Why Trend Direction Matters in Forex Trading

You may have heard the popular saying, “the trend is your friend.” In professional trading, this phrase carries real meaning. Identifying the direction of the trend on a currency pair—the direction in which price has been moving consistently over time—provides traders with a significant strategic advantage.

Trading in the direction of the trend on the Daily chart is similar to running with the wind at your back. In market terms, this means aligning your trades with overall market momentum, allowing price movement to work in your favor rather than against you.

When traders position themselves alongside the dominant trend, they increase the probability of success and reduce unnecessary risk.

The First Step: Start With the Daily Chart

The most effective way to determine the overall trend is to begin with the Daily timeframe. The Daily chart filters out short-term market noise and reveals the dominant direction institutional traders are following.

Traders should scan multiple currency pairs and focus on identifying those with the strongest and clearest trends, either upward or downward. If the trend direction is unclear or questionable, it is best to move on to another pair.

Clarity is essential. A strong trend should be immediately obvious without overanalyzing the chart.

Recognizing a Strong Uptrend Using Price Action

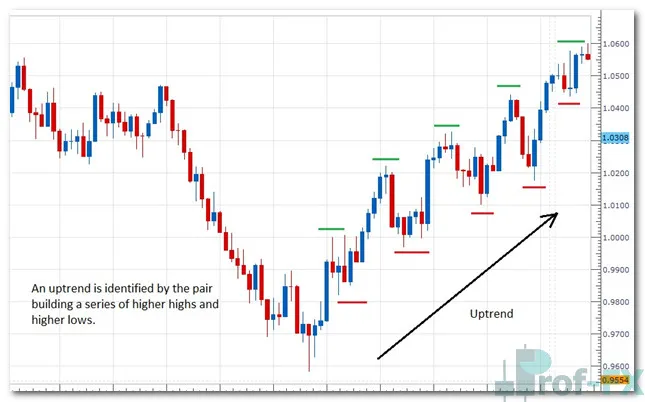

Example: AUD/USD in an Uptrend

A strong uptrend, such as the one shown on the AUD/USD Daily chart, can be identified quickly using price action alone. In a healthy uptrend, price consistently moves higher over time, leaving little doubt about the overall direction.

An uptrend is confirmed when the market forms:

- Higher highs

- Higher lows

Visually, price will move from the lower-left portion of the chart toward the upper-right, reflecting sustained buying pressure. These higher highs (often marked in green) and higher lows (commonly marked in red) signal that buyers remain in control of the market.

If a trader finds themselves unsure about whether price is trending up or not, that uncertainty alone is a signal to avoid the pair and look for a cleaner setup elsewhere.

Trading an Uptrend: Buying on Dips

Once an uptrend is clearly established on the Daily chart, traders should avoid chasing price at highs. Instead, a high-probability approach is to wait for a pullback toward a support level and then enter a long (buy) position in the direction of the trend.

This technique is commonly referred to as “buying on dips.”

In practice:

- Wait for price to retrace toward a support area

- Enter a buy trade aligned with the Daily trend

- Place the stop-loss below the lowest point of the pullback

This approach allows traders to enter at more favorable prices while remaining aligned with broader market momentum.

Identifying a Downtrend on the Daily Chart

Example: USD/CAD in a Downtrend

The same principles apply when identifying a downtrend—only in the opposite direction. A downtrend is defined by:

- Lower highs

- Lower lows

On the USD/CAD Daily chart, price action clearly shows sellers maintaining control as the market continues to move lower over time. Lower highs (green) indicate weakening buying pressure, while lower lows (red) confirm sustained selling momentum.

Trading a Downtrend: Selling on Rallies

When trading a downtrend, traders should avoid selling at the very bottom of price swings. Instead, the preferred strategy is to wait for a pullback toward a resistance level, then enter a short (sell) position in the direction of the Daily trend.

This method is known as “selling on rallies.”

Key elements include:

- Waiting for price to retrace upward into resistance

- Entering short trades aligned with the Daily trend

- Placing the stop-loss above the highest point of the pullback

By doing this, traders benefit from entering trades where risk is controlled and probabilities favor continuation.

Why Trading With the Trend Reduces Risk

The most important takeaway is that trading in the direction of the Daily trend places the trader on the same side as overall market momentum. This alignment increases the likelihood of successful trades because the broader market is supporting the position.

While it is possible to generate profits by trading against the trend, countertrend trades inherently carry higher risk. Any pips earned against the dominant direction require precise timing and come with reduced margin for error.

As professional traders, the goal is not to trade frequently—but to trade intelligently by eliminating unnecessary risk whenever possible.

Final Thoughts on Determining Trend Direction

By consistently analyzing the Daily chart, identifying higher highs and higher lows in uptrends—or lower highs and lower lows in downtrends—traders can develop a clear understanding of market direction.

This foundational skill forms the backbone of trend-based trading strategies and provides a strong framework for making disciplined, probability-driven trading decisions.

Once you master trend identification, every other aspect of trading—entries, exits, and risk management—becomes significantly more effective.