The forces of supply and demand seem to drive every other market on earth, so why shouldn’t they also drive the Forex market? As you just saw in our brief history section, even when the governments of the world’s leading economies were trying to control currency prices, the forces of supply and demand won out in the end.

Of course, it is relatively simple to explain the impact that shifts in supply and demand will have on the value of a currency. It is another thing entirely to try to explain what factors cause those shifts, but that is exactly what we are going to do.

Just to make sure that we are all on the same page as we discuss how various fundamental forces affect the Forex market; however, let’s take a moment to review the basics of supply and demand.

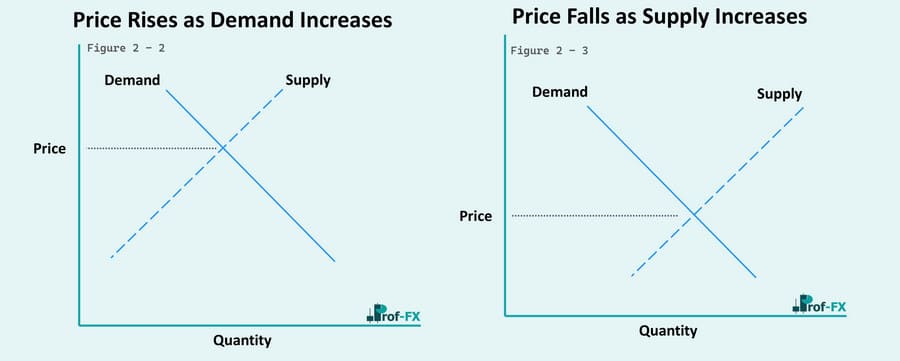

Figure 2.1 shows a typical supply and demand chart. Demand for a currency is represented by the solid line that is sloping downward from left to right, and supply of a currency is represented by the dashed line that is sloping upward from left to right. The point at which these two lines cross represents the price that the market has set for the currency.

As we look at these charts, we are going to try to keep things as simple as possible. The slope of the lines is not going to change.

Instead, we are going to locus solely on increases and decreases in the overall level of supply and demand. Here’s how it works:

- When supply and demand increase, the lines move horizontally from left to right along the x axis.

- When supply and demand decrease, the lines move horizontally from right to left along the x axis.

Now that we’ve got the basics covered, let’s take a look at what happens to the value of a currency when demand for that currency increases. As you can see in Figure 2.2, increasing demand for a currency increases the value of that currency.

So if increasing demand increases the value of a currency, what happens when the supply of that currency increases? As you can see in Figure 2.3, increasing supply of a currency decreases the value of that currency.

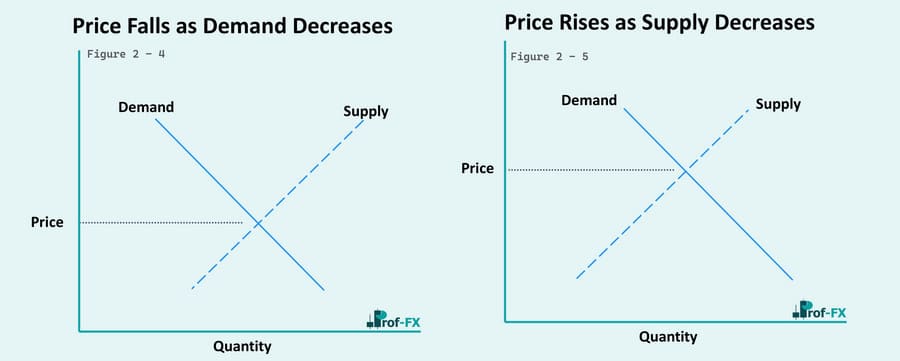

We’ve now seen what happens when we see an increase in either demand or supply. Now let’s explore what happens when we see a decrease in either demand or supply. As you can see in:

Figure 2.4, decreasing demand for a currency decreases the value of that currency.

And as you have probably guessed by now, and as you can see in Figure 2.5, decreasing supply of a currency increases the value of that currency.

So there you have it – the basics of supply and demand in the Forex market. Now it’s time to dig a little dipper and analyze which forces push supply and demand in one direction and which forces push them in the other direction.

Supply and demand in the currency market are driven primarily by the following five factors.

- Trade flows

- Investment flows

- Money supply

- Government interventions and currency manipulation

- Investor fear

Let’s take a look at each of these five factors to make sure that we have a handle on why each one is important. Since the U.S. dollar is the most widely traded currency, we are going to look at each of these factors from a U.S. dollar perspective, but we will be conducting a thorough review of how these five factors relate to each individual currency, “Getting to Know the Currencies,”.