The Swiss National Bank: A Forex Trader’s Guide

The Swiss National Bank (SNB) plays a critical role in the global forex market, particularly for traders who actively monitor movements in the Swiss Franc (CHF). As Switzerland’s central bank, the SNB is responsible for maintaining monetary and financial stability—two pillars that directly influence currency valuation, interest rate expectations, and capital flows.

For forex traders, understanding how the Swiss National Bank operates is not optional. Changes in SNB monetary policy often lead to significant volatility in CHF pairs such as EUR/CHF, USD/CHF, and GBP/CHF. This article will guide you through the SNB’s mandate, its policy tools, and how traders can interpret interest rate decisions more effectively.

What Is the Swiss National Bank (SNB)?

The Swiss National Bank was established in 1907 and serves as the central authority for Switzerland’s monetary policy. One of its primary responsibilities is issuing Swiss Franc banknotes and ensuring the smooth functioning of the financial system.

Unlike many central banks, the SNB has a unique ownership structure. While it operates independently, it is partially privately owned, with the majority of its shares held by Swiss Cantons and Cantonal banks. This structure does not diminish its independence, but it does add an institutional characteristic that is often discussed in academic and policy circles.

Like other major central banks—such as the Federal Reserve, European Central Bank (ECB), and Bank of England (BoE)—the SNB relies on a range of monetary policy instruments to guide inflation, economic growth, and currency stability. Among these tools, interest rate policy and forward guidance are the most relevant for forex traders.

Core Economic Mandates of the Swiss National Bank

According to official SNB communications, its policy framework is built around two main objectives:

1. Price Stability

2. Sustainable Economic Development

These mandates are closely connected and often require careful balancing, especially during periods of economic uncertainty or global financial stress.

Price Stability and Inflation Control

Price stability is at the heart of SNB monetary policy. The central bank defines price stability as an annual inflation rate below 2%, measured by the Consumer Price Index (CPI).

Monetary policy plays a vital role in anchoring inflation expectations and preventing both runaway inflation and prolonged deflation. When inflation rises persistently above the SNB’s target range, the central bank may consider tightening policy—most commonly through interest rate increases.

Higher interest rates tend to:

- Attract foreign capital seeking higher yields

- Strengthen the Swiss Franc (CHF)

- Increase borrowing costs for businesses and households

- Apply downward pressure on equity valuations

However, traders should avoid oversimplifying this relationship. Inflation above 2% does not automatically lead to rate hikes.

If inflation rises while GDP growth remains weak or negative, the SNB may choose to maintain accommodative policy to support economic activity. This highlights a crucial concept for traders:

The SNB always seeks a balance between inflation control and economic growth.

Upcoming inflation data, interest rate announcements, and SNB speeches can be tracked using a professional economic calendar, which remains an essential tool for macro-focused traders.

Economic Development and Monetary Policy Alignment

Economic development is deeply intertwined with monetary policy decisions. Indicators such as GDP growth, employment data, export performance, and financial stability metrics influence how the SNB assesses the economic outlook.

When economic momentum weakens, central banks—including the SNB—often adjust their policy stance to stabilize growth. This may involve lower interest rates, liquidity support, or verbal intervention through forward guidance.

For forex traders, these shifts often precede changes in interest rate expectations, which are a key driver of currency movements.

How SNB Interest Rates Influence the Swiss Franc (CHF)

One of the most important lessons for forex traders is this:

Currencies move based on changes in interest rate expectations, not just actual rate changes.

The Swiss National Bank influences the Swiss Franc primarily through its impact on expected future interest rates. Even when rates remain unchanged, shifts in guidance or tone can move the market significantly.

The SNB, like other central banks, uses:

- Policy rate decisions

- Forward guidance

- Liquidity measures

- Balance sheet operations

The forex market continuously prices in these expectations. When expectations shift, CHF can appreciate or depreciate rapidly—sometimes well before any official policy action occurs.

General Market Principles

- Rising interest rate expectations

- CHF strengthens

- Equity markets tend to weaken

- Falling interest rate expectations

- CHF weakens

- Equity markets tend to benefit

Understanding this relationship helps traders position themselves ahead of major policy announcements.

Interest Rates and Their Impact on the Real Economy

The Swiss National Bank lowers interest rates when it aims to stimulate economic growth and raises them when the economy shows signs of overheating.

Lower interest rates support the economy through several channels:

First, businesses can borrow at lower costs, allowing them to invest in projects with positive expected returns above the borrowing rate.

Second, equity markets are discounted at lower rates, which often leads to higher stock valuations and a wealth effect that supports consumer spending.

Third, investors are encouraged to allocate capital into risk assets—such as stocks and real estate—rather than holding cash at very low yields.

All of these dynamics feed back into currency valuation through capital flows and investor sentiment.

How to Trade SNB Interest Rate Decisions

To trade SNB announcements effectively, traders must compare market expectations with actual policy outcomes. The table below outlines common scenarios and their typical impact on currencies:

| Market Expectations | Actual Outcome | FX Impact |

| Rate Hike | Rate Hold | Currency Depreciation |

| Rate Cut | Rate Hold | Currency Appreciation |

| Rate Hold | Rate Hike | Currency Appreciation |

| Rate Hold | Rate Cut | Currency Depreciation |

These reactions occur because markets are forward-looking. When expectations are disappointed or exceeded, price adjustments happen quickly.

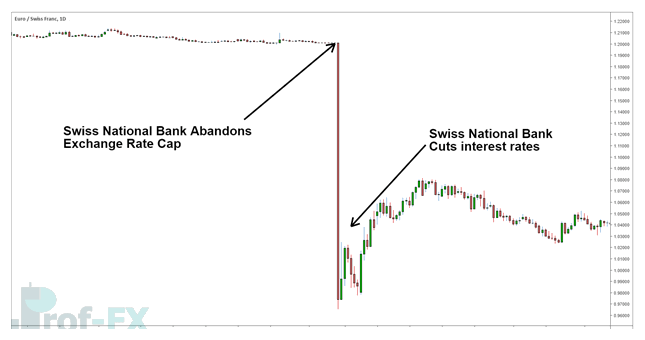

Case Study: SNB Shock and EUR/CHF in 2015

A classic example of SNB influence occurred in January 2015, when the central bank unexpectedly abandoned its exchange rate cap of 1.20 on the EUR/CHF pair.

The result was immediate and dramatic. The Swiss Franc appreciated by nearly 20% in a very short period. This move highlighted the power of central bank intervention—and the risks traders face when policy credibility shifts suddenly.

Following the shock, Swiss policymakers moved toward negative interest rates, which eventually contributed to a depreciation of the CHF as capital flows adjusted.

Key Takeaways for Forex Traders

The Swiss National Bank is a fundamental driver of Swiss Franc valuation.

The CHF reacts primarily to changes in interest rate expectations, not just actual rate decisions.

Unconventional policies, such as quantitative easing, can have effects similar to interest rate changes.

Rising inflation alone does not guarantee tighter policy—the SNB always weighs inflation against economic growth.

Stay Informed With Professional Trading Tools

Using a reliable economic calendar allows traders to track SNB interest rate decisions, central bank speeches, and key macroeconomic releases.

It is also recommended to monitor a Central Bank Rates Calendar to prepare for recurring policy announcements that may impact CHF volatility.

For traders looking to deepen their understanding, learning how central bank interventions work can significantly improve macro-based trading strategies.

If you are new to forex, start by mastering the fundamentals in a comprehensive Forex Trading Beginner’s Guide.

Understanding Other Major Central Banks

While most central banks share similar mandates, each institution has unique policy frameworks and communication styles. Expanding your knowledge across multiple central banks can enhance your macro trading edge.

Learn more about:

- The European Central Bank (ECB)

- The Bank of England (BoE)

- The Swiss National Bank (SNB)

- The Federal Reserve (Fed)