The Asian trading session – commonly referred to as the Tokyo session—is one of the most underestimated periods in the global forex market. Yet, for traders who understand its unique characteristics, this session can offer consistent and structured trading opportunities. Research from the Prof FX Traits of Successful Traders series highlights that certain market conditions, such as lower volatility and clearly defined price ranges, can actually support disciplined and repeatable trading behavior.

While the Tokyo session does not generate the same level of liquidity or volatility as the London or New York sessions, these very characteristics make it attractive to traders who prioritize risk control, technical precision, and structured execution. In this guide, I will walk you through how the Tokyo session works, when it takes place, and which trading strategies are most suitable during this period.

Tokyo Forex Market Hours Explained

The Asian forex session officially begins the global trading week. From a practical standpoint, it starts when Tokyo’s financial institutions and major Japanese banks come online, as they facilitate a significant portion of regional trading volume.

In Japanese Standard Time (JST), the Tokyo session runs from 09:00 to 18:00. For traders based in other major financial centers, this translates into overnight or early-morning trading hours.

Although the forex market operates 24 hours a day, session start times are largely defined by institutional participation rather than fixed rules. While New Zealand and Sydney technically open earlier, Tokyo remains the most influential Asian financial hub due to its scale and liquidity.

Asian Trading Session Times by Region

| Trading Location | Major Market | Trading Hours (Local Time) |

| Asia | Tokyo | 09:00 – 18:00 JST |

| Europe | London | 00:00 – 09:00 GMT |

| United States | New York | 19:00 – 04:00 ET |

Note: Trading hours may shift slightly during daylight savings adjustments.

During most of the Tokyo session, European and U.S. financial centers are inactive, which explains the reduced trading volume and slower price movements observed during this period.

Key Characteristics of the Tokyo Trading Session

The Tokyo session is best known for respecting technical levels, particularly support and resistance, due to thinner liquidity. These characteristics shape how price behaves and how traders should approach the market.

1. Lower Market Liquidity

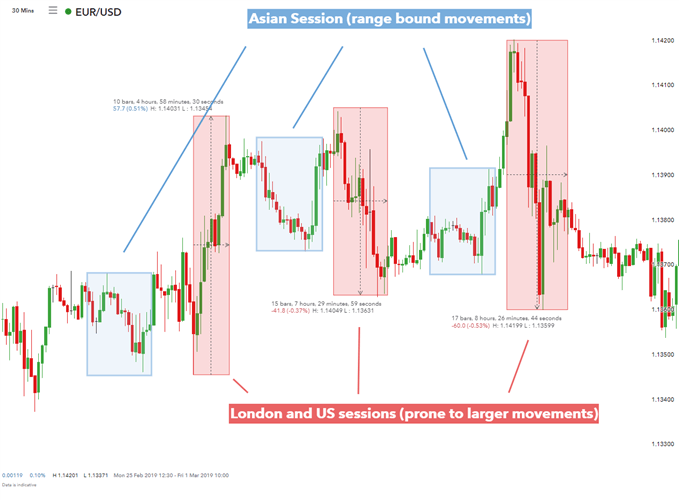

With fewer institutional participants from Europe and the United States, liquidity during the Asian session is noticeably lower. As a result, major non-Asian currency pairs such as EUR/USD, GBP/USD, and EUR/GBP tend to trade within narrower ranges.

This environment often discourages large impulsive moves, making it easier for traders to anticipate price behavior based on historical ranges.

2. Reduced Volatility

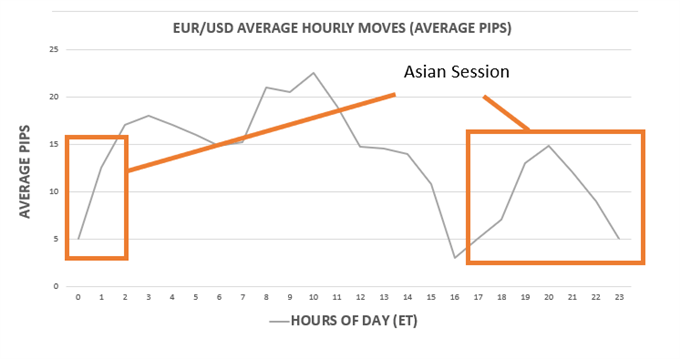

Because market participation is primarily driven by Asian financial centers—such as Japan, Singapore, Australia, and Hong Kong—price fluctuations are generally smaller compared to later sessions.

Currencies like EUR/USD often act as a useful proxy for observing intraday volatility, showing relatively muted price action during Asian hours and stronger movements once London and New York enter the market.

3. Clearly Defined Entry and Exit Zones

One advantage of low volatility environments is that support and resistance levels tend to hold more consistently. For beginner traders, this makes the Tokyo session an excellent environment to practice structured trade planning.

When combined with technical indicators—such as RSI or Stochastic oscillators—these levels can provide high-probability entry and exit signals without excessive noise.

4. Favorable Conditions for Risk Management

The slower pace of the Tokyo session allows traders to evaluate risk-to-reward ratios more carefully. Price typically respects well-defined trading ranges, which simplifies stop-loss placement and profit targeting.

For many traders, especially those still developing discipline, the Asian session offers a calmer environment to focus on process over emotion.

5. Breakout Potential as the Session Ends

As the Tokyo session transitions into the London session, liquidity increases sharply. This overlap frequently leads to range breakouts, as fresh capital enters the market and price escapes previously established boundaries.

Understanding this shift is crucial for traders who want to position themselves ahead of increased volatility.

Best Currency Pairs to Trade During the Tokyo Session

The ideal currency pairs depend largely on a trader’s objectives and risk tolerance.

- Traders seeking higher volatility often focus on Asian-linked pairs such as USD/JPY, AUD/JPY, NZD/JPY, AUD/USD, and NZD/USD.

- Traders who prefer range-bound conditions typically favor pairs like EUR/USD, GBP/USD, and EUR/GBP, which tend to remain stable during Asian hours.

These dynamics are influenced by regional economic activity, central bank policies from institutions like the Bank of Japan (BoJ) and Reserve Bank of Australia (RBA), and overall global risk sentiment.

How Range Trading Works During the Asian Session

Range trading is particularly effective during the Tokyo session because price often oscillates between well-established support and resistance levels.

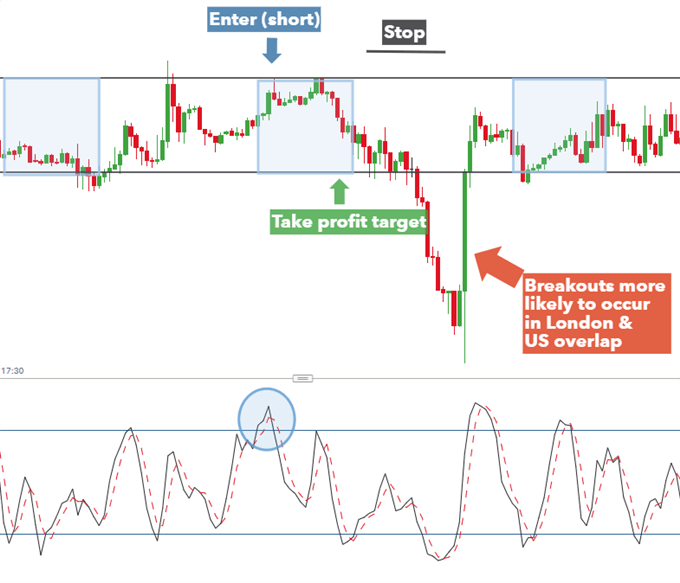

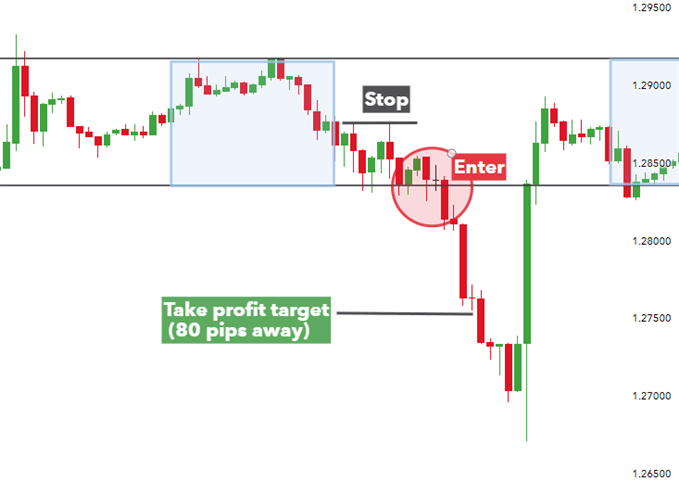

The two most common approaches during this session are range trading and pre-London breakout positioning. Below is an example illustrating a short trade setup within a defined range.

Trade Setup Explanation

When price approaches the upper boundary of a trading range, traders look for sell signals near resistance. Conversely, buying opportunities emerge near support.

Oscillators such as the Stochastic indicator or RSI are commonly used to identify overbought or oversold conditions, improving trade timing.

Entry Strategy

In this example, price approaches resistance while the stochastic indicator signals overbought conditions. This confluence suggests a potential short entry, especially when price action confirms rejection at resistance.

Stop-Loss Placement

A stop-loss is typically placed above the resistance level, as this represents the price point where the range structure is invalidated.

Take-Profit Targeting

Professional traders prioritize favorable risk-to-reward ratios, ideally 1:1 or better. If a range spans 80 pips and the stop-loss risks only 30 pips, the resulting 1:2.67 risk-to-reward ratio offers a strong statistical edge.

Once London and New York liquidity enters the market, range conditions often break down. This reinforces the importance of using protective stops and respecting session boundaries.

The Asian Breakout Trading Strategy

The Asian breakout strategy focuses on capturing momentum as the London session opens at 00:00 GMT (04:00 ET). The sudden influx of institutional liquidity often leads to decisive price movements.

On lower timeframes—such as 5-minute to 30-minute charts—traders wait for a candle to close above or below the Asian session range. A confirmed breakout provides an entry signal, with a tight stop-loss placed near the most recent swing high or low.

Profit targets are commonly set by measuring the height of the Asian range and projecting that distance from the breakout point, creating a structured and repeatable approach.

Further Learning on Forex Trading Sessions

Understanding how volatility, liquidity, and participation change throughout the day is essential for long-term trading success. Traders are encouraged to explore the characteristics of the London and New York sessions, as well as how session overlaps influence price behavior.

For those just beginning their journey, mastering session-based trading is a foundational step toward developing consistency in the 24-hour global forex market.