|

|

|

|

What Is the NXC Slope Divergence Indicator

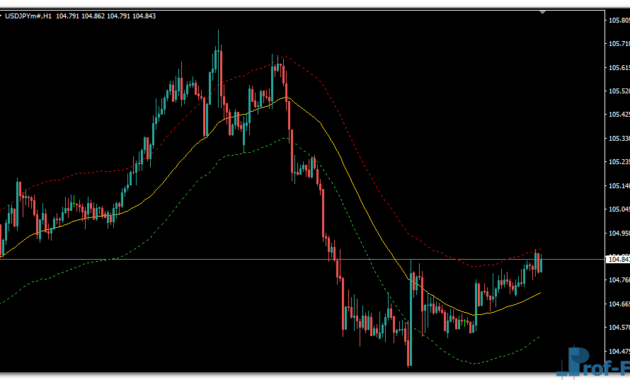

The NXC Slope Divergence Indicator for MT4 is a precision-engineered momentum and divergence analysis tool designed to help traders detect early market reversals before they appear on price charts. Created by the legendary Mladen, this indicator refines how traders read momentum by combining slope direction, signal smoothing, and divergence detection within a single framework.

Unlike standard oscillators that react slowly to price shifts, NXC Slope Divergence integrates advanced slope calculations and real-time divergence alerts. It shows when price continues in one direction while momentum weakens — a clear warning that a trend may be nearing exhaustion. Whether you trade reversals, breakouts, or trend continuations, this indicator provides an intelligent edge through visual clarity and analytical accuracy.

Many traders consider it one of the best custom indicators for MT4 because it brings professional-grade momentum reading into a compact, user-friendly format that works on any timeframe and market — from forex to indices or commodities.

See also: Overbought Oversold Range

How It Works — NXC Slope Divergence

The NXC Slope Divergence Indicator operates on a foundation of momentum slope analysis. It computes how fast momentum changes relative to recent price movement, converts that into a smoothed line, and then tracks when price and momentum start to disagree — signaling potential divergence setups.

Let’s break down how it functions step by step:

Momentum Calculation:

The indicator analyzes the slope of price changes across the chosen period. Instead of simply measuring how far price moves, it measures how fast that move accelerates or decelerates.

Signal Smoothing:

To eliminate noise, NXC applies smoothing algorithms, producing a steady slope line that oscillates around a zero level. This helps traders distinguish between genuine momentum shifts and random volatility.

Divergence Detection:

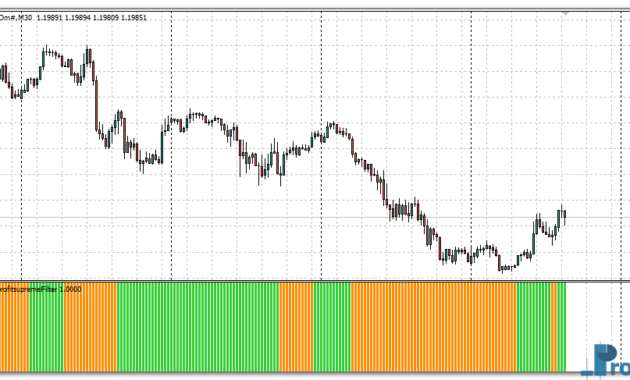

The real power of this indicator lies in its automatic divergence detection system. It identifies two main divergence types:

- Bullish Divergence: Price makes lower lows, but the slope indicator makes higher lows — suggesting selling pressure is fading, and buyers may soon regain control.

- Bearish Divergence: Price prints higher highs, but the indicator shows lower highs — signaling momentum weakness and a potential upcoming reversal.

Visual Alerts and Color Codes:

The indicator plots colored lines and markers directly on the chart and oscillator window, giving you instant visual feedback. Color changes often correspond to shifts from bullish to bearish slope or vice versa.

In short, when price diverges from momentum, the indicator warns you early, allowing you to prepare for potential turning points before they become obvious to the crowd.

NXC Slope Divergence Indicator Settings

The indicator offers flexible inputs that let traders tune its sensitivity and appearance. Here’s how you can adjust it for your trading style:

- Slope Period:

Defines the number of bars used for calculating the slope. A shorter period reacts faster but may generate more false signals; a longer period smooths out market noise. - Smoothing Method:

Allows you to choose how aggressively the slope is smoothed. Experiment with this setting depending on your preferred timeframe — tighter smoothing for scalping, lighter smoothing for swing trading. - Divergence Detection:

Enables or disables automatic divergence signals. Keeping it enabled helps highlight early reversal zones directly on your chart. - Color Customization:

You can modify bullish and bearish colors for both slope lines and divergence markers, ensuring visibility against any chart background. - Alerts:

Optional sound and pop-up alerts can be turned on so you never miss a potential divergence setup.

Recommended Settings

For most traders, the default parameters work effectively across standard timeframes (M15–H4). However:

- Scalpers can lower the slope period for faster reaction.

- Swing traders may increase it for smoother, more reliable trend recognition.

- Day traders can blend both by combining short and medium-term configurations on multiple charts.

How to Use the NXC Slope Divergence Indicator in Forex Trading

The NXC Slope Divergence Indicator is versatile enough to integrate into virtually any forex trading strategy. Here are several proven applications:

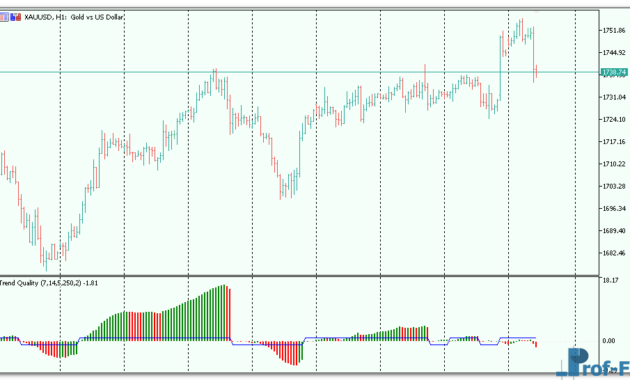

1. Reversal Trading

When the indicator displays a bullish divergence, and price forms a double bottom or a strong rejection candle, it’s often an early entry opportunity for a long trade. Conversely, a bearish divergence near resistance zones can signal an optimal short setup.

Combine this with price action vs indicators logic — for example, wait for a confirming candlestick pattern to validate the divergence.

2. Trend Continuation Filter

If the slope remains aligned with the trend (for instance, positive slope in an uptrend), it can confirm trend strength. Use this as a filter to avoid counter-trend trades and stay on the right side of market momentum.

3. Confluence with Other Tools

For better accuracy, traders often combine NXC Slope Divergence with:

- Moving averages (to confirm overall direction)

- Support/resistance zones

- Fibonacci retracements

- Other technical indicators for forex strategies such as MACD or RSI

This layered confluence approach refines entry timing and improves win rate.

4. Risk Management Applications

Use divergence alerts as exit signals when holding positions in mature trends. When you notice bearish divergence forming during a long trade, consider tightening your stop-loss or partially taking profit to lock in gains.

Why Traders Prefer NXC Slope Divergence

- Early warning system for reversals before price action confirms it.

- Visually clear slope color shifts make trend direction obvious at a glance.

- Automatic divergence plotting removes guesswork and saves time.

- Works across all markets (forex, indices, metals, crypto).

- Compatible with other MT4 indicators for multi-indicator strategy building.

By highlighting the balance between price action and internal momentum, NXC Slope Divergence helps you make faster, smarter decisions — a vital edge in fast-moving forex environments.

How to Instal “NXC Slope Divergence” Indicator for Metatrader 4

- Open your Metatrader 4 platform.

- Download and save the “NXC Slope Divergence” indicator to your desktop or any other folder located on your local computer.

- Choose “File” then “Open Data Folder” (Ctrl + Shift + D) on your Metatrader 4 platform.

- Explore the following folder: MQL4 > Indicators.

- Copy and paste the “NXC Slope Divergence” indicator into this folder.

- Restart Metatrader 4.

- “NXC Slope Divergence” indicators are stored by default in the custom indicator folder.

- To access these indicators, go to Top Menu > Insert > Indicators > Custom.

- In order to add a “NXC Slope Divergence” indicator to any of your Metatrader 4 charts, you will need to select a forex chart with one mouse click, then go to Top Menu > Insert > Indicators > Custom > click the “NXC Slope Divergence”.

- Done!

See a complete guide How To Install Metatrader 4 Custom Indicators

Final Thoughts

The NXC Slope Divergence Indicator for MT4 bridges the gap between technical clarity and trading practicality. It turns complex momentum dynamics into straightforward, visual signals you can act on. For traders who want to understand why a market is slowing down before it turns, this tool delivers valuable insights.

If you want to elevate your technical analysis, refine your timing, and identify reversals before they fully develop, this indicator deserves a spot in your trading toolkit.

Free Download NXC Slope Divergence indicator for Metatrader 4

- nxc-slope-divergence.zip

- Size: 85.7 kb

- Platform: MT4 | Format: .mql4/.ex4 | File: dir9mt4 | Request Remove!