Key Insights for Developing Consistent Trading Habits

Consistency is a cornerstone of long-term success in trading. A uniform and structured approach helps traders make rational, informed decisions instead of being driven by short-term emotions or market noise. However, achieving consistent profitability is less about having a flawless system that captures every pip and more about applying a method you fully understand and trust.

This article explores the importance of trading consistency – from the type of market analysis and trading tools you use, to execution discipline and risk management principles.

What Does Consistency in Trading Really Mean – And Why Is It So Important?

Consistency in trading refers to the repeated, disciplined application of specific trading principles over time. This predictable behavior helps traders avoid over-trading, reduces emotional interference, and supports solid risk management practices.

Core characteristics of consistent trading include:

- Adhering to a trading strategy

- Conducting structured analysis

- Avoiding both over-trading and under-trading

- Applying proper risk management

- Tracking and reviewing trades regularly

Consistency acts as the foundation for long-term trading success because it minimizes irrational decision-making. Emotional trading often results in erratic entries, exits, and position sizes—leading to unstable performance.

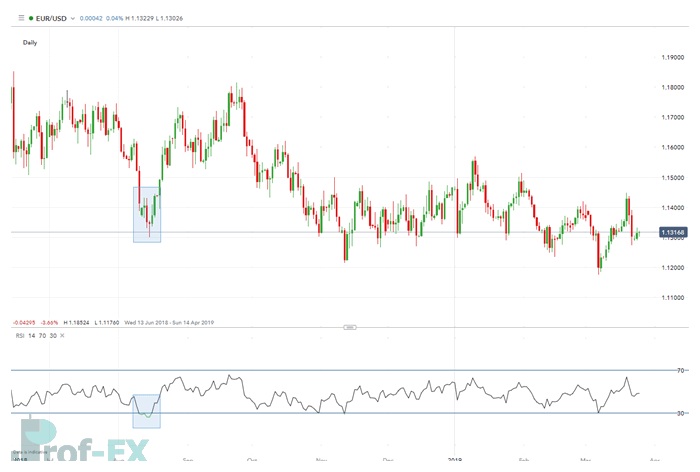

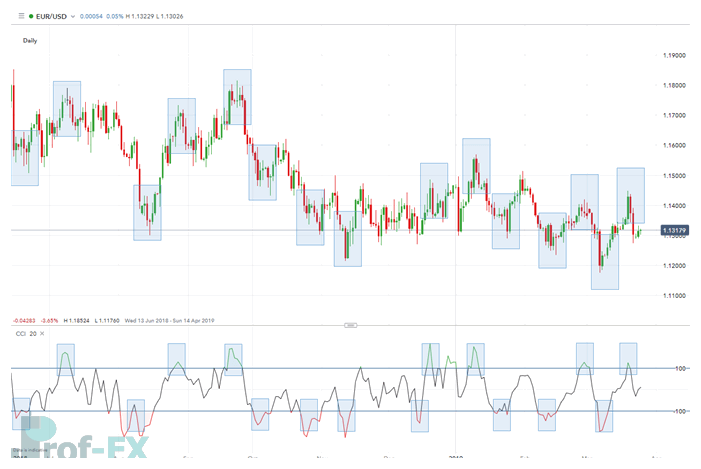

For example, the first chart (EUR/USD Daily with RSI) demonstrates how a simple RSI-based strategy identifies key entry and exit points in a trending market. The second chart (EUR/USD Daily with CCI) shows how switching to a different oscillator may dramatically increase the number of overbought/oversold signals—highlighted by the blue rectangles.

This comparison illustrates the risk of frequently changing strategies. Even small modifications, such as using a different oscillator, can lead to drastically different trading decisions. Since most trading systems are far more complex than these examples, inconsistent application of a strategy often leads to unpredictable results.

Chart 1: Daily EUR/USD Using the RSI Indicator

Chart 2: Daily EUR/USD Using the CCI Indicator

How to Build a Consistent Trading Strategy

There are several actionable steps traders can take to develop a consistent approach. Planning ahead, managing risk effectively, and maintaining a trading journal are among the most valuable.

1. Create a Comprehensive Trading Plan

A detailed trading plan acts as a roadmap for your decision-making. It helps you stay focused, avoid emotional reactions, and navigate both the elements you control and those you cannot. To prevent “analysis paralysis,” many traders benefit from using a minimalist approach—focusing on a small set of tools or analytical methods.

Since there are countless ways to analyze the markets—and no single “correct” approach—the key is to stay consistent with whichever methods you choose.

2. Maintain Consistency in Trade Execution

Execution is often where traders lose discipline. For example, when trading breakouts, will you enter immediately once the price breaches a level, or wait for a candle close? Either method can be valid, but switching between them leads to inconsistency and confusion.

Consistency in execution ensures that your strategy produces repeatable, measurable results over time.

3. Apply Uniform Risk Management

Risk management is arguably the most critical factor in trading success—and also where many traders fail. To achieve consistent results, traders must apply risk rules consistently.

Trading is ultimately a probability game: win percentage × risk/reward ratio. If your risk per trade is inconsistent, even a strong strategy may underperform.

Example:

If a trader gains 2% on one trade, loses 4% on the next, and gains 1% on another, the results will be negative—even though the trader won two out of three trades. This imbalance shows why consistent risk allocation and favorable risk/reward ratios are essential.

4. Maintain a Detailed Trading Journal

A trading journal is a powerful tool for developing consistency. Whether updated daily or weekly, it helps traders monitor performance, analyze behavioral patterns, and refine their strategies. Reviewing past trades and comparing them to the trading plan helps identify deviations and areas of improvement.

What About a Consistent Forex Trading Strategy?

Consistency starts with choosing a strategy that matches your trading personality, resources, and time commitment. Most forex traders rely on either technical analysis, fundamental analysis, or a combination of both.

You can explore how technical and fundamental analysis complement each other to strengthen your overall strategy.

Additional Resources to Strengthen Your Trading Skills

- Our research team analyzed more than 1 thousand live trades to identify what sets successful traders apart. Apply these insights to gain an edge in the market.

- Beginners should start by mastering trading basics. Visit our Forex Course for a complete introduction to the forex market.