The Bollinger Band® reversal pattern is one of the most frequently occurring setups across forex, equities, commodities, and indices. When applied correctly, this pattern can offer traders attractive risk-to-reward opportunities, making it suitable for both beginner and experienced forex traders.

In this article, I will explain how Bollinger Band® reversal patterns work, how to identify them step by step, and how traders can execute trades with structure and discipline. The explanation is presented in a descriptive, educational style, as if guiding you through a live market presentation.

What Is a Bollinger Band® Reversal Pattern?

A Bollinger Band® reversal pattern is a momentum-based reversal signal that forms when price action shows signs of exhaustion at the outer Bollinger Bands®. These patterns are most commonly associated with:

- Bullish reversals after a downtrend

- Bearish reversals after an uptrend

Technically, this setup closely resembles classic double bottom (“W”) and double top (“M”) chart patterns. What differentiates the Bollinger Band® version is the relationship between price and volatility, measured through the bands.

Why Bollinger Band® Reversals Matter

Bollinger Bands® adapt to volatility. When price pushes outside the bands, it suggests strong momentum. However, when that momentum fails to repeat on a second attempt, it often signals that the prevailing trend is losing strength.

This loss of momentum is what creates the opportunity for a reversal trade.

Key Characteristics of Bollinger Band® Reversal Patterns

A valid Bollinger Band® reversal setup typically includes:

- A clear preceding trend (uptrend or downtrend)

- A first price extreme that breaks outside the Bollinger Band®

- A second price extreme that fails to break the band

- A structural confirmation, usually via a neckline break

This combination allows traders to avoid guessing tops and bottoms and instead wait for confirmation.

How to Identify a Bollinger Band® Reversal Pattern (Step by Step)

Below is a structured process for spotting this pattern on your chart:

Step 1: Apply the Bollinger Band® Indicator

- Use 20-period SMA

- Set 2 standard deviations

- Common timeframes: Daily or H1, though the pattern works across all timeframes

Step 2: Identify the Preceding Trend

- Use price action (higher highs / higher lows or lower highs / lower lows)

- Or confirm with trend indicators such as Moving Averages

Reversals are higher probability when they occur after a mature trend, not during consolidation.

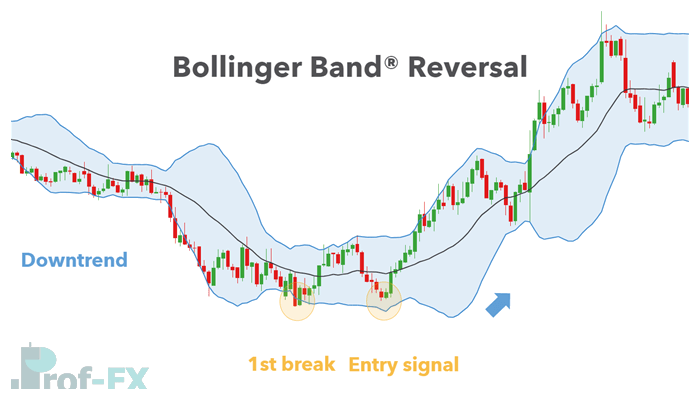

Step 3: Spot a Double Top or Double Bottom

- In an uptrend, look for a double top (M pattern)

- In a downtrend, look for a double bottom (W pattern)

Step 4: Analyze the Interaction with Bollinger Bands®

- The first top/bottom must break outside the Bollinger Band®

- The second top/bottom must fail to break the band

This failure indicates weakening momentum.

Step 5: Wait for Entry Confirmation

- Traders may enter aggressively after the second top/bottom

- Or conservatively by waiting for a neckline break, which is the traditional and higher-probability approach

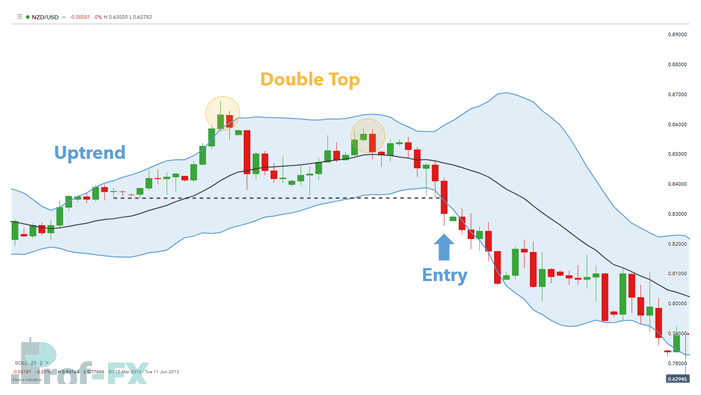

Example: Bearish Bollinger Band® Reversal on NZD/USD

Below is a practical example of a bearish Bollinger Band® reversal on the NZD/USD daily chart.

The broader trend is identified as an uptrend, based on higher highs and higher lows. Price then forms a double top structure.

- The first peak breaks above the upper Bollinger Band®

- The second peak fails to reach the upper band

This behavior signals that buyers are losing momentum, despite price being near previous highs.

Executing the Trade: Entry, Stop, and Target

Entry Strategy

While some traders enter immediately after the second top forms, a more disciplined approach is to:

- Use the neckline of the double top as a trigger

- Enter on:

- A clean break below the neckline, or

- A confirmed candle close below the neckline

This helps filter false signals.

Stop-Loss Placement

- Stops are typically placed above the most recent swing high

- This placement respects market structure and limits downside risk

Take-Profit Targets

Profit targets can be determined using:

- Key support levels

- Fibonacci retracement or extension levels

- Measured move techniques based on pattern height

Risk-to-reward ratios of 1:2 or better are commonly achievable with this setup.

Best Practices for Trading Bollinger Band® Reversals

To improve consistency, traders should:

- Avoid trading reversals in strong, accelerating trends

- Combine Bollinger Bands® with price structure

- Use proper risk management

- Treat Bollinger Band® reversals as confirmation tools, not standalone signals

Patience is critical—waiting for full confirmation often separates professional traders from impulsive ones.

Key Takeaways for Forex Traders

- Bollinger Band® reversal patterns are momentum exhaustion signals

- They work best when aligned with clear market structure

- The second failure to break the band is the core signal

- Neckline breaks offer high-quality confirmation

- Proper execution can deliver favorable risk-to-reward profiles

When applied with discipline and context, Bollinger Band® reversal patterns can become a reliable addition to a trader’s technical toolkit.

Further Reading on Bollinger Bands®

- Trade Forex with Bollinger Bands® (Beginner Guide)

- Using Bollinger Bands® in Day Trading Strategies

- Combining Bollinger Bands® and MACD for Confirmation

Bollinger Bands® is a registered trademark of John Bollinger.