Forex speculation sits at the heart of the global currency market. Regardless of experience level, every trader eventually faces the moment of commitment—pressing buy or sell based on an uncertain forecast. Even with solid analysis, the market can deliver outcomes far different from expectations, often forcing traders into uncomfortable introspection.

In this expanded guide, we will break down the psychological framework behind speculation and address the core questions that most forex traders face on their journey toward consistency.

Key Insights Covered in This Article

- What does speculation truly mean in the foreign exchange market?

- What happens psychologically when trades go wrong?

- How professional traders master mental discipline

- Four actionable tips to speculate with confidence and structure

- Entity-rich insights on market behavior, price action, EUR/USD conditions, risk management, and trader psychology

What Is Forex Speculation? A Clear and Practical Explanation

Forex speculation refers to the buying and selling of currency pairs with the intention of generating a profit from price movements. It is called “speculation” because outcomes are never guaranteed—currencies respond to complex forces such as macroeconomic data, central bank policy, geopolitical risks, market sentiment, and liquidity conditions.

Traders assess the probability of price moving upward or downward based on analysis—technical, fundamental, or both—before executing any position.

While speculation is inherently uncertain, it becomes manageable when traders apply structured analysis, disciplined risk management, and psychological resilience.

When Everything Goes Wrong: Understanding the Psychology Behind Trading Failure

After building a trading strategy, studying price action, and learning how the forex market functions, you may feel equipped for success. However, when results fail to match expectations, doubt begins to creep in:

- “Is my strategy wrong?”

- “Do I actually know what I’m doing?”

These thoughts are incredibly common—even among seasoned traders. Understanding how to process them is part of the growth curve.

Let’s address the psychological questions directly.

1. “Am I Trading the Right Strategy?” — Adapting to Market Conditions

One of the biggest oversights new traders make is assuming that market conditions remain constant. But forex markets evolve. Volatility contracts and expands, trends strengthen and fade, and trading environments shift based on global economic cycles.

A trader may spend weeks studying a strategy that works brilliantly during one phase—only to see it fail when conditions change.

A clear example is the EUR/USD price environment:

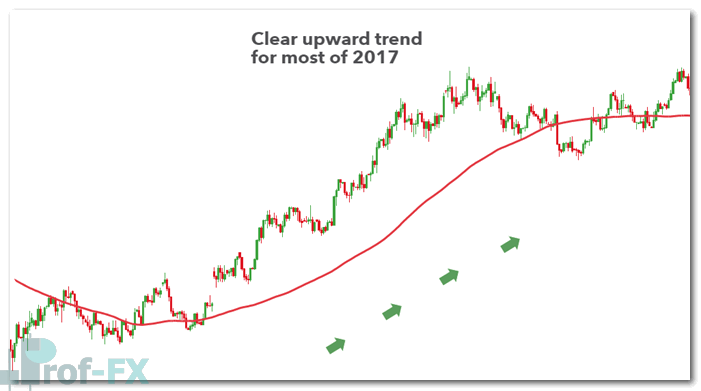

EUR/USD – A Strong Uptrend

In 2017, EUR/USD sustained a pronounced uptrend. Trend-following strategies, after backtesting, appeared both logical and profitable.

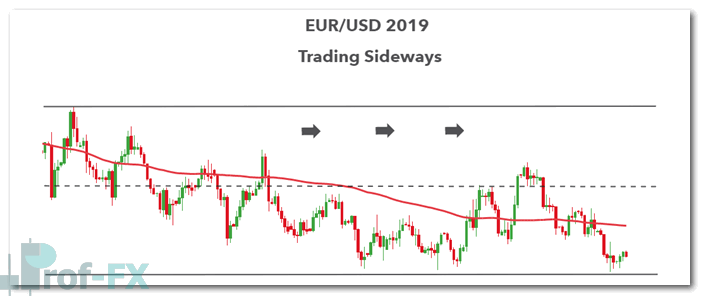

EUR/USD – A Sideways Market

By contrast, the first half of 2019 delivered range-bound, sideways movement. The 200-day moving average cut through price repeatedly, offering little directional clarity.

If your strategy suddenly stops performing, it may not be flawed—the market may have simply changed its behavior. Skilled traders continuously evaluate market conditions and adjust expectations accordingly.

2. “Do I Really Know What I’m Doing?” — The Reality of Learning Through Failure

As the saying goes:

“FAIL: First Attempt in Learning.”

Every trader starts with limited knowledge and gradually improves through repetition, reflection, and correction. Instead of questioning your competence, analyze what successful traders avoid.

At Prof FX, research using more than 30 million live trades from IG revealed the number one mistake traders make. Insights from the Traits of Successful Traders report show that many failures stem from behavioral issues—not analytical weakness.

The lesson:

Understand where traders commonly go wrong, then build habits to avoid those traps.

4 Professional Tips to Speculate Successfully and Regain Control

1. Don’t Let Risk Influence Your Behavior — Mastering Loss Aversion

Loss aversion is one of the most powerful psychological biases in trading. Traders feel the pain of a loss more intensely than the pleasure of an equally sized win.

Professionals prioritize risk management over trade frequency or excitement.

Even if you win 60–70% of trades, your account can still blow up without proper stop-loss usage. Many traders let losers run while cutting winners short—creating a negative expectancy.

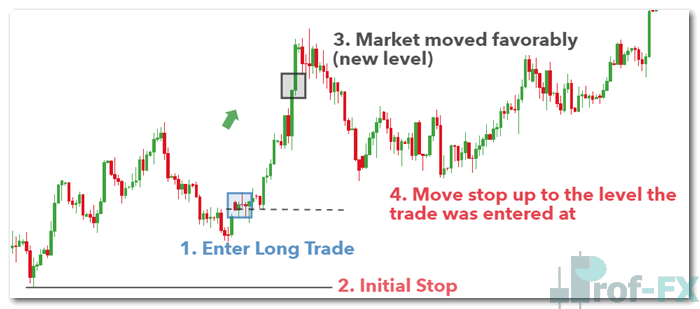

A powerful solution is to use a trailing stop or manually adjust your stop-loss once price moves in your favor. This approach helps you reduce emotional pressure and lock in gains.

Before placing any trade, define:

- Your acceptable risk level

- Your stop-loss distance

- A risk-to-reward ratio of at least 1:1 (preferably 1:2 or better)

This keeps speculation structured instead of emotional.

2. Approach the Charts With a Positive Mindset Every Day

Losses are inevitable in forex trading. Therefore, traders must prevent losses from shaping their emotional state.

Being stopped out often creates frustration or self-doubt. When this emotional shift happens, traders might:

- Force trades

- Skip analysis

- Modify their strategy impulsively

Think like a business owner: treat losses as operational expenses. When viewed in the context of the bigger picture, losses become manageable, not debilitating.

Mastering this mindset is a fundamental pillar of trading psychology.

3. Balance Fear and Greed — The Emotional Tug-of-War in Forex Trading

Fear and greed influence nearly every decision in financial markets. Both can sabotage your strategy:

- Greed encourages you to hold losing positions, hoping price returns.

- Fear pushes you to close profitable trades prematurely.

Professionals reverse these emotional impulses:

- Be patient and “greedy” when the market validates your analysis.

- Be “fearful” of losses early by protecting capital through stops.

If fear becomes overwhelming, using a breakeven stop can mentally free you while protecting your account.

4. Avoid Overconfidence — Consistency Matters More Than Winning Streaks

After several winning trades, confidence naturally grows. Yet excessive confidence leads to dangerous habits:

- Increasing position size impulsively

- Ignoring risk parameters

- Breaking your own rules

- Entering trades without proper justification

Successful forex traders maintain equilibrium—neither fearful nor overly confident. Consistency, not excitement, drives long-term results.

Additional Resources for Improving Your Forex Trading

- Enhancing your psychological discipline often begins with structured risk tools such as stop-loss orders and a positive risk-to-reward ratio.

- Prof FX also provides a variety of forex trading guides to strengthen your understanding of market structure, strategy development, and trader behavior.

- Many traders mistakenly believe they need a “perfect strategy.” In reality, simple, consistent systems often outperform complex ones.

- Explore our guide on how to trade consistently without needing the perfect strategy to develop confidence and clarity in your trading approach.