|

|

|

|

What Is the PIVOT DARMA Indicator

The PIVOT DARMA indicator for MT4 is a custom technical tool designed to calculate and display daily pivot levels directly on your MetaTrader 4 charts. Pivot levels are among the most popular and time-tested tools in technical analysis. They act as dynamic support and resistance zones based on the previous day’s price action.

Unlike traditional pivot indicators that only plot one standard pivot line, PIVOT DARMA gives traders multiple calculation options—using 2, 3, or 4-price averages—to better fit different trading strategies and market conditions. The result is a versatile indicator that helps both beginner and intermediate traders identify key levels where price is likely to react, reverse, or continue.

In essence, this indicator simplifies one of the most powerful price-based trading concepts: using the relationship between high, low, open, and close prices to forecast potential intraday turning points.

If you’re learning how to use indicators in forex trading, this tool is a great starting point because it visually shows how daily price dynamics build the foundation for short-term trading opportunities.

See also: Pivot Star v1.2 MT4 Indicator

How It Works – PIVOT DARMA Explained

The PIVOT DARMA indicator automatically calculates several versions of daily pivot points each day based on the previous session’s price data. Here’s how it operates in practical terms:

Calculation at a Specific Hour

You can set the change_day_hour parameter to determine when the indicator starts a new daily calculation. This allows flexibility for brokers with different server times or traders who want to align their trading day with a specific market session (for example, the London or New York open).

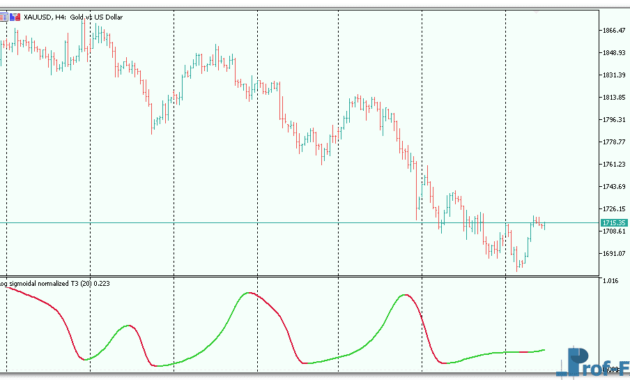

Pivot Level Variations

The indicator can calculate pivots using multiple formulas:

- HLper2 – average of High and Low (2-point pivot).

- HLCper3 – average of High, Low, and Close (3-point pivot).

- HLCCper4 – average of High, Low, Close, and Open (4-point pivot).

Each variation provides a slightly different central value, giving traders options to suit different volatility conditions or trading styles.

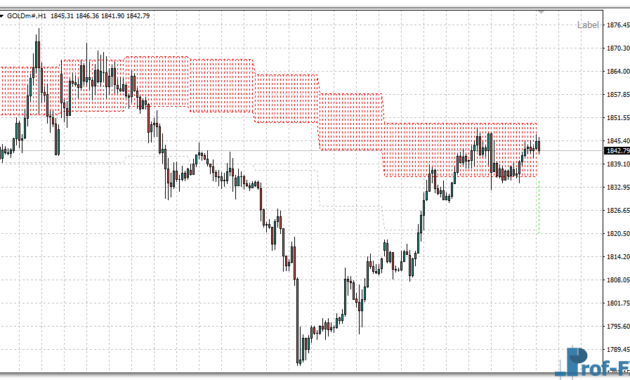

Support and Resistance Zones

When enabled, PIVOT DARMA plots corresponding support (S3, S4) and resistance (R3, R4) levels. These are calculated based on the difference between the pivot and the previous day’s high or low, essentially projecting price extensions upward or downward.

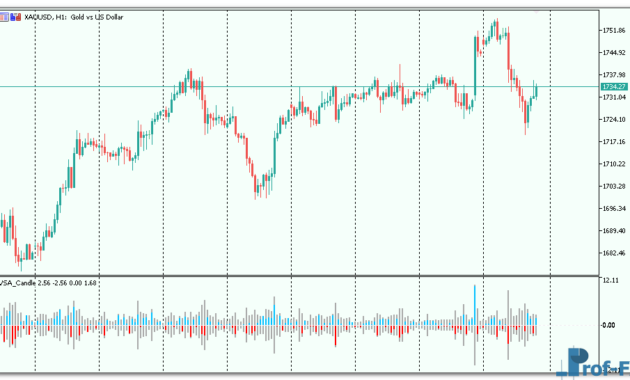

Daily Open Line

The indicator can also show the daily open price as a solid line. This level often acts as a strong psychological pivot, helping traders see whether price action is trading above (bullish bias) or below (bearish bias) the daily open.

By combining these elements, PIVOT DARMA creates a clear visual framework for day trading. Price movements relative to these pivot lines often reveal market sentiment shifts and potential breakout or reversal zones.

For example:

- If price bounces from a support pivot and crosses above the daily open, it may signal short-term bullish momentum.

- If price stalls near a resistance pivot and forms rejection candles, it could suggest a potential pullback or reversal.

These observations make the PIVOT DARMA indicator an essential tool for developing trading strategies with MT4 indicators.

PIVOT DARMA Settings

Here’s an overview of the main parameters and how they affect the indicator’s behavior:

- change_day_hour – Defines the hour when the indicator starts a new daily calculation. Useful for adjusting to broker server time or personal trading sessions.

- HLCCper4 / HLCper3 / HLper2 – Enable one or more of these to plot the 4-point, 3-point, or 2-point pivot averages. You can use multiple options simultaneously for comparison.

- DailyOpen – Displays the opening price of the current day as a separate line.

- Sup_Res4 / Sup_Res3 – Enables the drawing of the corresponding support and resistance lines for the 4-point and 3-point pivots.

Each set of pivots and support/resistance levels is color-coded for clarity. For instance, the main pivot line appears as a bold solid line, while secondary pivots and S/R levels are dashed or dotted for easy distinction.

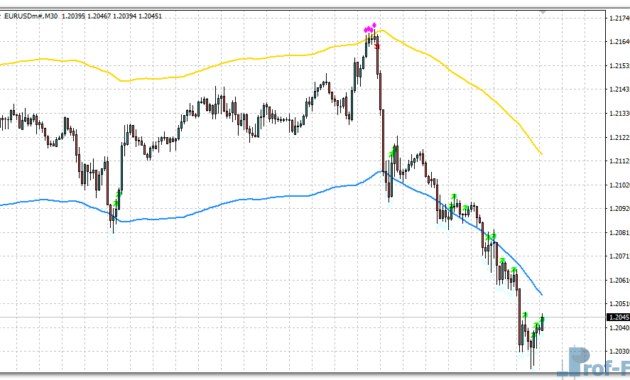

Traders can customize which lines appear on their charts depending on their strategy. For example:

- Scalpers may prefer only the daily open and one pivot formula to avoid clutter.

- Swing or intraday traders may activate all pivot and S/R levels for deeper analysis of potential turning zones.

Trading With the PIVOT DARMA Indicator

Using PIVOT DARMA effectively involves integrating it into your daily analysis routine. Here are some best practices and ideas to enhance your results:

- Use It With Price Action Confirmation

Pivot levels work best when combined with candlestick analysis. Look for reversal patterns (pin bars, engulfing candles) near pivot lines to confirm potential entries. - Combine With Trend Indicators

To increase accuracy, pair PIVOT DARMA with trend tools like Moving Averages or MACD. If price stays above the 50-period MA and bounces from a pivot support, it often confirms a bullish continuation setup. - Session-Based Trading

Because the indicator adjusts based on time, you can align it with major sessions (London, New York, or Tokyo) to target the most active price movements. - Avoid Overtrading Around Pivot Clusters

When multiple pivot lines are close together, it often indicates indecision or consolidation. Wait for a clean breakout before entering trades.

By applying these techniques, traders can build forex trading strategies explained around pivot-based logic—an approach that has stood the test of time in both manual and automated trading systems.

Why Use PIVOT DARMA

- Simplicity – No complicated inputs; pivots are calculated automatically.

- Clarity – Visually clean with adjustable line styles and colors.

- Adaptability – Works across all forex pairs, timeframes, and market sessions.

- Education Value – Excellent for learning the logic behind support and resistance in a real trading environment.

This indicator is not just another visual tool—it’s a practical educational resource that strengthens your understanding of market structure and daily price dynamics. Whether you are studying forex education for beginners or refining your technical skills, PIVOT DARMA fits seamlessly into your learning and trading toolkit.

How to Instal “Pivot Darma” Indicator for Metatrader 4

- Open your Metatrader 4 platform.

- Download and save the “Pivot Darma” indicator to your desktop or any other folder located on your local computer.

- Choose “File” then “Open Data Folder” (Ctrl + Shift + D) on your Metatrader 4 platform.

- Explore the following folder: MQL4 > Indicators.

- Copy and paste the “Pivot Darma” indicator into this folder.

- Restart Metatrader 4.

- “Pivot Darma” indicators are stored by default in the custom indicator folder.

- To access these indicators, go to Top Menu > Insert > Indicators > Custom.

- In order to add a “Pivot Darma” indicator to any of your Metatrader 4 charts, you will need to select a forex chart with one mouse click, then go to Top Menu > Insert > Indicators > Custom > click the “Pivot Darma”.

- Done!

See a complete guide How To Install Metatrader 4 Custom Indicators

Final Thoughts

The PIVOT DARMA indicator for MT4 gives traders a professional, flexible, and visually clean way to apply pivot analysis in daily trading. It translates yesterday’s price behavior into meaningful trading zones for today—helping you anticipate reactions before they happen.

If you’re looking for one of the best custom indicators for MT4 to improve your chart analysis and trading consistency, PIVOT DARMA is worth adding to your setup.

You can try this tool directly by downloading it below and integrating it into your own MT4 trading strategy.

Free Download Pivot Darma indicator for Metatrader 4

- pivot-darma.zip

- Size: 19.6 kb

- Platform: MT4 | Format: .mql4/.ex4 | File: dir9mt4 | Request Remove!