When interest rates approach zero, central banks are often forced to look beyond conventional monetary policy tools. One of the most influential – and controversial – alternatives is Quantitative Easing (QE). Over the past two decades, QE has reshaped global financial markets, influenced currency valuations, and altered how traders interpret central bank policy.

In this article, I will explain how quantitative easing works, why major central banks adopted it, and what its long-term implications are – particularly for forex traders.

This guide covers:

- Why central banks turned to quantitative easing

- How quantitative easing works in practice

- QE policies of the Federal Reserve, Bank of Japan, Bank of England, and ECB

- The risks, limitations, and diminishing returns of QE

- The impact of quantitative easing on currencies

How Quantitative Easing Works

Quantitative easing, commonly referred to as QE, is a monetary policy tool used by central banks when traditional interest rate cuts are no longer effective. Under QE, a central bank purchases financial assets—most commonly government bonds—from commercial banks and financial institutions.

By doing so, the central bank injects liquidity into the financial system, increasing the overall money supply. With more money available, borrowing costs decline, making it cheaper for businesses and consumers to finance spending on housing, automobiles, and business expansion.

While interest rate cuts primarily affect short-term borrowing costs, QE can influence longer-term interest rates, depending on the assets purchased. This makes QE particularly powerful when central banks are trying to stimulate credit growth during periods of economic stress.

The Federal Reserve and Quantitative Easing

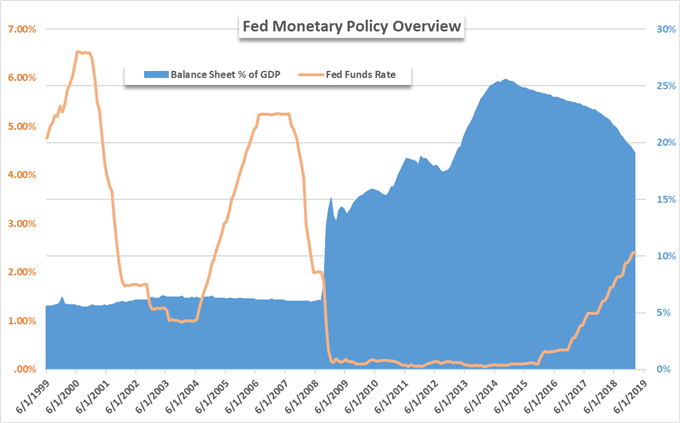

As the central bank of the United States, the Federal Reserve (Fed) operates under a dual mandate: maintaining price stability and maximizing employment. To achieve these goals, the Fed uses a range of monetary policy tools, including interest rates and balance sheet operations.

When the Global Financial Crisis of 2008 pushed the US economy into recession, the Fed aggressively cut interest rates. However, with rates approaching zero and economic recovery still weak, traditional policy tools lost effectiveness.

In November 2008, the Fed introduced its first round of quantitative easing, commonly referred to as QE1. This marked a significant shift in monetary policy.

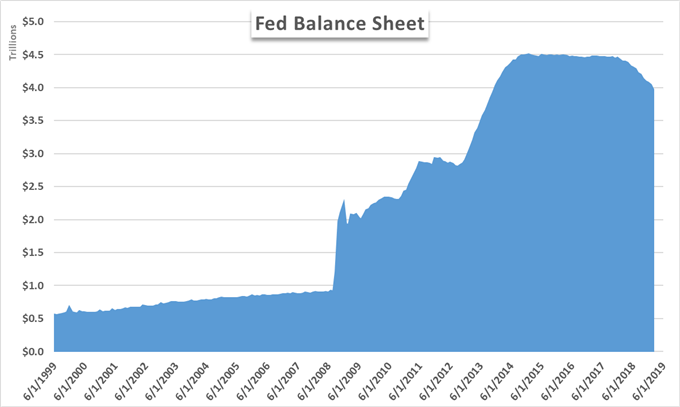

Federal Reserve Total Assets

Under QE1, the Fed purchased large quantities of:

- US Treasury bills, notes, and bonds

- Mortgage-backed securities (MBS)

- High-quality asset-backed securities

These purchases expanded the Fed’s balance sheet and lowered borrowing costs across the economy. QE1 ran from December 2008 to March 2010 and was accompanied by a reduction in the Federal Funds rate to a range of 0–0.25%.

Expansion of the Fed Balance Sheet

With interest rates effectively at zero and negative rates off the table at the time, QE became a critical component of the Fed’s policy toolkit. Additional rounds followed:

- QE2 (November 2010 – June 2011)

- QE3 (September 2012 – December 2013)

These programs helped stabilize financial markets and support economic growth. The Fed eventually raised interest rates again in December 2015, signaling a shift away from emergency policy measures.

Balance Sheet Reduction and Quantitative Tightening

After years of expansion, the Fed began reducing its balance sheet in 2018—a process often referred to as Quantitative Tightening (QT). While many policymakers supported gradual normalization, uneven global growth and external risks such as trade tensions complicated the process.

Debate around the appropriate use and timing of QE remains central to modern monetary policy discussions.

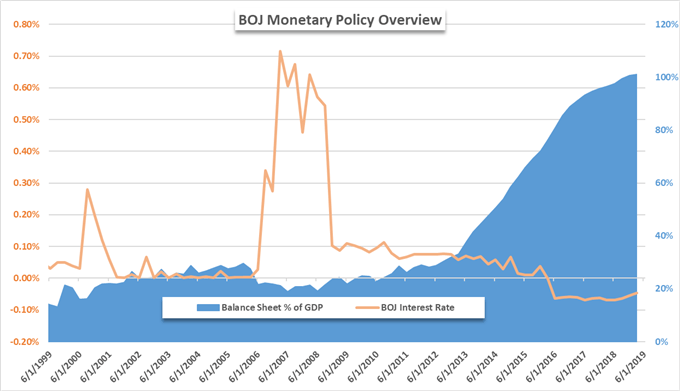

The Bank of Japan’s Experience with Quantitative Easing

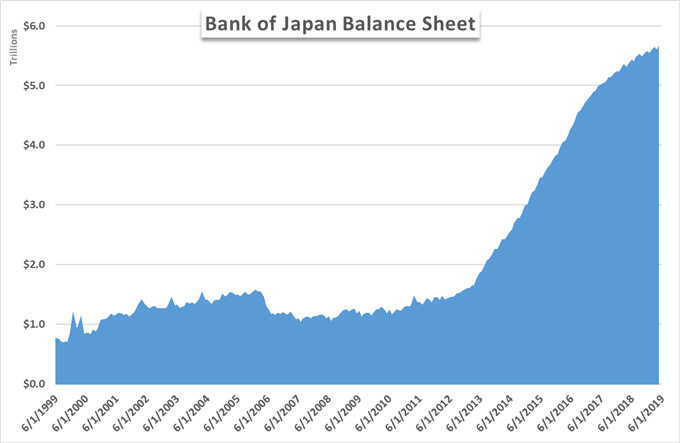

The Bank of Japan (BOJ) has one of the longest histories with quantitative easing—and one of the most debated outcomes.

Japan first experimented with QE in the late 1990’s by purchasing commercial paper to support banks during a period of low growth and weak inflation. When results proved limited, the BOJ expanded asset purchases between 2001 and 2004, injecting trillions of yen into the financial system through long-term government bond purchases.

Despite these efforts, Japan continued to struggle with deflation and stagnant growth.

BOJ Asset Purchases Over Time

In later years, the BOJ expanded its approach further through Qualitative and Quantitative Easing (QQE), purchasing not only Japanese Government Bonds (JGBs) but also:

- Exchange-Traded Funds (ETFs)

- Japanese Real Estate Investment Trusts (J-REITs)

BOJ Ownership of Financial Assets

By 2018, the BOJ owned approximately 70% of Japan’s ETF market, making it a major shareholder in a significant portion of Japanese publicly listed companies. While this provided short-term market stability, it also introduced concerns about balance sheet risk and market distortion.

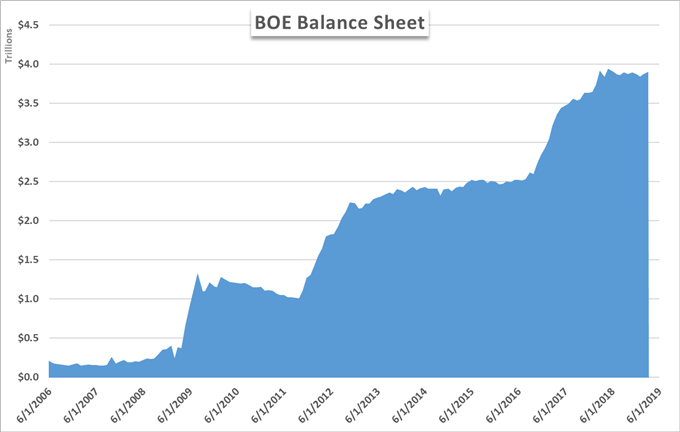

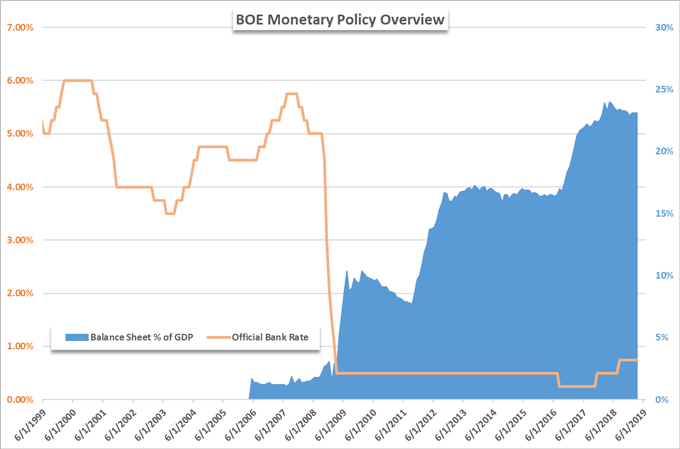

The Bank of England and Quantitative Easing

The Bank of England (BOE) adopted QE in response to the global recession and later expanded its efforts amid political uncertainty surrounding Brexit.

The BOE focused its purchases primarily on:

- UK government bonds (Gilts)

- Selected corporate bonds

Bank of England Asset Holdings

Compared to Japan, the BOE’s balance sheet remains relatively small. As of early 2019, its holdings amounted to roughly 5.7% of UK GDP, giving the bank more flexibility and reducing the risk of diminishing returns.

QE Relative to GDP Comparison

While Brexit-related uncertainty persists, the BOE’s QE strategy has generally proven more effective than Japan’s and broadly comparable to that of the Federal Reserve.

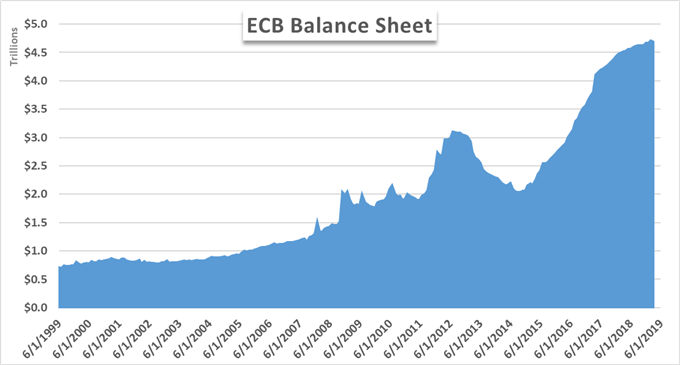

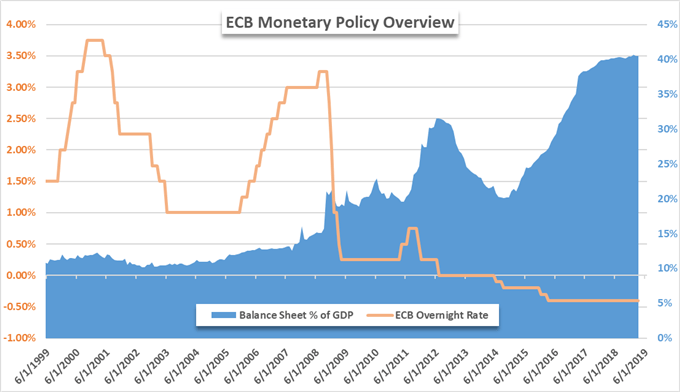

The European Central Bank and QE

The European Central Bank (ECB) entered the QE arena later than its peers. Between March 2015 and December 2018, the ECB spent nearly €3 trillion purchasing:

- Government bonds

- Corporate debt

- Asset-backed securities

- Covered bonds

ECB Asset Purchases

These purchases were aimed at preventing deflation and supporting recovery following the Eurozone Debt Crisis. According to Reuters, purchases were conducted at a pace equivalent to €1.3 million per minute.

Despite the scale of intervention, economic growth and inflation remained subdued.

TLTROs: The ECB’s Alternative to QE

In early 2019, the ECB introduced Targeted Long-Term Refinancing Operations (TLTROs). These programs provide low-interest loans to banks for periods of one to four years, encouraging lending and improving liquidity ratios.

TLTRO Mechanism

While TLTROs aim to stabilize the banking system, prolonged monetary stimulus has raised concerns about diminishing returns and long-term financial stability.

Negative Effects and Diminishing Returns of Quantitative Easing

While quantitative easing initially proved effective in stabilizing financial markets—particularly in the United States – its long-term impact has revealed clear limitations and unintended consequences, especially in Japan and the Eurozone. As QE programs extend over many years, their ability to stimulate real economic growth tends to weaken, a phenomenon commonly referred to as diminishing returns.

In Japan, prolonged and repeated rounds of QE have coincided with persistent deflationary pressures, despite massive liquidity injections and even the introduction of negative interest rates. Consumer demand has remained subdued, wage growth stagnant, and inflation expectations anchored well below the central bank’s targets. This suggests that while QE can support asset prices, it does not necessarily translate into stronger consumption or sustainable economic expansion.

Another significant concern is the extraordinary expansion of the Bank of Japan’s balance sheet, which now exceeds the country’s gross domestic product (GDP). This level of balance sheet growth is unprecedented among major central banks and raises questions about long-term financial stability. A balance sheet of this magnitude limits future policy flexibility and complicates any potential exit strategy without disrupting markets.

Furthermore, the BOJ’s increasing exposure to equity markets and real estate assets, such as ETFs and J-REITs, introduces additional risk. By becoming a major shareholder in a large portion of Japanese corporations, the central bank blurs the line between monetary policy and market participation. This exposure makes the central bank more vulnerable during periods of market downturns and increases the risk of asset price distortions.

A similar pattern has emerged in the Eurozone. Despite years of aggressive asset purchases and supplementary programs such as TLTROs, the European Central Bank continues to face weak economic growth and persistently low inflation. Structural challenges—including demographic trends, rigid labor markets, and uneven fiscal policy across member states—have reduced the effectiveness of monetary stimulus alone.

These outcomes underscore a critical lesson for traders and policymakers alike: quantitative easing is not a cure-all. While it can provide short-term relief and stabilize financial systems during crises, prolonged reliance on unconventional monetary policy may reduce its effectiveness over time and introduce new risks into the financial system.

For forex traders, this environment creates a market where central bank policy remains influential but increasingly complex. Price movements driven by QE are often less about economic improvement and more about relative policy positioning between central banks. Understanding the limits of QE helps traders better interpret long-term currency trends and anticipate periods where monetary policy may lose its impact on exchange rates.

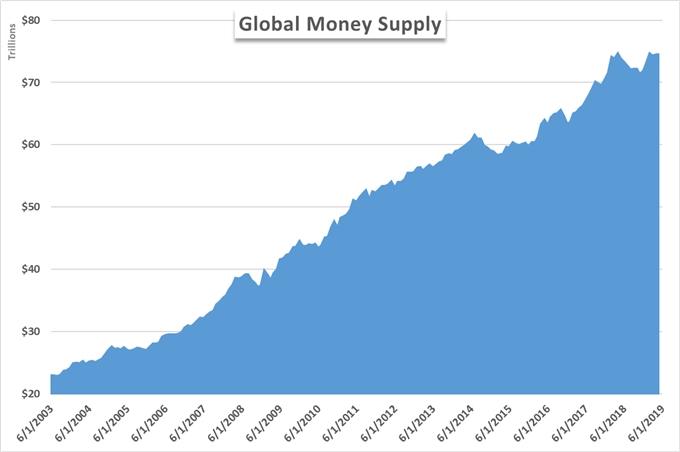

The Impact of Quantitative Easing on Currencies

From a forex perspective, quantitative easing increases the supply of a currency, which—under supply and demand principles—should reduce its value. However, currencies are traded in pairs, meaning weakness is always relative.

In today’s global environment, where multiple central banks pursue dovish policies simultaneously, currency strength often emerges on a relative basis. Traders increasingly compare central banks by degrees of dovishness rather than absolute policy stance.

This dynamic can escalate into competitive easing, sometimes described as a currency war.

QE and Currency Valuation

As global money supply continues to expand, currency values remain fluid. While QE has become a widely accepted policy tool, its long-term role—and sustainability—remains one of the most critical questions facing modern central banking.