The market can do only three things once you are in trade: fail, go sideways, or follow thru in the direction of the trigger.

A professional will have a modest loss on one of those circumstances, make a bit on the second, and bank on the third, for a net profit.

A novice on the other hand will lose on the first two trades, make a bit on the 3rd, for a net loss. The difference is, among other things, the pro spends a lot less time analyzing the set-up and trigger and a lot more time sitting tight in the trade, compared to the novice, who over analyzes the situation and then panics 6 minutes into the trade because he can’t take the stress of a market 12 pips against him…

The reasons so many don’t stick w/ the trade is they lack confidence in their trading method, and haven’t addressed trade management properly.

I host what we call Live Market Exercise on the London / U.S. overlap for 3 days a week for three hours a day. It’s my job to highlight trade set-ups and triggers in live markets for my clients, to demonstrate the trading methods we recommend.

When I walk to the office in the mornings I imagine getting into a trade, and staying in the trade all morning as the market follows thru for me.

My first mentor Bill Williams told me that as a trader you get paid to wait.

As an educator I know the first thing I need to do is address the client’s penchant for what I call “jack-rabbit trading”. Unless you’re a professional scalper, all that in and out virtually guarantees you losses.

Making the right decisions, and sticking w/ your method thru intra-trade draw-down’s is what trade management is all about and it’s even more important than money management.

If you have a hard time sitting thru routine draw-down’s and can’t seem to be able to allow a profit to run, it’s likely because you have not done enough manual back-testing and demo-trading to acquire a strong enough believe in your method to overcome the fear of failure and loss. It also can be that you don’t have the proper method to start.

One big tip-off is if you aren’t using “time” based triggers — signals that only occur on the close of the candle. A signal that fires mid-candle and fails, won’t show up in a back-test because the back-test can only account for closed candles.

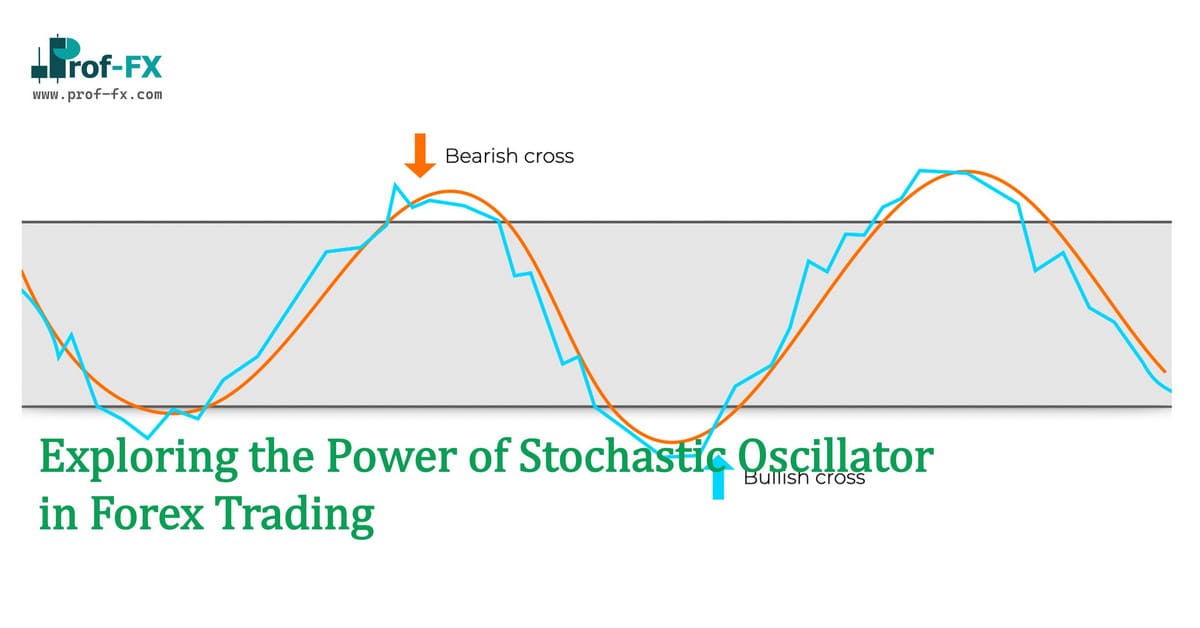

This is a problem for individuals using moving average crosses, or oscillators.

They don’t fully understand that a moving average can cross and uncross several times during the life of an individual candle, as can a stochastic or other centered oscillators, and it’s only on the candles close when it’s recorded. It’s therefore very important that you understand the difference between a fact (time) based trigger and one that is not.

Otherwise when you go back on the chart it will look like the method works great, until you demo trade it, and find out it’s flaws.

You will determine pretty quickly if a method is sound or not because on the the times you lose, it will most likley be because you muffed the management on the trade, because you still had resisual fear left over from a previous method you counted on that was flawed.

The good news there is the method works, you just mismanaged it. That’s a surface blemish…easy to correct. A bad method though, that will cut you to the bone…

-Magnus-