The Bank of England (BoE) is the United Kingdom’s central bank and one of the most influential monetary authorities in the global forex market. For currency traders, particularly those trading GBP pairs, understanding how the BoE operates is essential. Shifts in Bank of England monetary policy can significantly impact the British Pound (GBP), as well as closely related currencies such as the Euro (EUR) due to strong regional and economic linkages.

Keeping track of BoE policy decisions, interest rate expectations, and official communication is a core part of macro-driven forex trading.

What Is the Bank of England (BoE)?

Founded in 1694, the Bank of England is one of the world’s oldest central banks. It serves as the banker to the UK government and is publicly owned, yet it operates with operational independence when setting monetary policy.

The Bank of England’s responsibilities include:

- Setting monetary policy, primarily through interest rate decisions

- Issuing UK banknotes

- Supervising key payment systems

- Safeguarding the stability and resilience of the financial system

For forex traders, the most important function of the BoE is its role in shaping monetary policy, as this directly influences capital flows, market sentiment, and exchange rates. While central bank independence is an important institutional feature, it tends to be a more pressing concern in emerging market economies than in developed markets like the UK.

Core Economic Mandates of the Bank of England

According to official Bank of England guidance, its policy framework is built around two main mandates:

1. Monetary Stability

2. Financial Stability

Both mandates work together to support long-term economic health, but from a forex trading perspective, monetary stability is the dominant driver of GBP spot price movements.

Monetary Stability and Inflation Control

Monetary policy plays a central role in preventing excessive inflation and anchoring long-term inflation expectations. This allows the economy to grow at a sustainable pace without overheating or slipping into deflation.

The Bank of England’s Monetary Policy Committee (MPC) has set a formal inflation target of 2%, measured by the Consumer Price Index (CPI).

When inflation rises above this target, the BoE may consider raising interest rates. Higher interest rates tend to:

- Attract foreign capital into GBP-denominated assets

- Support an appreciation of the British Pound

- Increase borrowing costs for businesses and consumers

- Place downward pressure on equity valuations due to higher discount rates

Upcoming inflation releases, interest rate decisions, and MPC statements are closely watched by traders and can be tracked using a professional economic calendar.

However, traders must understand an important nuance:

Inflation above 2% does not automatically lead to interest rate hikes.

If inflation is elevated while GDP growth remains weak or negative, the Bank of England may keep interest rates low to support economic activity. This highlights the BoE’s constant effort to strike a balance between price stability and economic growth.

Financial Stability and the UK Economy

Financial stability is essential to the long-term health of the UK economy. To support this objective, the Bank of England established the Financial Policy Committee (FPC) in June 2011.

The FPC focuses on identifying and reducing systemic risks within the financial system, including risks related to credit growth, banking leverage, and asset bubbles. While financial stability tools can indirectly affect market sentiment, monetary policy remains the primary driver of GBP movements in the forex market.

How Bank of England Interest Rates Affect the Pound (GBP)

Interest Rate Expectations and Currency Valuation

The Bank of England influences the value of the British Pound mainly through changes in interest rate expectations. For traders, this distinction is critical.

Currencies typically move not because rates have changed, but because the market’s expectations about future rates have shifted.

For example:

- If the BoE leaves rates unchanged but signals future rate hikes through forward guidance, the Pound may appreciate.

- If the BoE signals fewer future hikes—or potential cuts—the Pound may weaken.

This forward-looking nature of the forex market explains why GBP often moves sharply during MPC statements and press conferences, even when policy rates remain unchanged.

General Market Relationships

While markets do not always react perfectly, the following principles generally apply:

- Higher interest rate expectations

- Strengthen the British Pound (GBP)

- Tend to weigh on equity markets

- Lower interest rate expectations

- Weaken the British Pound (GBP)

- Tend to support equity markets

Quantitative Easing and the Pound

Interest rates are not the only policy tool used by the Bank of England. Quantitative easing (QE) has also played a major role in shaping GBP valuation.

When the BoE announces or expands a QE program:

- Liquidity in the financial system increases

- The supply of money rises

- Interest rates are pushed lower or kept artificially suppressed

As a result, the Pound often depreciates, as lower yields reduce the currency’s attractiveness to global investors. Even changes in expectations of QE—rather than the policy itself—can move GBP significantly.

Interest Rate Impact on the Real Economy

The Bank of England lowers interest rates to stimulate economic growth and raises them to cool an overheating economy.

Lower interest rates support the economy through several key channels.

First, businesses can borrow at lower costs, allowing them to invest in projects with returns above the borrowing rate.

Second, equity markets are discounted at lower rates, which often boosts asset prices and creates a wealth effect that supports consumer spending.

Third, investors are incentivized to allocate capital into productive assets—such as stocks and real estate—rather than holding cash at low yields.

These economic effects eventually feed back into the forex market through capital flows and investor confidence.

How to Trade Bank of England Interest Rate Decisions

Successful trading around BoE announcements requires comparing market expectations with actual policy outcomes. The table below outlines common scenarios and their typical impact on currencies:

| Market Expectations | Actual Outcome | FX Impact |

| Rate Hike | Rate Hold | Currency Depreciation |

| Rate Cut | Rate Hold | Currency Appreciation |

| Rate Hold | Rate Hike | Currency Appreciation |

| Rate Hold | Rate Cut | Currency Depreciation |

Because markets are forward-looking, currencies react most strongly when expectations are surprised.

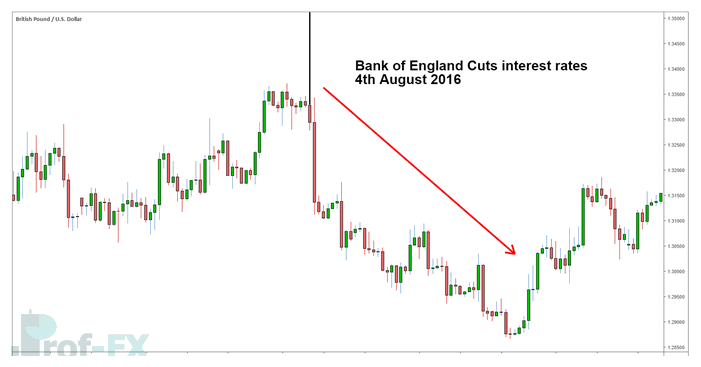

Case Study: GBP/USD and the 2016 BoE Rate Cut

A notable example occurred on August 4, 2016, when the Bank of England cut interest rates and announced a broad stimulus package, including a quantitative easing program.

The market reaction was swift. GBP/USD declined sharply as investors reassessed interest rate expectations and future yield prospects. This event clearly demonstrated how combined policy actions—rate cuts and QE—can exert strong downward pressure on a currency.

Key Takeaways for Forex Traders

The Bank of England is a primary driver of British Pound valuation.

GBP movements are driven by changes in interest rate expectations, not just actual policy changes.

Quantitative easing can have effects similar to interest rate cuts and often weakens the Pound.

Rising inflation alone does not guarantee tighter policy—the BoE always weighs inflation against economic growth.

Stay Informed With Professional Trading Tools

Using a reliable economic calendar helps traders stay ahead of Bank of England interest rate decisions, MPC speeches, and major macroeconomic releases.

It is also recommended to bookmark a Central Bank Rates Calendar to prepare for recurring policy announcements that may drive GBP volatility.

To strengthen your macro foundation, understanding how central banks operate in the forex market and how central bank interventions work can significantly improve trading decisions.

If you are new to trading, start with a comprehensive Forex Trading Beginner’s Guide to build a solid foundation.