A currency carry trade is a classic forex strategy where traders aim to profit from the interest rate differential between two currencies. In simple terms, it involves borrowing a low-yielding currency and using it to buy a higher-yielding currency, allowing the trader to earn interest—known as rollover—while also benefiting from potential price appreciation.

This guide explains what a currency carry trade is, how it works in practice, the risks involved, and a practical carry trade strategy designed for traders who want a structured, long-term approach.

What Is a Currency Carry Trade and How Does It Work?

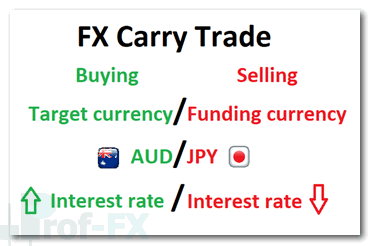

An FX carry trade involves two currencies with different interest rates:

- The funding currency: a currency with a low interest rate

- The target currency: a currency with a higher interest rate

When a trader goes long the higher-yielding currency against the lower-yielding one and holds the position overnight, the broker applies a positive rollover, crediting interest to the trader’s account. This daily interest payment is the core attraction of the carry trade.

Over time, traders hope to collect:

- Daily interest income (positive carry)

- Capital gains if the higher-yielding currency appreciates

Understanding Rollover in Forex Trading

Rollover refers to the process by which forex brokers extend the settlement date of open positions held past the daily cut-off time (typically New York close).

- If the interest rate differential is positive, the trader receives a credit

- If the differential is negative, the trader pays interest

Because central bank interest rates are quoted on an annual basis, rollover is applied as a daily adjusted amount. The exact rollover credited or debited will vary by broker, as spreads and adjustments are applied.

Why Interest Rates Matter in Carry Trades

Interest rates are determined by a country’s central bank, based on its monetary policy objectives such as inflation control and economic growth.

A trader earns interest when they are:

- Long the currency with the higher interest rate

- Short the currency with the lower interest rate

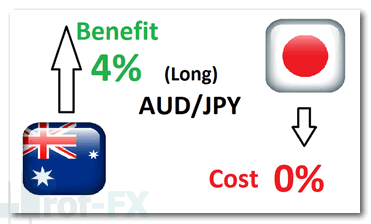

Example

If:

- The Australian Dollar (AUD) yields 4%

- The Japanese Yen (JPY) yields 0%

A trader may look to go long AUD/JPY to capture the net interest rate differential.

The Two Core Components of a Currency Carry Trade

A currency carry trade is unique because it offers traders two potential sources of return. Unlike many short-term trading strategies that rely solely on price movement, carry trades combine interest income with exchange rate performance. Understanding how these two components interact is essential for evaluating both profit potential and risk.

Below is a clear breakdown of the two pillars that determine the success or failure of a carry trade.

1) Interest Rate Differential: The Foundation of the Carry Trade

The interest rate differential is the cornerstone of every carry trade. It refers to the difference between the interest rate of the target currency and that of the funding currency.

When traders go:

- Long the higher-yielding currency

- Short the lower-yielding currency

they earn a positive rollover for each day the position remains open.

Why This Matters

Even if the exchange rate remains relatively stable:

- Traders can still generate returns purely from overnight interest payments

- This makes carry trades attractive for long-term, position-style trading

However, interest income is not fixed or guaranteed. Central banks frequently adjust rates in response to inflation, growth, or financial stability concerns. Any change in monetary policy can directly impact the profitability of a carry trade.

Key Risk Consideration

If:

- The target currency’s central bank cuts rates, or

- The funding currency’s central bank raises rates,

the interest rate differential narrows, reducing or eliminating the positive carry. This is why interest rate risk is one of the primary vulnerabilities of carry trade strategies.

2) Exchange Rate Movement: Enhancing or Undermining Returns

While interest income provides the base return, exchange rate movement often determines whether a carry trade is truly profitable.

In an ideal scenario:

- The target currency appreciates against the funding currency

- The trader earns capital gains in addition to rollover income

This combination can significantly enhance overall returns.

When Exchange Rates Work Against the Trade

If the target currency depreciates:

- Price losses may quickly outweigh accumulated interest

- Even months of positive rollover can be erased by a sharp adverse move

This risk is particularly pronounced during:

- Periods of heightened market volatility

- Risk-off environments

- Sudden shifts in global capital flows

Realizing Profits and Losses

It is important to note that:

- Interest income is credited daily

- Exchange rate gains or losses are only realized when the trade is closed

Until that point, price-based profits or losses remain unrealized and can change with market conditions.

How These Two Components Work Together

A strong carry trade setup typically features:

- A wide and stable interest rate differential

- A supportive or strengthening trend in the target currency

When both components align, the carry trade benefits from:

- Consistent income

- Favorable price movement

- Improved risk-to-reward dynamics

When either component weakens, the trade’s risk profile increases.

Key Takeaway for Forex Traders

The success of a currency carry trade depends on the balance between interest income and price movement. Traders who monitor both central bank policy and exchange rate trends—and manage risk accordingly—are far better positioned to use carry trades as a sustainable, long-term strategy in the forex market.

Currency Carry Trade Example: AUD/JPY

Continuing with the AUD/JPY example:

If the Australian Official Cash Rate is 4% and Japanese rates remain near 0%, a trader may decide to enter a long AUD/JPY position if market conditions suggest upward price movement.

In this scenario:

- The trader is effectively borrowing JPY at a low rate

- And receiving interest tied to AUD’s higher yield

Retail traders should note that the credited interest will be less than the headline rate, as brokers apply rollover spreads.

For a deeper calculation breakdown, traders can refer to resources on understanding foreign exchange rollover.

Key Risks Involved in Currency Carry Trades

While currency carry trades can offer consistent income through interest rate differentials, they are not risk-free. In fact, carry trades often perform well for extended periods and then experience sharp, sudden drawdowns when market conditions change. For this reason, disciplined risk management is essential for any trader considering this strategy.

Below are the two most significant risks associated with currency carry trades, explained in practical terms.

1) Exchange Rate Risk

The most immediate risk in a carry trade comes from adverse price movement.

A carry trade assumes that the target currency (the higher-yielding currency) will remain stable or appreciate against the funding currency. However, if the target currency weakens sharply:

- The open position can move into a capital loss

- The daily interest income may be insufficient to compensate for the price decline

- Long-term gains accumulated from rollover can be wiped out in a short period

This risk is particularly elevated during:

- Periods of risk-off sentiment

- Global market stress or financial shocks

- Sudden capital flight into safe-haven currencies such as the Japanese Yen (JPY) or Swiss Franc (CHF)

In such environments, carry trades are often unwound rapidly, leading to accelerated losses.

2) Interest Rate Risk

Carry trades are fundamentally dependent on central bank monetary policy, making them highly sensitive to interest rate expectations.

Two scenarios pose significant risk:

Rate Cuts in the Target Currency

If the central bank of the high-yielding currency reduces interest rates:

- The positive carry diminishes or disappears

- The strategy becomes less attractive to global investors

- Capital outflows may weaken the target currency

Rate Hikes in the Funding Currency

If the central bank of the funding currency raises interest rates:

- The interest rate differential narrows

- Borrowing costs increase

- The carry trade’s profitability declines

Either scenario can trigger a rapid repricing of currency pairs as market participants adjust to the new policy outlook.

Lessons from the 2008–2009 Global Financial Crisis

The global financial crisis of 2008–2009 highlighted the vulnerability of carry trades.

In response to the crisis:

- Many developed economies slashed interest rates to near-zero levels

- Traditional carry trade opportunities in major currencies diminished

- Traders were pushed toward higher-yielding emerging market currencies, which carried greater political, economic, and liquidity risk

When market conditions deteriorated, these higher-risk carry trades experienced severe drawdowns, reinforcing the importance of understanding macroeconomic risk and not relying solely on yield.

Risk Management Considerations for Carry Traders

To mitigate these risks, professional carry traders often:

- Monitor central bank communications and interest rate expectations

- Avoid overleveraging positions

- Align carry trades with long-term trend direction

- Use protective stop-losses and diversify across currency pairs

Key Takeaway

Currency carry trades can be profitable during stable, risk-on market conditions, but they are vulnerable to exchange rate volatility and shifts in monetary policy. Traders who understand these risks—and plan for them—are far better positioned to use carry trades as part of a sustainable, long-term forex strategy.

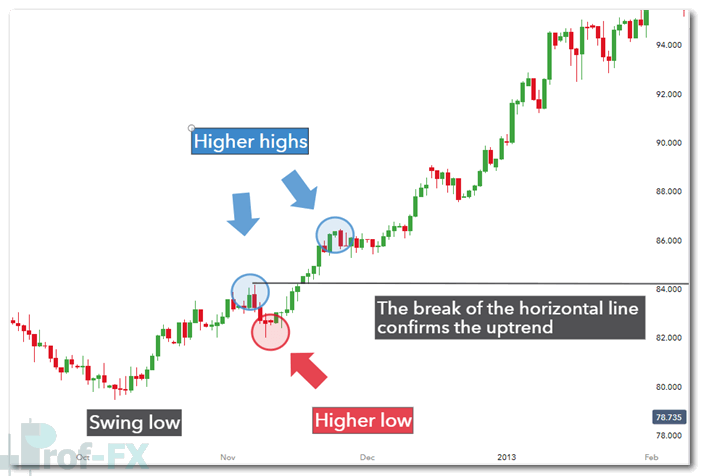

A Practical FX Carry Trade Strategy

Because carry trades are typically long-term positions, professional traders often combine them with trend-following analysis to improve probability.

Step 1: Trade in the Direction of the Trend

Carry trades perform best when aligned with strong, established trends. Traders should first confirm an uptrend using:

- Higher highs and higher lows

- Breaks above key resistance levels

In the example above, the break above the initial higher high confirms the bullish trend.

Step 2: Refine Entries Using Technical Tools

Once the trend is confirmed, traders may use:

- Multiple time frame analysis

- Trend indicators

- Support and resistance levels

This helps improve entry timing while maintaining a long-term bullish bias.

Conclusion: Is the Currency Carry Trade Right for You?

Currency carry trades offer traders two potential sources of profit:

- Interest rate differentials

- Exchange rate appreciation

However, these benefits come with risks tied to market volatility and central bank policy changes. For higher-probability outcomes, traders should:

- Align carry trades with strong trends

- Monitor interest rate expectations closely

- Apply strict risk management rules

When used correctly, the currency carry trade can be a powerful strategy for patient, disciplined forex traders seeking consistent returns over time.