If you regularly follow financial news, you have likely heard phrases such as “the central bank governor sounded slightly hawkish today following strong economic data.” For many beginner traders, these terms can sound abstract. In reality, hawkish and dovish are two of the most important concepts in understanding how monetary policy drives movements in the forex market.

In this article, I will explain what hawkish and dovish monetary policy means, how central banks communicate these stances through forward guidance, and how forex traders can apply this knowledge when analyzing currency movements.

Why Hawkish and Dovish Policy Matters in FX Trading

Central bank policymakers determine whether interest rates should rise or fall, and these decisions have a direct and powerful impact on currency valuations. Interest rates are adjusted to manage inflation and economic growth.

When an economy is growing too quickly, central banks may raise interest rates to prevent inflation from accelerating. When growth slows or deflation risks emerge, central banks may cut rates to stimulate borrowing, spending, and GDP growth.

The expectations surrounding these decisions often matter more than the decisions themselves. This is where hawkish and dovish signals become critical for forex traders.

Forward Guidance: How Central Banks Signal Policy Direction

Hawkish and dovish policy stances affect currency prices through a mechanism known as forward guidance. Forward guidance refers to the effort by central banks to clearly communicate their future policy intentions to financial markets.

Rather than surprising markets, policymakers aim to gradually prepare investors for upcoming changes. Forex traders closely analyze these communications because even subtle changes in tone can influence interest rate expectations and trigger large currency moves.

What Does Hawkish Mean in Monetary Policy?

The term hawkish is used to describe a contractionary monetary policy stance. Central bankers are considered hawkish when they emphasize the need to tighten monetary conditions, usually by raising interest rates or reducing monetary stimulus.

A central bank may be described as hawkish when:

- Economic growth is strong

- Inflation pressures are rising

- Interest rate hikes are expected

- The central bank discusses reducing its balance sheet

Hawkish language often signals confidence in the economy and concern about inflation. As a result, currencies associated with hawkish central banks tend to strengthen as higher interest rates attract foreign capital.

Currencies frequently experience their largest moves when policymakers shift from a dovish tone to a hawkish one. This change alters market expectations and can lead to rapid repricing.

What Does Dovish Mean in Monetary Policy?

Dovish represents the opposite stance. When central bankers express concern about weak economic growth, declining inflation, or deflation risks, they are considered dovish.

A dovish policy stance is associated with:

- Weak or slowing economic growth

- Falling inflation or deflation risks

- Interest rate cuts

- Expansion of the central bank balance sheet through quantitative easing

Dovish communication signals that policymakers are prioritizing economic support over inflation control. Lower interest rates generally reduce a currency’s appeal, often leading to depreciation as capital flows toward higher-yielding alternatives.

Hawkish vs Dovish: Key Differences Explained

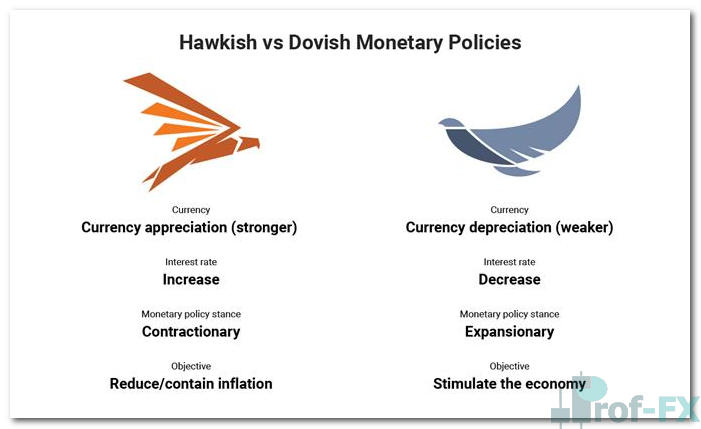

The graphic below provides a high-level snapshot of the differences between hawkish and dovish monetary policy.

Below is a more detailed comparison highlighting how each stance impacts currencies and investor behavior.

Hawkish Monetary Policy

- Increasing interest rates to control inflation

→ Currency may appreciate as capital flows toward higher yields - Reducing the central bank balance sheet by selling assets

→ Currency may strengthen as liquidity tightens - Positive forward guidance on growth and inflation

→ Investors anticipate further tightening

Dovish Monetary Policy

- Cutting interest rates to stimulate growth

→ Currency may depreciate as yields decline - Expanding the balance sheet through quantitative easing

→ Currency may weaken as money supply increases - Negative forward guidance on growth and inflation

→ Markets price in continued accommodation

How Forex Traders Trade Hawkish and Dovish Central Banks

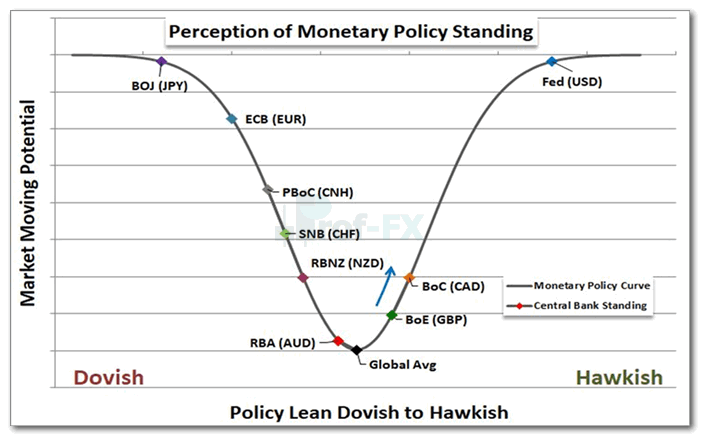

A small shift in central bank language can have significant consequences for currency prices. This is why traders carefully monitor central bank meetings, press conferences, and policy minutes—particularly those from institutions like the Federal Reserve, ECB, Bank of England, and Bank of Japan.

The image above illustrates how different central banks can be positioned along a spectrum from dovish to hawkish. When a central bank shifts toward a more hawkish stance, its currency may strengthen. When it moves toward dovishness, depreciation often follows.

However, trading central bank policy is not as simple as buying hawkish currencies and selling dovish ones. What truly drives price movement is change in expectations, not the policy stance itself.

Understanding Expectation Shifts: Two Key Scenarios

In forex trading, currencies rarely move simply because a central bank is hawkish or dovish. Instead, price action is driven by changes in expectations. The market is constantly forecasting future policy outcomes, and these forecasts are embedded into prices well before any official decision is announced.

This is why traders often say that “the market prices in expectations.” Understanding this principle is essential when interpreting central bank communication and positioning trades around monetary policy events.

Scenario One: Hawkish Expectations Are Already Priced In

When a central bank is in an established rate-hiking cycle, the market typically anticipates additional interest rate increases well in advance. Bond yields, currency valuations, and derivative markets already reflect these expectations.

In this scenario, a currency may fail to rise further, even if the central bank delivers another rate hike. This can confuse beginner traders who expect higher rates to automatically lead to currency appreciation.

What truly matters is whether the central bank’s tone becomes more hawkish than expected or unexpectedly less hawkish. If policymakers signal that inflation risks are accelerating or that rates may need to rise faster or higher than previously projected, the currency can strengthen sharply.

Conversely, if the central bank hints that it may slow the pace of hikes or pause tightening, the currency can weaken—even though interest rates are still rising. This reaction occurs because the market must reprice future expectations downward.

Scenario Two: Dovish Expectations Are Already Priced In

A similar dynamic occurs during periods of monetary easing. When a central bank is cutting interest rates or expanding stimulus and economic data remains weak, the market often fully prices in continued dovish policy.

In this environment, further rate cuts may have limited impact on the currency if they are already expected. However, currencies can move aggressively when policymakers signal a potential shift away from dovishness.

If economic indicators begin to stabilize or inflation pressures emerge, even subtle hints that policy easing may slow or end can lead to a sharp currency appreciation. Traders interpret this as a turning point in the monetary policy cycle.

This explains why currencies sometimes rally during periods of weak growth—because the worst-case expectations are already reflected in prices.

Why Expectation Changes Drive the Largest Moves

The largest and fastest moves in the forex market occur when expectations change abruptly. Central bank surprises—whether hawkish or dovish—force traders to rapidly adjust positions, leading to increased volatility.

Professional traders focus less on where interest rates are today and more on where they are likely to be in the future. By aligning trades with shifts in expectations rather than absolute policy levels, traders gain a clearer framework for interpreting central bank-driven market movements.

Ultimately, successful forex trading around monetary policy requires understanding that currencies trade on direction and momentum of expectations, not static policy labels.

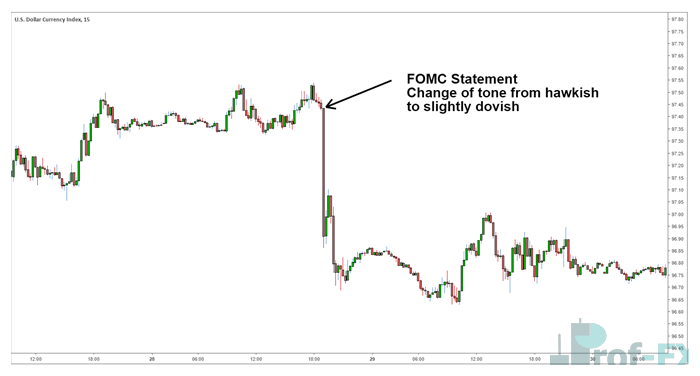

Real-World Example: Federal Reserve Policy Shift in 2018

A clear example of this dynamic occurred in late 2018. In October, Federal Reserve Chair Jerome Powell stated that interest rates were “a long way away from neutral.” Markets interpreted this as a strongly hawkish signal, leading to US dollar appreciation.

Later, in November, Powell indicated that interest rates were “just below neutral.” This subtle change in wording signaled a shift toward a less hawkish stance. As a result, the US dollar weakened as expectations for aggressive rate hikes declined.

This example highlights how tone changes, not just policy actions, can drive significant forex market moves.

Staying Informed on Central Bank Policy

Keeping up with central bank developments can be challenging, especially for new traders. Regularly following policy announcements, economic calendars, and central bank commentary is essential for understanding currency trends.

For traders at the beginning of their journey, building a strong foundation in forex fundamentals—especially monetary policy and interest rates—can significantly improve long-term decision-making and risk awareness.