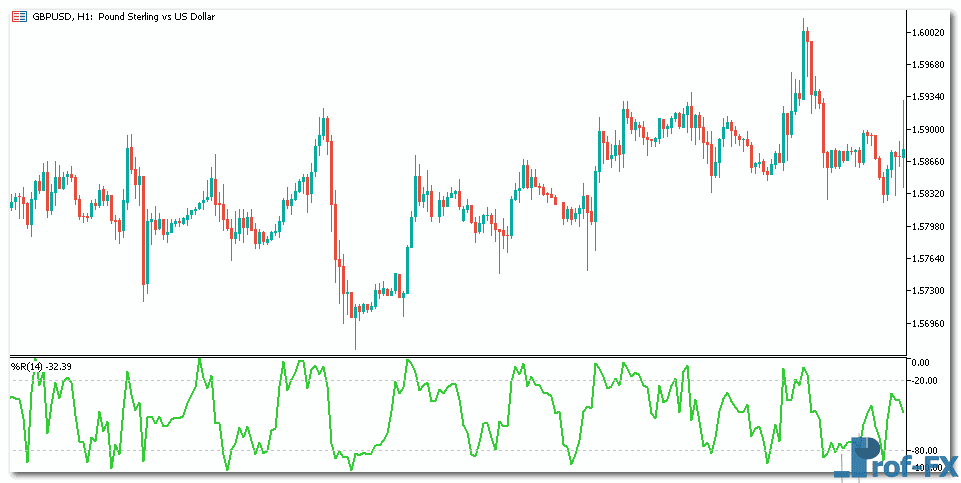

The Williams’ %R indicator, invented by Larry Williams measures momentum in the forex market. The Williams’ %R indicator oscillates between -100 and 0.

Readings above -20 are considered overbought while readings below -80 are considered oversold.

GBP/USD Williams’ %R Hourly Chart

Type of technical indicator: Momentum oscillator

Forex signals from the Williams’ %R oscillator

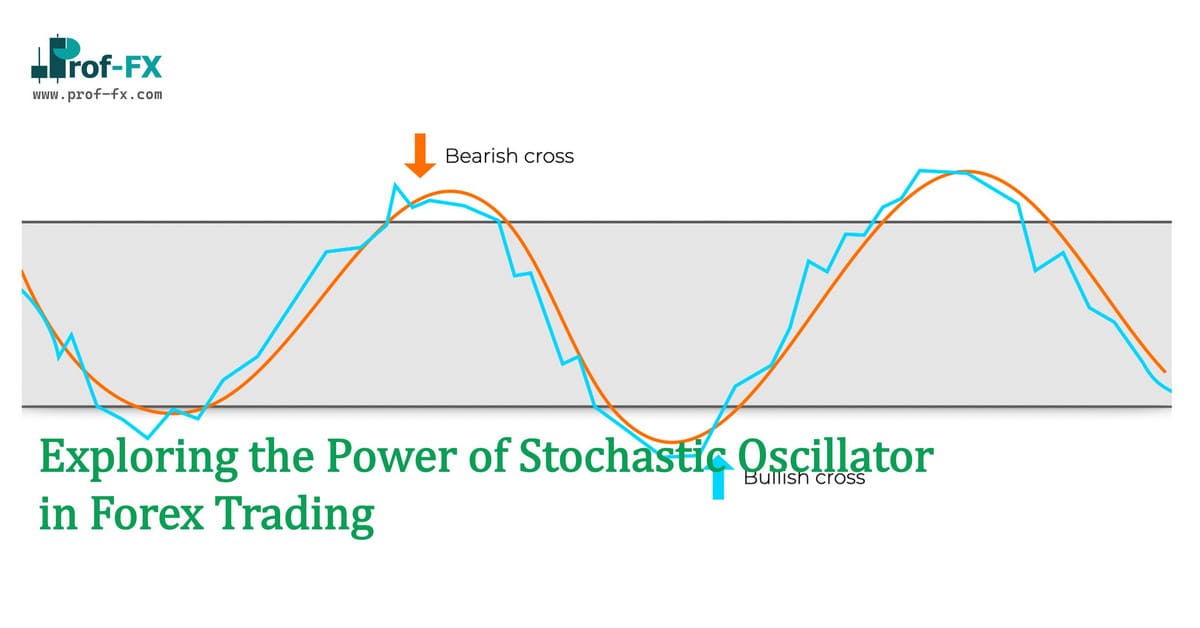

The approach is very similar to that of trading the Stochastic Oscillator.

1. In trending markets

Oversold values (-80 to -100): Look to buy dips in up trends.

Overbought values (-20 to -0): Look to sell rallies in downtrends.

2. In range bound markets

Oversold values (-80 to -100): Look for opportunities to buy near the low of the trading range.

Overbought values (-20 to -0): Look for opportunities to sell near the high of the trading range.

Powerful trading combinations with the Williams’ %R indicator

Always use in conjunction with other analysis tools/indicators to make better trading decisions in the forex market.

Our preferences: Candlestick patterns, trend lines and trend following indicators.