Forex trading, also known as currency trading, is the process of profiting from small increases and decreases in a currencies value. You do not actually buy tangible denominations of the currency to trade in at a later date, it is all done electronically.

Forex trading is done through a spread betting platform where you are in fact speculating on a currency to increase or decrease in value against another. Since super fast internet connections and live data feeds it has become possible for the average person to trade forex from the comfort of their homes.

Forex trading has become so popular that the once reserved global market for the rich and large financial corporation’s; has opened up for thousands of people around the world to get a slice of the profits that can be obtained. The currencies of the market are always traded in pairs one against another and are displayed in there abbreviated form. EUR/USD (Euro V’s US Dollar) is a popular currency pair to trade. It is the second currency of the pair that is fluctuating against 1 denomination of the first currency.

This is illustrated by using the Euro which in this currency pair will always be worth 1 against the fluctuating US Dollar that for this example is standing at 1.3300. This would mean that 1 Euro = $1.33. The last two decimal places of the 4 displayed in the value are known as “pips” and it is these that we see the fluctuations and profit from.

A pip is usually worth a tenth of the smallest currencies denomination in this case it is worth one tenth of a cent. It is the fluctuation of these denominations that we are able to profit from in the forex market. Although they seem small to the relative currency they can be worth huge amounts of money in forex trading.

If we where to look at the EUR/USD currency pair again and the price had increased to 1.3310 this would be a rise in value of 10 pips. Although this is insignificant when you round the price up to two decimal places which still stands at $1.33, it can mean a significant amount of profit.

These small increases can generate massive profits depending on how much you are willing to risk. If you risked $1 per pip and the currency moved 10 pips you would profit $10, if you risked $10 per pip you would profit $100, $100 per pip $1000 profit. That is an amazing amount of profit for a currency that just moved a tenth of a cent.

The forex market moves in waves and is the most volatile market in the world. It has trillions of Dollars traded on it every single day which makes it a fickle place to invest. It also makes it the biggest return on investment.

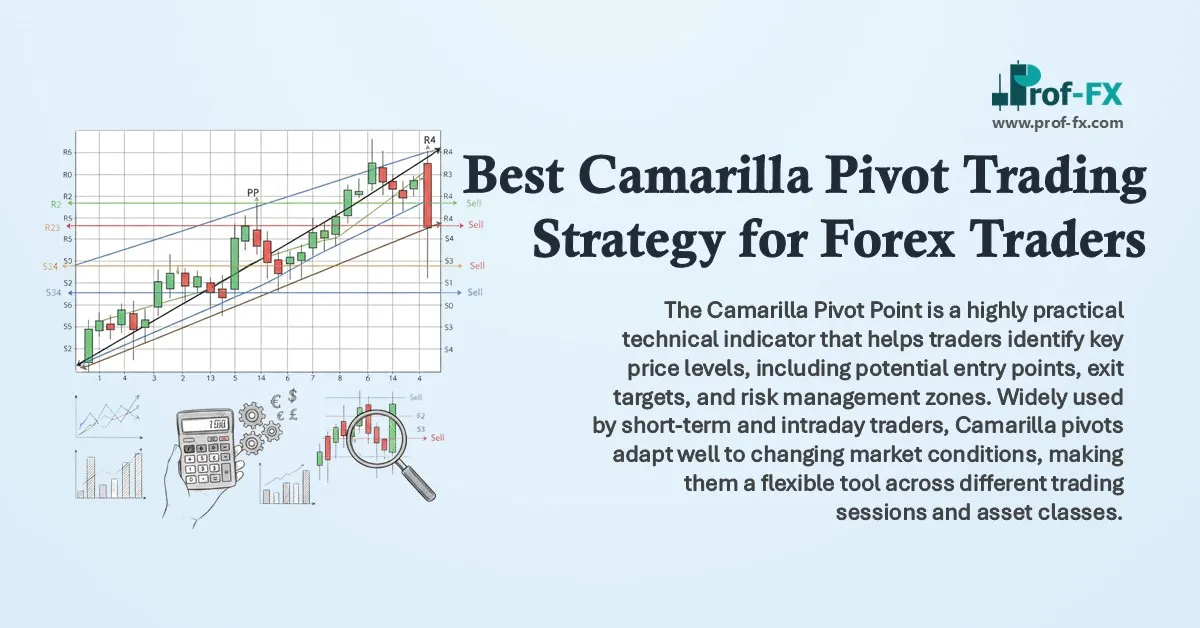

Professional forex traders use clever software to analyse technical data from the forex markets. They decipher this information which will show them a trend in a currency pair. Once the trend is established the professional trader will work out the best place to enter and exit that particular trade, they will always know how much profit to expect and how much loss they could incur and manage this against their account balance.

Forex trading is an exciting way to make money online. but you need to have the right forex trading tools in order to get the job done right.. Also published at How Do You Profit From Forex Trading?.