Together

At its core, trendline trading is about connecting dots on a chart. But doing it correctly requires discipline and structure.

To summarize:

- Draw trendlines using two or more swing highs or swing lows

- Ensure price has not broken the line between those points

- Look for a third bounce to validate the trendline

- Trade with the trend, not against it

- Always protect trades with proper stop losses

When applied consistently, trendlines can become a reliable framework for identifying high-probability trade setups across forex markets.

Final Thoughts for Forex Traders

Trendlines are simple, but simplicity does not mean weakness. Many professional traders rely on trendlines as a core component of their technical strategy.

With practice, you will gain confidence in drawing trendlines that the market respects—and more importantly, in executing trades around them with discipline.

Identifying entries and exits is only one part of trendline trading. To strengthen your overall performance, it’s equally important to develop the psychological discipline and strategic mindset that successful traders consistently apply.

Prof FX provides forex news and technical analysis on the trends that influence the global currency markets.