The London trading session is widely recognized as the most influential period in the global forex market. According to data from the Bank for International Settlements (BIS), the London session accounts for approximately 35% of total average daily forex turnover, making it the single largest contributor to global trading volume.

What makes this session even more significant is its overlap with the New York session, a period when two of the world’s largest financial centers are active simultaneously. For forex traders—especially those focused on volatility, liquidity, and momentum—the London session offers some of the most dynamic trading conditions of the day.

In this guide, I will walk you through the essential characteristics of the London session, optimal trading hours, suitable currency pairs, and practical breakout strategies that beginner traders can realistically apply.

London Forex Market Opening Hours Explained

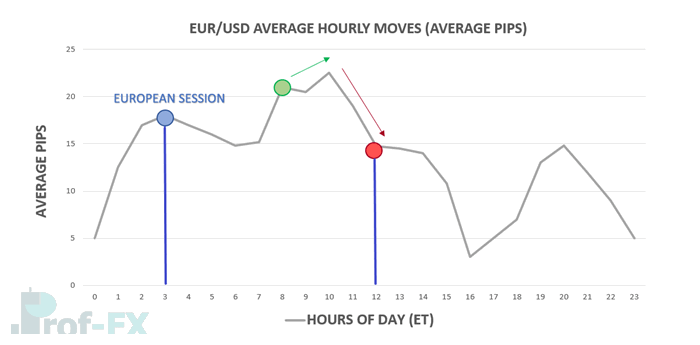

The London forex market operates during the most liquid portion of the global trading day. In Eastern Time (ET), the London session runs from 3:00 AM to 12:00 PM ET.

London Trading Hours (ET)

- Market Open: 3:00 AM

- Market Close: 12:00 PM

- Overlap with Asian Session: 3:00 AM – 4:00 AM

- Overlap with New York Session: 8:00 AM – 12:00 PM

During these hours, the forex market experiences its highest overall trading volume, driven by activity from major banks, hedge funds, and institutional liquidity providers based in London, Frankfurt, Zurich, and other European financial hubs.

Top Characteristics of the London Trading Session

The London session behaves very differently from the quieter Asian session. Understanding these differences is critical for traders who want to align their strategies with market conditions rather than fight against them.

1. Fast-Paced and Highly Active Market Conditions

As the market transitions from the Tokyo session into the London session, volatility begins to rise noticeably. Liquidity providers based in the United Kingdom and Europe start executing large orders, causing price movements to expand.

For many major currency pairs, the average hourly price movement increases significantly once the Asian session closes at 3:00 AM ET. This shift is clearly visible on intraday volatility studies, such as those based on EUR/USD.

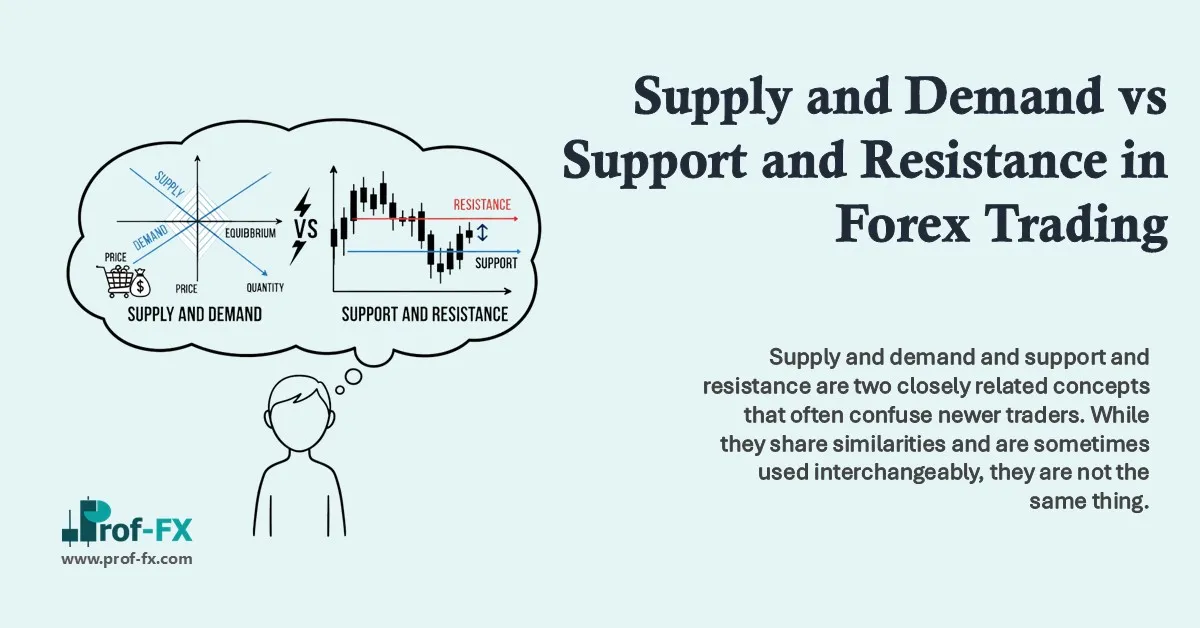

During this period, support and resistance levels are more likely to break, unlike during the Asian session where price tends to remain range-bound. This environment favors traders who focus on breakout strategies, where momentum can persist for extended periods.

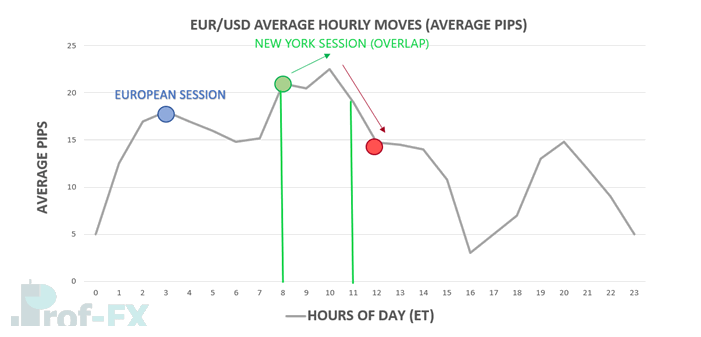

2. The Importance of the London–New York Overlap

One of the most powerful features of the London session is its overlap with the New York session, which occurs between 8:00 AM and 12:00 PM ET.

This four-hour window represents the convergence of the two largest forex trading centers in the world. As a result, liquidity and volatility reach their daily peak, often leading to sharp and decisive price movements.

During the overlap, institutional flows from U.S. banks, European banks, multinational corporations, and asset managers enter the market simultaneously. Traders who understand this dynamic often employ breakout or momentum-based strategies to take advantage of these conditions.

3. Exceptionally High Liquidity and Tight Spreads

The London session is the most liquid trading session in forex. High participation leads to tight bid-ask spreads, particularly on major currency pairs.

This environment is ideal for day traders and short-term traders, as reduced spread costs improve trade efficiency. Lower transaction costs allow traders to focus on capturing price movement rather than overcoming execution friction.

Best Currency Pairs to Trade During the London Session

There is no single “best” currency pair to trade during London hours. However, some pairs naturally benefit from the high liquidity and institutional activity seen during this session.

Major currency pairs that typically offer tight spreads and strong price movement include:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

Currency pairs most affected by the London–New York overlap include EUR/USD, GBP/USD, and USD/JPY, due to intense interbank activity between European and U.S. financial institutions.

For traders whose strategies rely on volatility and momentum, these pairs are often the most responsive during London hours.

How to Trade Breakouts During the London Session

Trading breakouts during the London session follows the same technical principles used at other times of day, but with one key difference: traders can reasonably expect a surge in liquidity and volatility, especially near the session open.

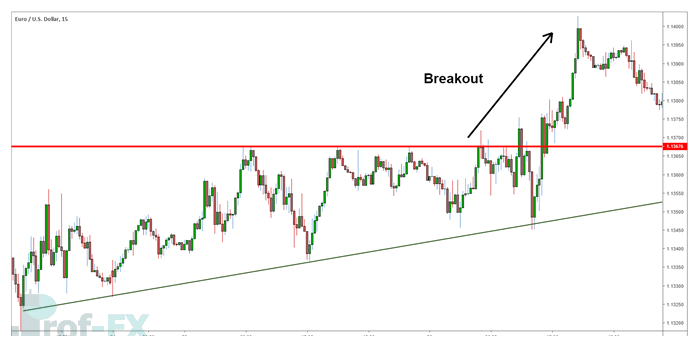

Breakout traders typically begin by identifying well-established support and resistance levels that formed during the Asian session or early European trading.

The chart below illustrates a rising wedge pattern, where price compresses against resistance before eventually breaking out.

Risk Management Advantage

One of the biggest advantages of London breakout setups is risk control. Traders can place tight stop-losses just beyond the broken trend line or support level.

If the breakout fails, losses are limited. If the breakout succeeds, the increased momentum can generate a favorable risk-to-reward ratio, which is essential for long-term trading consistency.

The combination of high liquidity and expanding volatility during the London session significantly increases the probability of meaningful breakouts compared to quieter trading periods.

London Session Trading Tips for Forex Traders

When trading the London session, it is essential to respect the changing market environment. Volatility and liquidity increase rapidly, which can magnify both profits and losses.

Traders—especially beginners—should remain mindful of leverage usage and avoid overexposure during fast-moving conditions.

It is also important to recognize that, like the London session, both the New York session and the Asian session have unique characteristics that require different strategic approaches.

Key Takeaways

- Liquidity and volatility rise sharply during the London session

- Breakouts occur more frequently compared to the Asian session

- The London–New York overlap offers the highest volatility of the trading day

- Tight spreads on major pairs reduce transaction costs

Understanding these dynamics allows traders to align their strategies with institutional market behavior rather than reacting emotionally to price movement.